Earlier this month, the Joint Committee on Taxation (JCT) reminded us that capital gains taxes can drastically impact realizations. This is because taxpayers can choose when they sell an asset and pay capital gains taxes. This effect could be eliminated by taxing all capital gains under a mark-to-market system. Mark-to-market taxation of capital gains would eliminate this realization effect but also increase taxes on saving.

Under current law, capital gains—or the value of an asset in excess of its cost basis— are not taxed until an asset is sold (or “realized”). The option to time when capital gains are realized allows taxpayers to minimize their taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. bill, and makes capital gain realizations sensitive to tax rates.

This sensitivity can be seen in the “elasticity” of capital gains, which measures how a change in the capital gains taxA capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate income taxes, frequently resulting in double taxation. These taxes create a bias against saving, leading to a lower level of national income by encouraging present consumption over investment. rate impacts capital gains realizations. Estimates of this elasticity show that capital gains realizations fall when capital gains tax rates rise.

According to the JCT, most estimates of the permanent elasticity of capital gains are approximately -0.79, while estimates of the transitory elasticity are more than 1 in absolute value. Looking at the permanent elasticity and given current capital gains tax rates, this means a 10 percent increase in capital gains tax rates should lead to a 7.9 percent reduction in capital gains income.

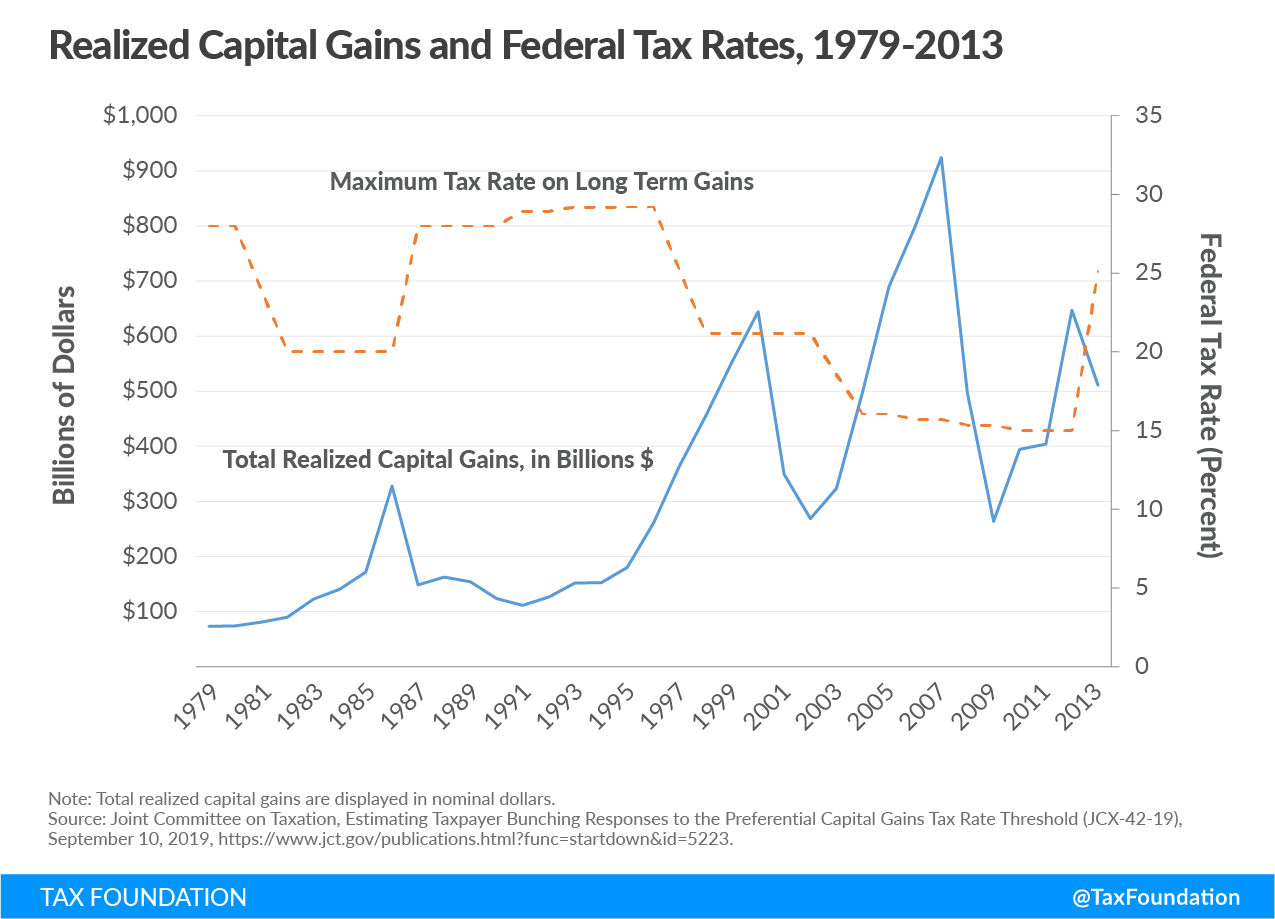

Researchers distinguish between permanent and temporary elasticities because expected changes in the tax rate can have a temporarily large effect on capital gains realization behavior. This can be seen in JCT’s “Figure 1” below, which graphs total realized capital gains against the maximum tax rate on capital gains, from 1979 to 2013[1].

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeThe JCT study points to two tax-related events that encouraged large, albeit brief, upticks in capital gains realizations. Realizations nearly doubled from 1985 to 1986. This was in anticipation of an increase in the top rate on capital gains to 28 percent from 20 percent, beginning in 1987. Likewise, realizations jumped in 2012. This was in anticipation of an increase in the top capital gains tax rate from 15 percent to 23.8 percent. Importantly, two spikes displayed in this chart—from 1996-2000 and 2003-2007—were not due to tax reasons, but due to the business cycle. Overall, capital gains realizations tend to increase when the economy expands but decrease when the economy contracts.

JCT’s study shows how challenging taxing capital gains can be with deferral. Though policymakers can increase rates, taxpayers can change their behavior to avoid these higher rates. Taxpayers accelerated realizations twice between 1979-2013 to avoid higher tax rates. And under current law, taxpayers can avoid capital gains taxes completely if they pass property on to heirs at death, under step-up in basis. This generates a “lock-in effect” that discourages capital gains realizations.

Senate Finance Committee Ranking Member, Ron Wyden (D-OR), has proposed a mark-to-market tax system that would eliminate deferral for individuals earning more than $1 million annually or with assets totaling over $10 million. Under his proposal, these taxpayers would pay capital gains taxes on unrealized capital gains in liquid assets annually. Capital gains in illiquid assets would not be taxed annually, but a “lookback charge” would be assessed on these gains upon realization to mitigate the tax benefit of deferral and encourage realizations.

Eliminating deferral would have mixed effects. As my colleague, Taylor LaJoie, pointed out:

Wyden’s plan would eliminate the lock-in effect for some taxpayers. Individuals subject to Wyden’s proposal would no longer have a choice over when they paid taxes on capital gains. As a result, there would no longer be an incentive to hold on to these assets. Even so, the proposal would also increase the tax burden on savings by accelerating taxes on capital gains and could have an impact on the incentive to save.

JCT’s report on capital gains elasticities reminds us that capital gains realizations, at least under a tax system that allows deferral, are sensitive to tax rates. Moving to mark-to-market taxation of all capital gains would remove this sensitivity by taxing capital gains annually. This would increase economic efficiency by removing taxation from the decision of when to realize capital gains. It would also increase taxes on savings and limit incentives to save.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe[1] Source: Joint Committee on Taxation, Estimating Taxpayer Bunching Responses to the Preferential Capital Gains Tax Rate Threshold (JCX-42-19), September 10, 2019, https://www.jct.gov/publications.html?func=startdown&id=5223.

Share this article