Key Findings

- The United States’ worldwide system of corporate taxation requires multinational corporations to pay taxes twice, first to the foreign country in which they do business and then to the IRS after they repatriate their profits.

- Multinational corporations reported paying $128 billion in corporate taxes to foreign countries on $470 billion of taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. For both individuals and corporations, taxable income differs from—and is less than—gross income. in 2010, according to most recent IRS data.

- Over the past eighteen years, foreign corporate taxable income has grown by about 250 percent and foreign corporate taxes paid by 265 percent, while the effective taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rate has remained around 26 percent.

- The effective tax rate on foreign income was 27.2 percent in 2010, prior to paying additional taxes to the United States.

- More than 60 percent of all reported foreign taxable income was earned in Europe and Asia in 2010.

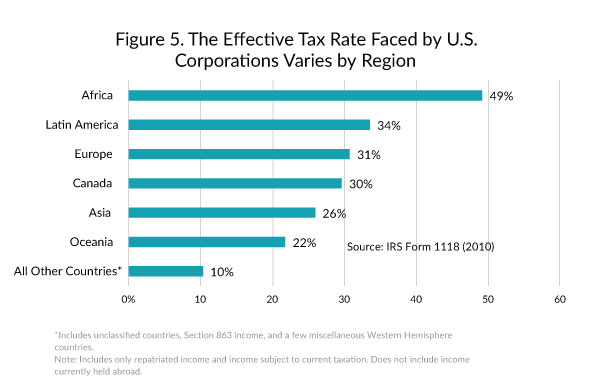

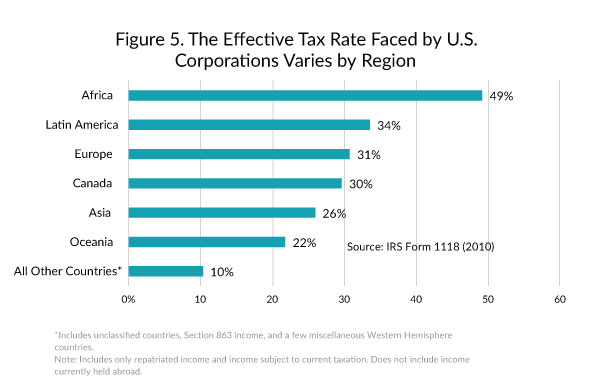

- The effective tax rate faced by U.S. multinationals abroad varies substantially by region and country and is higher than 60 percent in some nations.

- While some corporations pay low effective rates in some countries on foreign income, U.S. multinationals faced effective rates over 20 percent on most income earned overseas, prior to paying taxes to the United States.

- 60 percent of income earned abroad was by manufacturers. Most was income from petroleum and coal manufacturers, who paid an average effective tax rate of 36 percent.

Every year, there are news stories outlining how much multinational corporations are paying in taxes. Many of the more sensational stories lead people to believe that U.S. companies pay little or nothing in taxes on their foreign earnings. Some politicians suggest implementing a “minimum tax” on corporate foreign earnings to prevent tax avoidance. Unfortunately, legislation that would impose these types of taxes on multinational corporations is based on a misunderstanding of how U.S. international tax ruleInternational tax rules apply to income companies earn from their overseas operations and sales. Tax treaties between countries determine which country collects tax revenue, and anti-avoidance rules are put in place to limit gaps companies use to minimize their global tax burden. s work. In any discussion of U.S. corporate tax policy and tax reform, it is important to understand how and to what extent multinational firms’ foreign earnings are taxed.

The United States’ Worldwide Corporate Tax System and the Foreign Tax CreditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income, rather than the taxpayer’s tax bill directly.

