The HEROES Act, proposed by House Democrats as a next round of fiscal relief during the coronavirus outbreak, contains about $1.08 trillion in aid to states and localities. That would bring the pandemic total to $1.63 trillion—an amount so large that it might overwhelm their ability to spend it and could reward fiscal irresponsibility.

With the CARES Act, the Stafford Declaration (freeing up emergency funding), and now the proposed HEROES Act, states would be in line for about $1.12 trillion, of which $714 billion could be regarded as “flexible,” able to be spent backfilling lost revenues or for other general purposes. The remainder—particularly funding from the Coronavirus Relief Fund under the CARES Act—would be for dedicated purposes, many of which would not have existed prior to the pandemic. Localities would receive about $515 billion, of which $375 billion is flexible.

| Flexible and Dedicated Aid by Source, in Billions of Dollars | |||

|---|---|---|---|

| Source of Aid | Flexible | Dedicated | Total |

| HEROES Act (proposed) | $996 | $81 | $1,077 |

| CARES Act | $93 | $413 | $506 |

| Stafford Declaration | $0 | $50 | $50 |

| Total Aid | $1,089 | $544 | $1,633 |

|

Sources: HEROES Act; CARES Act; Stafford Declaration; Tax Foundation calculations. |

|||

For context, state taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. revenue was $1.08 trillion in FY 2019 and, prior to the pandemic, was projected at $1.10 trillion in FY 2020 before the pandemic reduced collections. Local tax collections are responsible for another $760 billion. The HEROES Act’s state and local aid is identical to a full year’s worth of state tax collections nationwide. Combined with relief efforts from earlier in the year, total aid to states and localities is equivalent to about 88 percent of the combined annual tax collections of all state and local governments.

It is also significantly more than state and local governments are expected to lose. Using FY 2020 projected revenues as a baseline, Moody’s projects that state and local governments would lose a combined $482 billion across FYs 2020 and FY 2021. If the HEROES Act were enacted, state and local governments would be eligible for up to $1.09 trillion in flexible aid by the close of FY 2021, more than twice their anticipated revenue losses.

| Revenue Adjustment | State | Local | Total |

|---|---|---|---|

| FYs 2020-’21 Revenue Change (projected) | ($330) | ($152) | ($482) |

| Current and Proposed Fiscal Relief | $714 | $375 | $1,089 |

| Total Change | $384 | $223 | $607 |

|

Sources: HEROES Act; CARES Act; Moody’s; Tax Foundation calculations. |

|||

The HEROES Act itself includes $915 billion in direct relief and about $81 billion in enhanced Medicaid funding that would free up an equivalent amount in states’ budgets, for a total of at least $996 billion in flexible aid. The remaining $100 billion would be provided to states for dedicated expenses that might not have existed prior to the crisis. Funding would be paid out between now and May 2021, thus covering fiscal years 2020 and 2021.

Of this, $375 billion would be allocated to localities, though in some cases the state would receive the funding for distribution to them. The remaining $702 billion would go to states in some form, with about $621 billion of it properly considered flexible aid that could be used to backfill revenue losses or (in some cases) increase spending. This is on top of about $366 billion in state funding under the CARES Act, of which about $93 million is flexible.

Does this mean that state budgets are about to soar? Perhaps. The bill is maddeningly unclear on what is permitted.

While some of the funding would allow for actual budget increases during a period when revenues are in decline, the largest share of state and local aid under the HEROES Act is subject to limitations, though those limits are vague. The $915 billion in non-Medicaid (FMAP) flexible funding must be used to “respond to, mitigate, cover costs or replace foregone revenues not projected on January 31, 2020 stemming from the public health emergency, or its negative economic impacts, with respect to the Coronavirus Disease (COVID-19).”

