2019 State Business Tax Climate Index

Our 2019 State Business Tax Climate Index compares each state on over 100 variables including corporate, individual, property, and sales taxes. How does your state rank?

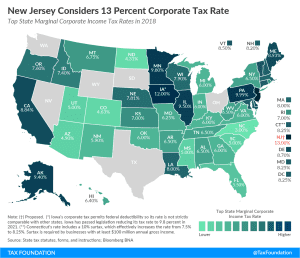

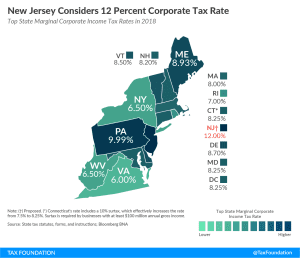

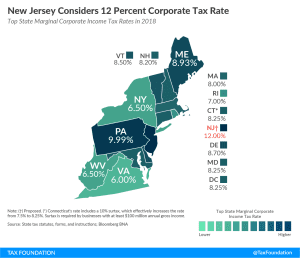

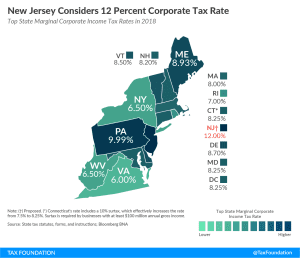

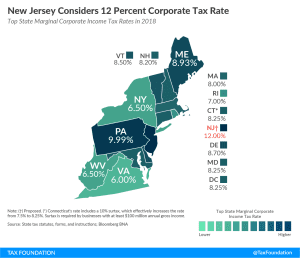

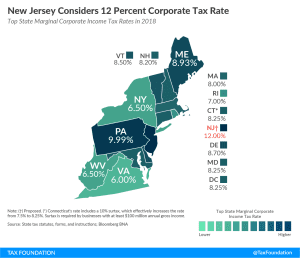

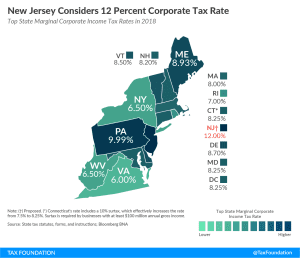

17 min readHow does New Jersey’s tax code compare? New Jersey has a graduated individual income tax, with rates ranging from 1.40 percent to 10.75 percent. There is also a jurisdiction that collects local income taxes. New Jersey has a 6.5 percent to 11.5 percent corporate income tax rate. New Jersey has a 6.625 percent state sales tax rate, a max local sales tax rate of 3.313 percent, and an average combined state and local sales tax rate of 6.60 percent. New Jersey’s tax system ranks 50th overall on our 2023 State Business Tax Climate Index.

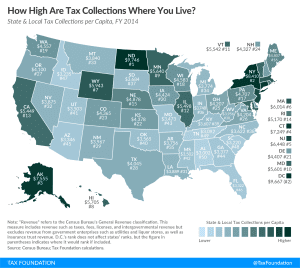

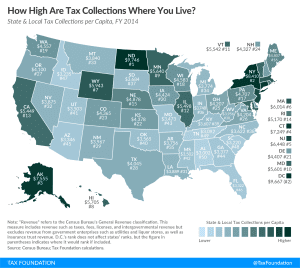

Each state’s tax code is a multifaceted system with many moving parts, and New Jersey is no exception. The first step towards understanding New Jersey’s tax code is knowing the basics. How does New Jersey collect tax revenue? Click the tabs below to learn more! You can also explore our state tax maps, which are compiled from our annual publication, Facts & Figures: How Does Your State Compare?

Our 2019 State Business Tax Climate Index compares each state on over 100 variables including corporate, individual, property, and sales taxes. How does your state rank?

17 min read

Four states have brought a lawsuit against the federal tax bill claiming that its $10,000 cap on the state-local deduction is unconstitutional. Here’s why the lawsuit has little merit.

7 min read

The threatened lawsuit may be more a political exercise than a legal one, as a judge is unlikely to rule that the SALT deduction cap violates either the Equal Protection Clause or the Tenth Amendment

14 min read

New Jersey has the worst state business tax climate of the 50 states and the third highest state and local tax burden. If federal tax reform prompts New Jersey to overhaul its tax code, it’s long overdue.

3 min read