The U.S. has what is often called a “worldwide” system of taxation that requires American businesses to pay the 35 percent federal corporate tax rate on their income no matter where it is earned—domestically or abroad.[1]

First, companies operating in foreign countries pay income taxes to the country in which those profits were earned. For example, if a subsidiary of a U.S. firm earns $100 in profits in England, it pays the United Kingdom corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. rate of 21 percent (or $21) on those profits.[2] When those profits are brought back to the United States, an additional tax equal to the difference between the U.S. tax rate of 35 percent and the UK corporate rate of 21 percent ($14 in this case) is collected by the IRS. Between the two nations, the U.S. firm will have paid a total of $35, or 35 percent, in taxes on its foreign profits.

To arrive at a 35 percent effective tax rate on corporate foreign earnings, the IRS affords U.S. corporations a foreign tax credit against U.S. taxes equal to the corporate taxes they paid to foreign governments. When corporations repatriate their foreign earnings, they are required to report how much income they earned in each country they operated in and how much they paid those countries in corporate income taxes. The credit U.S. corporations receive is equal to the corporate income taxes paid to foreign governments on foreign earned income that is returned to the U.S.[3]

In the above case of the corporation that paid $21 in the United Kingdom, the foreign tax credit would equal $21, credited against the U.S. tax of $35. This means the corporation pays $21 to the U.K. and $14 in taxes to the U.S., for a total of $35 in taxes paid on the $100 in foreign income.

American firms can delay paying the additional U.S. tax on their foreign profits—called deferral—as long as the earnings are reinvested in the ongoing activities of their foreign subsidiaries. The additional U.S. tax is due when the profits are eventually repatriated.

The United States is one of only six industrialized nations (of 34 OECD members) that taxes domestic corporations on a worldwide basis. In the past fifteen years, thirteen OECD countries have moved to a territorial system that exempts all or most of active foreign earned income from domestic taxation.[4]

What Did Corporations Pay Abroad on Their Reported Foreign Income?

On IRS Form 1118, U.S. companies report their foreign taxable income.[5] The form also shows the amount of taxes they paid to foreign governments and breaks these numbers down by country and by industry. According to the most recent IRS data on Form 1118 (from tax year 2010),[6] U.S. multinationals reported paying $128 billion in taxes on $470 billion in foreign taxable income. This represents an effective tax rate on foreign income of 27.2 percent.[7]

Foreign Taxable Income and Foreign Taxes Paid by U.S. Multinationals has Grown by about 250 Percent over Eighteen Years

As the global economy has grown, so too have the foreign earnings and tax bills of U.S. companies. Figure 1 shows the foreign taxable earnings of U.S. companies and their foreign corporate income taxes paid between 1992 and 2010.

Over those eighteen years, taxable income grew in real terms by 248 percent while foreign taxes paid grew by 265 percent.

The $470 billion in taxable income and $128 billion taxes paid reported by U.S. corporations in 2010 is a record high over this eighteen year period, after adjusting for inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. .

The Effective Tax Rate on Foreign Taxable Earnings has Remained Steady over the Past Two Decades

While U.S. multinationals’ foreign taxable income and taxes paid have grown, the effective tax rate on this income has remained steady. The average effective tax rate on foreign earned income between 1992 and 2010 was 26.4 percent and has not moved far from this average (Figure 2). The lowest effective tax rate paid on this income was 24.9 percent in 1999. The highest effective tax rate on foreign-earned income was 29.3 percent in 2008. The most recent data indicates an effective tax rate of 27.2 percent, an effective rate higher than the nineteen-year average.

More than 60 Percent of Corporate Foreign Taxable Income was Reported in Europe and Asia in 2010

U.S. corporations do business in every part of the world. However, most foreign income was concentrated in two regions. Figure 3 shows the reported taxable income and taxes paid by U.S. corporations by global region in 2010. By far, U.S. multinationals reported the most taxable income and taxes paid in European countries. In 2010, they reported $206.8 billion in income originating in Europe and paid $63.6 billion in corporate income taxes to European governments. This represents 44 percent of all foreign taxable income and 50 percent of foreign taxes paid for 2010.

Asia had the second-largest concentration of reported foreign taxable income in 2010. U.S. corporations reported $83.4 billion in taxable income and paid $21.6 billion taxes in this region.

Combined, Europe and Asia accounted for 62 percent of all foreign taxable income and 67 percent of all corporate income taxes paid reported by U.S. multinationals in 2010.

One-Fifth of All Foreign Earned Income and Taxes Paid Were Reported in Three Countries

About one-fifth of all reported foreign taxable income and foreign taxes paid was concentrated in three countries and about half was concentrated in ten countries in 2010. Table 1, below, lists the over ninety countries in which U.S. multinationals reported earning income and paying taxes in 2010.

The country that accounted for the most reported taxable income and taxes paid by U.S. corporations was the Netherlands with $35.5 billion in taxable income and $12.3 billion in taxes paid. The United Kingdom accounted for nearly as much with $33.5 billion in taxable income and $11.9 billion in taxes paid. Canada followed with $31.3 billion in income and $9.2 billion in taxes paid.

These three countries accounted for one-fifth of all reported taxable income and foreign taxes paid in 2010 (Figure 4). Combined, the top ten countries that U.S. corporations reported income earned in accounted for 51 percent of all foreign income earned in 2010.

Two countries that are typically referred to as tax havens—Bermuda and the Cayman Islands—fall in the top fifteen countries in which U.S. multinationals reported foreign-source taxable income. U.S. corporations reported $23 billion in taxable income in Bermuda (the fifth largest amount) and $12 billion in the Cayman Islands (the eleventh largest amount). Neither of these countries have corporate income taxes, but multinationals reported taxes paid in these locations. These taxes are “deemed” paid. What this reflects are the taxes U.S. subsidiaries in Bermuda and the Cayman Islands paid to other foreign countries. U.S. corporations reported paying $2.6 billion in taxes on income from Bermuda and $4 billion in taxes on income from the Cayman Islands.

Effective Tax Rates Abroad Vary Substantially by Country and Region

Although all multinationals will end up paying at least a 35 percent effective tax rate on their foreign active earnings once they are repatriated, the effective rate these earnings face in foreign countries and regions can vary substantially.

Figure 5 shows the effective tax rate faced by U.S. corporations on their reported foreign income by region in 2010. U.S. corporations faced the highest effective tax rate on their foreign earnings (49.2 percent) in Africa in 2010. Latin America followed with an effective rate of 33.5 percent. The third highest effective rate was paid in Europe (30.7 percent), where a majority of foreign earned income was reported in 2010. Only two regions (Oceania and Other Countries[8]) had effective tax rates on foreign earnings below 25 percent.

By country, effective rates can vary even more significantly. Of just the top ten countries from which U.S. multinationals reported taxable income in 2010, the effective rates ranged from 10.5 percent in Ireland to 66 percent in Norway (Table 1, below).

Looking across all ninety countries, some of the lowest effective tax rates were in countries with low or no corporate income tax. Of the countries with more than $1 billion in reported taxable income, Singapore (6.92 percent), Bahamas (5.5 percent), and the British Virgin Islands (4.5 percent) had effective tax rates below ten percent.

U.S. multinationals reported paying particularly high effective tax rates in some countries. Norway (66 percent), Nigeria (77.4 percent), and Saudi Arabia (59.7 percent) are all countries known for high corporate taxes on oil companies.[9]

Most Foreign Taxable Income Is Taxed at Rates over 20 percent

While there are undoubtedly U.S. multinationals that paid low effective rates on their foreign earned income in some countries, a majority of foreign taxable income reported by U.S. corporations was taxed at effective rates between 20 and 30 percent overseas. Figure 6 shows the distribution of foreign taxable income by effective rate faced overseas in 2010. A plurality (34.7 percent) of all reported foreign income faced effective tax rates between 20 and 30 percent and nearly 75 percent of all reported taxable income was taxed at 20 percent or higher. Only 8.2 percent of foreign taxable income reported in 2010 faced an effective rate below 10 percent.