Rarely has so much money ridden on a few commas, to say nothing of undefined terms. A narrow interpretation is that the funding must be used for either (1) direct responses to the COVID-19 pandemic or (2) backfilling revenue losses, which would make it like the $150 billion CRF under the CARES Act but, importantly, with the added ability to offset revenue declines. A broader interpretation would see responding to, mitigating, and covering costs as distinct, and not necessarily tied to revenue declines, or might interpret responding to negative economic impacts quite generously, to allow a wide array of expenditures.

In a narrow interpretation, if a state is allocated $5 billion, experiences $1.5 billion in revenue losses against projections, and spends $500 million on direct COVID-19 responses of the sort that would also be authorized under the CRF, it would have to return $3 billion. Using a broader interpretation, however, states might conclude that bailing out their long-neglected pension funds, which might be on the verge of collapse due to recent investment losses, is a response to negative economic impacts of the virus, or that new spending programs could be justified under these ill-defined terms.

In an extreme case, perhaps Alabama lawmakers could even fund the construction of a new state capitol building with the money, as some want to do using CARES Act funding (for which it is clearly ineligible), on the grounds that its employment of construction workers operates as an economic stimulus. An extreme interpretation, perhaps, but it’s easy to imagine many ways in which states could use the HEROES Act to ramp up spending.

It’s also unclear how long the clock runs. The second installment of funding is to be paid by early May 2021, but states could potentially spend the money for years thereafter. To the extent that they use it to offset revenue losses, states which had projected out more years of revenue as of January 2020 might be in a better position to use their full share, whereas states which only issued official projections for two years might be out of luck after that.

If it seems peculiar that states might be able to radically increase spending at a time when revenues are plummeting, it is equally surprising that they might be able to use the money for sizable tax cuts. Not only might it be possible to justify them as part of the economic response to the crisis, but to the extent that they reduce revenues compared to prior projections, they also likely increase the amount of revenue that states are allowed to backfill.

