Kentucky’s current fiscal situation is dire. With one of the worst funded pension systems in the country and a budget that’s facing the possibility of severe cuts, legislators in the state are understandably having a difficult time juggling the state’s finances.

The House budget plan has not yet been released, but details have emerged on the revenue raisers. To ease budget cuts, the House budget plan increases the cigarette taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. from $0.60 to $1.10 and introduces a new tax on opioids at 25 cents per dosage on the wholesaler level. The plan also eliminates Kentucky’s $10 personal credit.

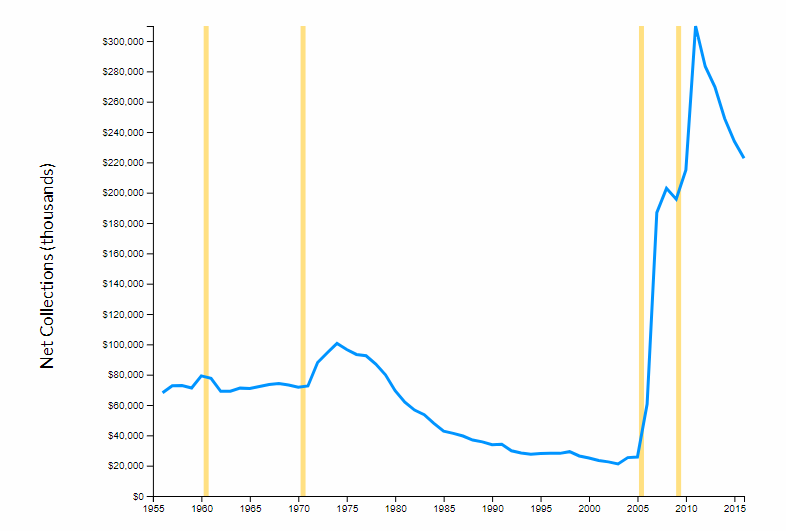

There are a number of problems with this approach. First, excise taxes should not be used to overcome structural issues with the tax code that lead to an underfunding of basic core services. The cigarette tax in particular is an unstable source of revenue. Typically, when states increase their cigarette tax rates, it’s followed by a spike in revenue that later leads to a revenue decrease, sometimes even dipping to lower revenue levels than before the tax increase. We’ve illustrated this pattern for all 50 states in our cigarette revenue tool, and it holds true for Kentucky. The chart below shows inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. -adjusted cigarette tax revenue collections in Kentucky (you can compare other states using the full tool at the bottom of this page). When the state increased its cigarette tax rate in 2009 (rate increases are noted with vertical yellow bars), revenue jumped initially but declined significantly in following years. Basic services like education deserve to be funded by a revenue source more stable than excise taxes.

Kentucky Cigarette Tax Collections and Tax Rate Increases

(1955-2015)

Second, due to neighboring states with low cigarette tax rates, cross-border competition could be an issue for Kentucky at a rate of $1.10. Tennessee, Virginia, Indiana, and Missouri all levy rates lower than $1.10. The lower nearby rates would incentivize smokers to drive across the border to buy cheaper cigarettes – some, like those who would buy in Virginia where the tax rate is only $0.30 per pack, would see significant cost savings from a quick trip into a nearby state.

This proposal underscores Kentucky’s desperate need for comprehensive tax reform. If the legislature decided to take on comprehensive tax reform, it would be options that balance revenue increases with pro-growth tax provisions. Kentucky’s tax code penalizes investment and is outdated and uncompetitive on both a regional and national scale. Its tax structure ranks just 33rd out of all 50 states on our State Business Tax Climate Index.

Comprehensive tax reform is difficult, and Kentucky legislators have a lot on their plate this year. However, if they continue to try to bandage the problem instead of truly fixing the structural issues in Kentucky’s tax code, they’ll be struggling with the same revenue issues in future years. The legislature should think twice before increasing Kentuckians’ tax burdens without providing them the benefits that comprehensive, pro-growth tax reform would provide families in the state.