Most Foreign Taxable Income and Foreign Corporate Income Taxes Were Reported by Manufacturers

It is also important to understand the extent to which different industries do business overseas. Table 2, below, breaks down the reported foreign earned income and foreign taxes paid by industry. By far, manufacturers accounted for most of the foreign income earned by multinational corporations. In 2010, manufacturers earned $282.5 billion in foreign income, which accounted for 60 percent of the total reported taxable income. Overall, manufacturers paid $79.4 billion in foreign taxes, for an effective tax rate of 28.1 percent.

It is also worth noting that a major subcategory in manufacturing is “Petroleum and coal products manufacturing.” These corporations paid $42.7 billion in foreign taxes on $118.2 billion in taxable income. Remarkably, this industry accounted for a quarter of all foreign earned income and 33 percent of all foreign taxes paid by U.S. multinationals. The average effective tax rate paid by petroleum and coal products manufacturers was 36.1 percent.

The industry that reported the second largest amount of foreign taxable income was “Finance, insurance, and real estate, rental and leasing” with $54 billion reported taxable income and $10.4 billion in taxes. This is followed by “Services,” which reported $47.9 billion in taxable income and $15.2 billion in taxes.

Table 2. Taxable Foreign Income and Foreign Taxes Reported by U.S. Corporations by Industry, 2010 (thousands of dollars) |

|||

|

Major Industry |

Taxable Income |

Taxes Paid |

Effective Tax Rate |

|

Manufacturing |

$ 282,500,000 |

$ 79,480,458 |

28.1% |

|

Petroleum and coal products manufacturing |

$ 118,200,000 |

$ 42,717,766 |

36.1% |

|

Finance, insurance, real estate, rental and leasing |

$ 54,446,207 |

$ 10,413,112 |

19.1% |

|

Services |

$ 47,927,217 |

$ 15,287,418 |

31.9% |

|

Information |

$ 31,624,085 |

$ 6,985,747 |

22.1% |

|

Mining |

$ 26,253,172 |

$ 9,276,985 |

35.3% |

|

Wholesale and retail trade |

$ 23,889,752 |

$ 5,829,335 |

24.4% |

|

Transportation and warehousing |

$ 2,378,385 |

$ 330,460 |

13.9% |

|

Utilities |

$ 903,400 |

$ 279,674 |

31.0% |

|

Construction |

$ 477,468 |

$ 129,173 |

27.1% |

|

Agriculture, forestry, fishing, and hunting |

$ 27,796 |

$ 1,538 |

5.5% |

|

Source: IRS Form 1118 (2010). Note: Includes only repatriated income and income subject to current taxation. Does not include income currently held abroad. |

Conclusion

While it is undoubtedly true that U.S. multinational firms use numerous tax planning techniques to minimize the taxes they pay on their foreign earnings, IRS data shows that the subsidiaries of U.S. multinationals reported paying more than $128 billion in corporate income taxes to foreign tax authorities on roughly $470 billion in foreign taxable income in 2010. Averaged across some ninety countries, U.S. companies paid an effective tax rate of 27.2 percent on that income. While many corporations paid less than that on foreign earned income, a majority of foreign income in 2010 faced effective tax rates of 20 percent or higher in foreign countries. Furthermore, most corporate income was earned, and most corporate income taxes paid overseas were paid, by manufacturers, especially those engaged in petroleum and coal products manufacturing.

Reporters and lawmakers who criticize U.S. companies for “avoiding” taxes on their foreign earnings need to be more careful with their language and acknowledge that our worldwide tax systemA worldwide tax system for corporations, as opposed to a territorial tax system, includes foreign-earned income in the domestic tax base. As part of the 2017 Tax Cuts and Jobs Act (TCJA), the United States shifted from worldwide taxation towards territorial taxation. requires U.S. firms to pay taxes twice on their foreign profits—once to the host country and a second time to the IRS—before they try to reinvest those profits back home. Any discussion about reforming the corporate tax code must keep these facts in mind.