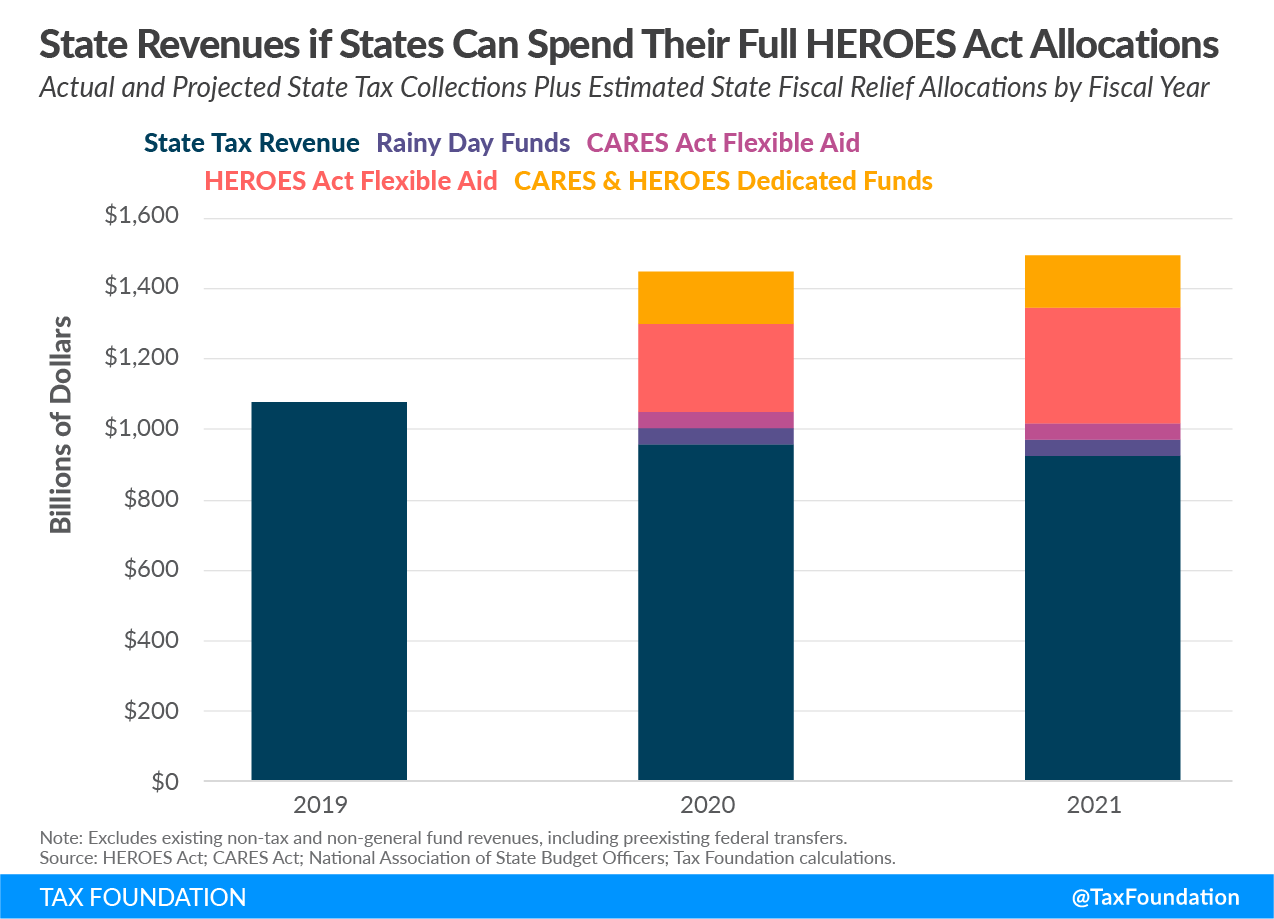

If these limitations prove relatively toothless, state tax revenues would be augmented so much that receipts (state tax revenues plus these new transfers, neglecting ongoing federal cost-sharing provisions) would soar from $1.08 trillion in FY 2019 to $1.30 trillion in FY 2020 and $1.35 trillion in FY 2021. That’s not even counting nearly $300 billion (over two years) in additional money for dedicated purposes, which could bring spending to $1.45 trillion and $1.50 trillion, respectively, in those two fiscal years. Even without counting the dedicated funding portion, state resources would be up 25 percent over a two-year period in which state tax collections could be expected to fall by about 15 percent, counting their own rainy day funds and the aid provided under the CARES Act and proposed under the HEROES Act.

Although this analysis is focused on states, the gap between available relief and ability to spend it is particularly acute in U.S. territories, which split $20 billion—even though their combined budgets are a fraction of that amount. Tiny American Samoa is in line for more than $42,000 per capita in aid, and Puerto Rico, which projected about $680 million in tax receipts across FYs 2020 and 2021, would be allowed to offset about $14.2 billion in revenue losses under the HEROES Act.

Depending on how the guardrails are interpreted, it may transpire that fiscally imprudent governments—those which had overly rosy revenue projections, or chronically underfunded their pensions—will benefit much more than those which were more responsible during the preceding 11 years of economic expansion. Furthermore, states might be incentivized to be less prudent now, either dramatically increasing spending or slashing taxes (or both) at a time when states would normally be expected to tighten their belts. This only defers the pain—potentially much greater pain—until after the federal funding runs out.

Which brings up another point: the funding comes in two installments, one shortly after enactment and another toward the end of FY 2021. But based on the amounts, it is reasonable to think that it is intended to last for as long as state revenues are recovering, which could take years. States, however, are not compelled to spend the money over time. Just as some states are clearly postponing even modest adjustments to their budgets at present in anticipation of federal relief, some states might spend the new money quickly, hoping for another round of bailouts in a year or two.

The HEROES Act is likely to meet with opposition in the Senate, if not before, so we may never know exactly how some of this money would have been allowed to be spent, but ideas from the HEROES Act are quite likely to make it into other legislative proposals. Both the scope of the relief and the methods of allocation could influence later bills. When discussing hundreds of billions or even trillions of dollars, there will be many questions in need of answers.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe