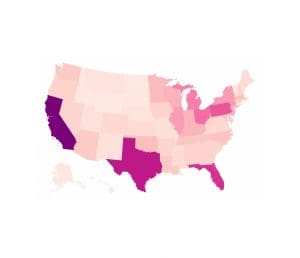

Compare Tobacco Tax Data in Your State

In the United States, tobacco is taxed at both the federal and state and sometimes even local levels. These layers of taxes often result in very high levels of taxation—the highest of any consumer item. The retail price of cigarettes, for instance, is more than 40 percent taxes on average. In some states, like Minnesota and New York, more than 50 percent of the price paid by consumers comes from taxes.

2 min read