Table 1. Foreign Taxable Income and Taxes Paid by Country, 2010 |

|||

(thousands of dollars) |

|||

|

Country |

Taxable income (less loss) before adjustments |

Foreign taxes paid, accrued, and deemed paid |

Average effective tax rate |

|

Netherlands |

$ 35,587,807 |

$ 12,365,352 |

34.75% |

|

United Kingdom |

$ 33,535,104 |

$ 11,981,791 |

35.73% |

|

Canada |

$ 31,337,782 |

$ 9,286,940 |

29.63% |

|

Luxembourg |

$ 30,339,409 |

$ 7,208,236 |

23.76% |

|

Bermuda* |

$ 23,617,694 |

$ 2,682,263 |

11.36% |

|

Japan |

$ 22,239,729 |

$ 6,371,096 |

28.65% |

|

Ireland |

$ 21,720,975 |

$ 2,299,108 |

10.58% |

|

Switzerland |

$ 15,558,547 |

$ 2,751,804 |

17.69% |

|

Australia |

$ 13,926,480 |

$ 3,151,267 |

22.63% |

|

Norway |

$ 13,467,814 |

$ 8,902,817 |

66.10% |

|

Cayman Islands* |

$ 12,934,771 |

$ 4,005,637 |

30.97% |

|

Qatar |

$ 11,924,303 |

$ 2,763,810 |

23.18% |

|

Spain |

$ 11,108,969 |

$ 2,957,122 |

26.62% |

|

Germany |

$ 9,976,850 |

$ 3,009,875 |

30.17% |

|

Mexico |

$ 9,244,129 |

$ 2,919,430 |

31.58% |

|

Singapore |

$ 8,458,552 |

$ 585,554 |

6.92% |

|

Brazil |

$ 8,341,607 |

$ 2,369,810 |

28.41% |

|

Puerto Rico |

$ 7,942,700 |

$ 943,307 |

11.88% |

|

Kazakhstan |

$ 7,514,888 |

$ 2,454,529 |

32.66% |

|

Indonesia |

$ 7,364,367 |

$ 3,128,094 |

42.48% |

|

China |

$ 7,003,451 |

$ 1,820,413 |

25.99% |

|

Nigeria |

$ 5,747,378 |

$ 4,452,564 |

77.47% |

|

Hong Kong |

$ 4,964,218 |

$ 536,559 |

10.81% |

|

France |

$ 4,534,225 |

$ 1,415,526 |

31.22% |

|

South Korea |

$ 4,475,633 |

$ 819,254 |

18.30% |

|

Bahamas |

$ 4,321,469 |

$ 237,769 |

5.50% |

|

Chile |

$ 4,281,898 |

$ 1,603,939 |

37.46% |

|

Denmark |

$ 4,146,151 |

$ 1,828,716 |

44.11% |

|

Portugal |

$ 3,482,792 |

$ 1,371,882 |

39.39% |

|

Saudi Arabia |

$ 3,446,523 |

$ 2,059,946 |

59.77% |

|

India |

$ 2,844,523 |

$ 920,667 |

32.37% |

|

Italy |

$ 2,670,710 |

$ 1,400,143 |

52.43% |

|

Peru |

$ 2,495,407 |

$ 1,063,365 |

42.61% |

|

Argentina |

$ 2,259,882 |

$ 990,988 |

43.85% |

|

Taiwan |

$ 2,195,459 |

$ 439,359 |

20.01% |

|

Malaysia |

$ 2,045,953 |

$ 710,751 |

34.74% |

|

Belgium |

$ 1,943,128 |

$ 488,217 |

25.13% |

|

Colombia |

$ 1,789,341 |

$ 551,062 |

30.80% |

|

Venezuela |

$ 1,678,495 |

$ 883,212 |

52.62% |

|

Sweden |

$ 1,631,720 |

$ 582,787 |

35.72% |

|

Jersey |

$ 1,517,187 |

$ 1,000,148 |

65.92% |

|

Egypt |

$ 1,499,392 |

$ 367,017 |

24.48% |

|

Thailand |

$ 1,484,771 |

$ 578,055 |

38.93% |

|

Equatorial Guinea |

$ 1,470,145 |

$ 394,852 |

26.86% |

|

Trinidad |

$ 1,379,703 |

$ 771,132 |

55.89% |

|

Russia |

$ 1,361,931 |

$ 206,817 |

15.19% |

|

New Zealand |

$ 1,220,765 |

$ 100,446 |

8.23% |

|

British Virgin Islands |

$ 1,141,583 |

$ 51,561 |

4.52% |

