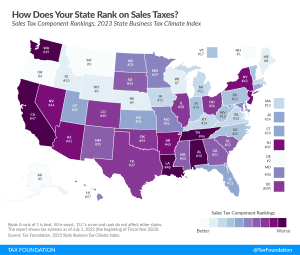

Ranking Sales Taxes on the 2023 State Business Tax Climate Index

An ideal sales tax applies to a broad base of final consumer goods and services, with few exemptions, and is levied at a low rate.

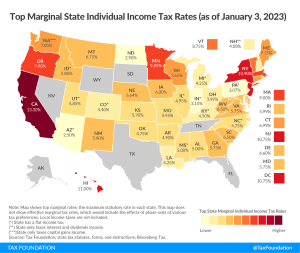

5 min readHow does Kentucky’s tax code compare? Kentucky has a flat 4.00 percent individual income tax rate. There are also jurisdictions that collect local income taxes. Kentucky has a 5.0 percent corporate income tax rate. Kentucky also has a 6.00 percent state sales tax rate and does not have local sales taxes. Kentucky has a 0.74 percent effective property tax rate on owner-occupied housing value.

Kentucky has an inheritance tax. Kentucky has a 30 cents per gallon gas tax rate and a $1.10 cigarette excise tax rate. The State of Kentucky collects $5,945 in state and local tax collections per capita. Kentucky has $12,020 in state and local debt per capita and has a 50 percent funded ratio of public pension plans. Overall, Kentucky’s tax system ranks 18th on our 2024 State Business Tax Climate Index.

Each state’s tax code is a multifaceted system with many moving parts, and Kentucky is no exception. The first step towards understanding Kentucky’s tax code is knowing the basics. How does Kentucky collect tax revenue? Click the tabs below to learn more! You can also explore our state tax maps, which are compiled from our annual publication, Facts & Figures 2024: How Does Your State Compare?

An ideal sales tax applies to a broad base of final consumer goods and services, with few exemptions, and is levied at a low rate.

5 min read

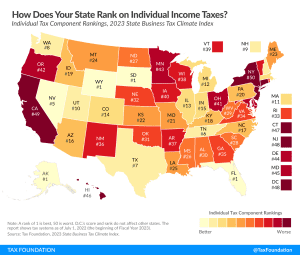

Individual income tax rates can influence location decision-making, especially in an era of enhanced mobility, where it is easier for individuals to move without jeopardizing their current job, or without limiting the scope of their search for a new one.

5 min read

The overall U.S. tax and transfer system is overwhelmingly progressive, and understanding the extent—and source—of that progressivity is essential for lawmakers considering the trade-offs associated with each tax policy decision.

23 min read

As housing prices are rapidly increasing, and property tax bills along with them, the property tax has come into the spotlight in many states. The design of a state’s property tax system can affect how attractive that state is to businesses and residents.

9 min read

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

As final negotiations occur between the House and Senate, legislators should avoid adopting new policies that would jeopardize Kentucky’s business tax competitiveness.

5 min read

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections:

9 min read

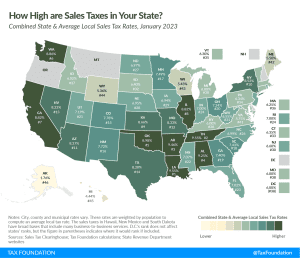

While many factors influence business location and investment decisions, sales taxes are something within policymakers’ control that can have immediate impacts.

11 min read

Forty-three states adopted tax relief in 2021 or 2022—often in both years—and of those, 21 cut state income tax rates. It’s been a remarkable trend, driven by robust state revenues and an increasingly competitive tax environment.

4 min read

At the end of 2022, prices were 14.6 percent higher than they were two years prior. That’s the fastest inflation rate over any two calendar years since the stagflation era of the late 1970s. State policymakers are understandably interested in bringing any tools at their disposal to bear on the problem. And many of them are reaching for tax policy solutions.

7 min read