Over the past couple of weeks there has been a lot discussion about the value-added taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. among those in the media and in certain policy circles. The conversation began because Senator Ted Cruz introduced a tax reform plan that would eliminate both the payroll taxA payroll tax is a tax paid on the wages and salaries of employees to finance social insurance programs like Social Security, Medicare, and unemployment insurance. Payroll taxes are social insurance taxes that comprise 24.8 percent of combined federal, state, and local government revenue, the second largest source of that combined tax revenue. and the corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. and replace the revenue with a “business flat taxAn income tax is referred to as a “flat tax” when all taxable income is subject to the same tax rate, regardless of income level or assets. ,” or subtraction-method value-added tax. We found that the tax plan would reduce federal revenues by $3.6 trillion over the next decade. However, if you accounted for the 13.9 percent larger GDP, revenues would only reduce by a little more than $700 billion.

Even though the plan is growth-oriented (it eliminates the corporate income tax!), some Conservatives have expressed concern about the plan. The concern is that the plan would introduce a European-style tax that would lead to a European-size government here. They state that since the 1960s when the VAT was introduced in Europe, their rates and collections have consistently increased and the VAT has resulted in the “large” governments we see there today. They believe that this would happen here if a similar tax were introduced.

I don’t know whether it is true that the VAT has led to larger governments in Europe, but what is often missing from these discussions is the fact that the VAT is not a uniquely European tax. Yes, all European countries utilize this tax, but so do most countries in the world.

According to KPMG, more than 140 countries throughout the world have a value-added tax.

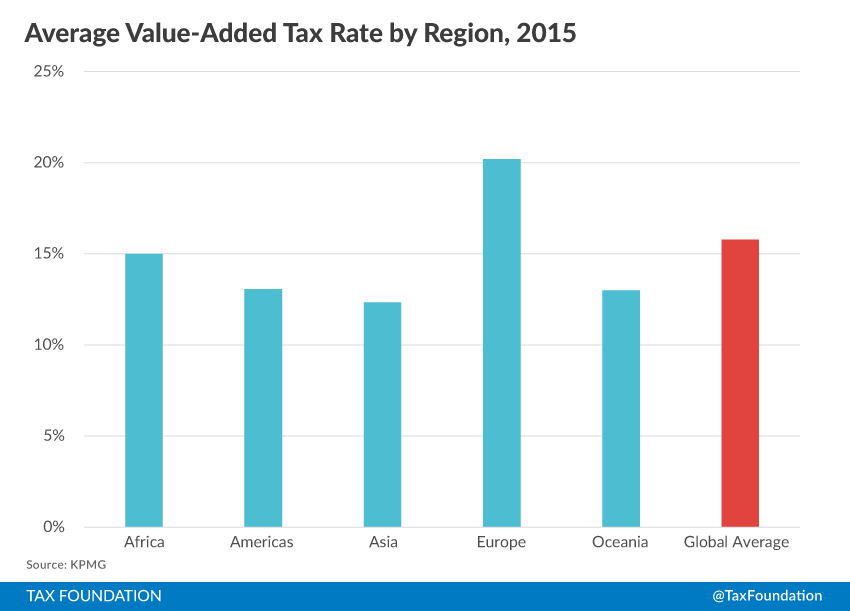

It is true that European countries tend to have high VAT rates. The average VAT rate in Europe is 20 percent, about 5 percentage points higher than the global average. However, not all European countries have high VATs (Switzerland has an 8 percent VAT rate, which is about as high as the state and local average retail sales tax rate in the United States). And it’s also important to point out that European countries also tend to have much lower corporate income tax rates. The average European corporate income tax rate is 18.7 percent, which is lower than the worldwide average of 22.8 percent.

Looking beyond Europe, you can see that VAT rates aren’t necessarily all high. Every other region of the world has lower VAT rates on average than Europe. African countries have an average VAT rate of about 15 percent, the Americas and Oceania have an average rate of 13 percent, and Asia has an average VAT rate of 12.3 percent. VATs are as low as 5 percent in countries such as Canada (federal only), Taiwan, and Zambia, to as high as 27 percent in Hungary.

VATs exist all over the world, rates vary widely and not all of them are significant.

Of course, the type of VAT counted here is a specific tax called the credit-invoice VAT. This is not the type of VAT that the Cruz plan would implement and certainly not the only type of VAT out there.

At the end of the day, A VAT is really just a consumption tax. If you think about it that way, U.S. states already have VAT-like taxes with their retail sales taxes (in fact, New Hampshire has a literal VAT). Even more, most tax systems throughout the world, including the tax system in the United States, have VAT-like features. For example, our payroll tax is simply a portion of a value-added tax. Most comprehensive tax reform proposals, such as the Hall-Rabushka Flat Tax, move to a VAT base.

Just because most countries on earth utilize the VAT, it does not mean it is something the U.S. needs to do. However, it is important to put the tax in context. It is not just a European tax, not all VATs are significant, and many taxes in the U.S. and proposals to reform the U.S. tax code are economically similar or identical to the VAT.

Click here to read more about the tax proposed in Senator Cruz’s reform plan

Share this article