|

Chad |

$ 1,084,647 |

$ 549,223 |

50.64% |

|

South Africa |

$ 928,809 |

$ 421,705 |

45.40% |

|

Angola |

$ 875,144 |

$ 57,516 |

6.57% |

|

Finland |

$ 855,904 |

$ 24,904 |

2.91% |

|

Poland |

$ 845,684 |

$ 235,065 |

27.80% |

|

Philippines |

$ 803,682 |

$ 293,234 |

36.49% |

|

Mauritius |

$ 601,325 |

$ 60,655 |

10.09% |

|

Austria |

$ 549,864 |

$ 146,154 |

26.58% |

|

Dominican Republic |

$ 526,718 |

$ 44,456 |

8.44% |

|

Israel |

$ 511,975 |

$ 140,191 |

27.38% |

|

United Arab Emirates |

$ 454,777 |

$ 139,441 |

30.66% |

|

Turkey |

$ 410,004 |

$ 122,807 |

29.95% |

|

Costa Rica |

$ 400,125 |

$ 65,632 |

16.40% |

|

Iraq |

$ 367,826 |

$ 369 |

0.10% |

|

Panama |

$ 349,613 |

$ 87,818 |

25.12% |

|

Netherland Antilles |

$ 347,540 |

$ 123,074 |

35.41% |

|

Pakistan |

$ 308,986 |

$ 170,401 |

55.15% |

|

Yemen |

$ 236,515 |

$ 68,325 |

28.89% |

|

Czech Republic |

$ 229,511 |

$ 51,658 |

22.51% |

|

Ecuador |

$ 197,662 |

$ 100,581 |

50.89% |

|

Ukraine |

$ 191,508 |

$ 62,137 |

32.45% |

|

Guatemala |

$ 185,337 |

$ 43,892 |

23.68% |

|

Gabon |

$ 176,254 |

$ 34,250 |

19.43% |

|

El Salvador |

$ 148,678 |

$ 50,450 |

33.93% |

|

Uruguay |

$ 140,610 |

$ 43,979 |

31.28% |

|

Kuwait |

$ 116,709 |

$ 6,525 |

5.59% |

|

Guam |

$ 116,154 |

$ 28,121 |

24.21% |

|

Algeria |

$ 114,971 |

$ 55,443 |

48.22% |

|

Vietnam |

$ 110,683 |

$ 22,022 |

19.90% |

|

Romania |

$ 102,999 |

$ 17,499 |

16.99% |

|

Honduras |

$ 100,733 |

$ 26,844 |

26.65% |

|

Barbados |

$ 88,804 |

$ 9,937 |

11.19% |

|

Nicaragua |

$ 84,612 |

$ 26,024 |

30.76% |

|

Virgin Islands, U.S. |

$ 67,059 |

$ 13,165 |

19.63% |

|

Paraguay |

$ 57,729 |

$ 12,674 |

21.95% |

|

Bolivia |

$ 56,045 |

$ 23,732 |

42.34% |

|

Sri Lanka |

$ 20,107 |

$ 10,580 |

52.62% |

|

Haiti |

$ 19,448 |

$ 2,001 |

10.29% |

|

Lebanon |

$ 15,381 |

$ 2,608 |

16.96% |

|

Bangladesh |

$ 7,787 |

$ 31,362 |

402.75% |

|

American Samoa |

$ 5,636 |

$ 2,138 |

37.93% |

|

Greece |

$ (1,493) |

$ 50,496 |

N/A |

|

Jamaica |

$ (5,008) |

$ 8,811 |

N/A |

|

Hungary |

$ (17,012) |

$ 52,871 |

N/A |

|

Bahrain |

$ (43,678) |

$ 4,485 |

N/A |

|

Source: IRS Form 1118 (2010). Note: Includes only repatriated income and income subject to current taxation. Does not include income currently held abroad. |

[1] The same rules apply to individuals, as well as non-corporate businesses such as S corporationAn S corporation is a business entity which elects to pass business income and losses through to its shareholders. The shareholders are then responsible for paying individual income taxes on this income. Unlike subchapter C corporations, an S corporation (S corp) is not subject to the corporate income tax (CIT). s, LLCs, and sole proprietorships.

[2] HM Revenue & Customs, Corporation Tax Rates, http://www.hmrc.gov.uk/rates/corp.htm.

[3] Other taxes, such as sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. es, and payments made to foreign governments, such as royalties for resource extraction, do not qualify for the foreign tax credit. The value of the credit is limited to the U.S. tax that would be due on the income if there was no foreign tax. For instance, if the corporation reports a $60 tax bill on $100 of foreign earned income, the foreign tax credit is only good up to the $35 due to the U.S. government.

[4] PricewaterhouseCoopers, Evolution of Territorial Tax Systems in the OECD, prepared for the Technology CEO Council (Apr. 2, 2013), http://www.techceocouncil.org/clientuploads/reports/Report%20on%20Territorial%20Tax%20Systems_20130402b.pdf.

[5] Either current passive income, or repatriated active income, where passive income is defined as investment income, such as interest, and active income is all other income. See IRS Subpart F rules for more detail.

[6] Form 1118 reflects the aggregate taxable profits, or the income that is subject to tax after all deductions and “above-the-line” tax preferences. This data does not include income that is not repatriated and not otherwise subject to U.S. tax. The U.S. Bureau of Economic Analysis (BEA) also reports how much U.S. corporations pay abroad. Their most recent data shows that corporations paid $131 billion in 2010 to foreign countries. See Bureau of Economic Analysis, Financial and Operating Data for U.S. Multinational Companies, http://bea.gov/international/di1usdop.htm. For a more detailed explanation of the data limitations, see Internal Revenue Service, Nuria E. McGrath, Corporate Foreign Tax Credit, 2009 (2013), http://www.irs.gov/pub/irs-soi/13itsumbulforetaxcredit.pdf.

[7] Internal Revenue Service, SOI Tax Stats – Corporate Foreign Tax Credit Statistics, http://www.irs.gov/uac/SOI-Tax-Stats-Corporate-Foreign-Tax-Credit-Statistics.

[8] “Other Countries” includes income earned in unclassified countries, Section 863 income, and a few miscellaneous Western Hemisphere countries.

[9] Saudi Arabia and Nigeria have a top corporate tax rate on oil production of 85 percent, and Norway has a “resource rent tax” of 50 percent on top of its standard corporate income tax. See Ernst & Young, 2013 Global oil and gas taxA gas tax is commonly used to describe the variety of taxes levied on gasoline at both the federal and state levels, to provide funds for highway repair and maintenance, as well as for other government infrastructure projects. These taxes are levied in a few ways, including per-gallon excise taxes, excise taxes imposed on wholesalers, and general sales taxes that apply to the purchase of gasoline. guide, http://www.ey.com/GL/en/Services/Tax/Global-oil-and-gas-tax-guide—Country-list.