You can grill out and wear flag paraphernalia all you want, but no Fourth of July celebration is complete without fireworks—and Americans are willing to pay to get their patriotism bursting in air. According to the American Pyrotechnic Association, Americans spent over $1.3 billion on fireworks in 2018, with consumer fireworks accounting for $945 million of the total. This revenue source sparks the interest of several states which impose excise taxes and licensing fees on fireworks sales, although almost all states also impose fees on fireworks sellers.

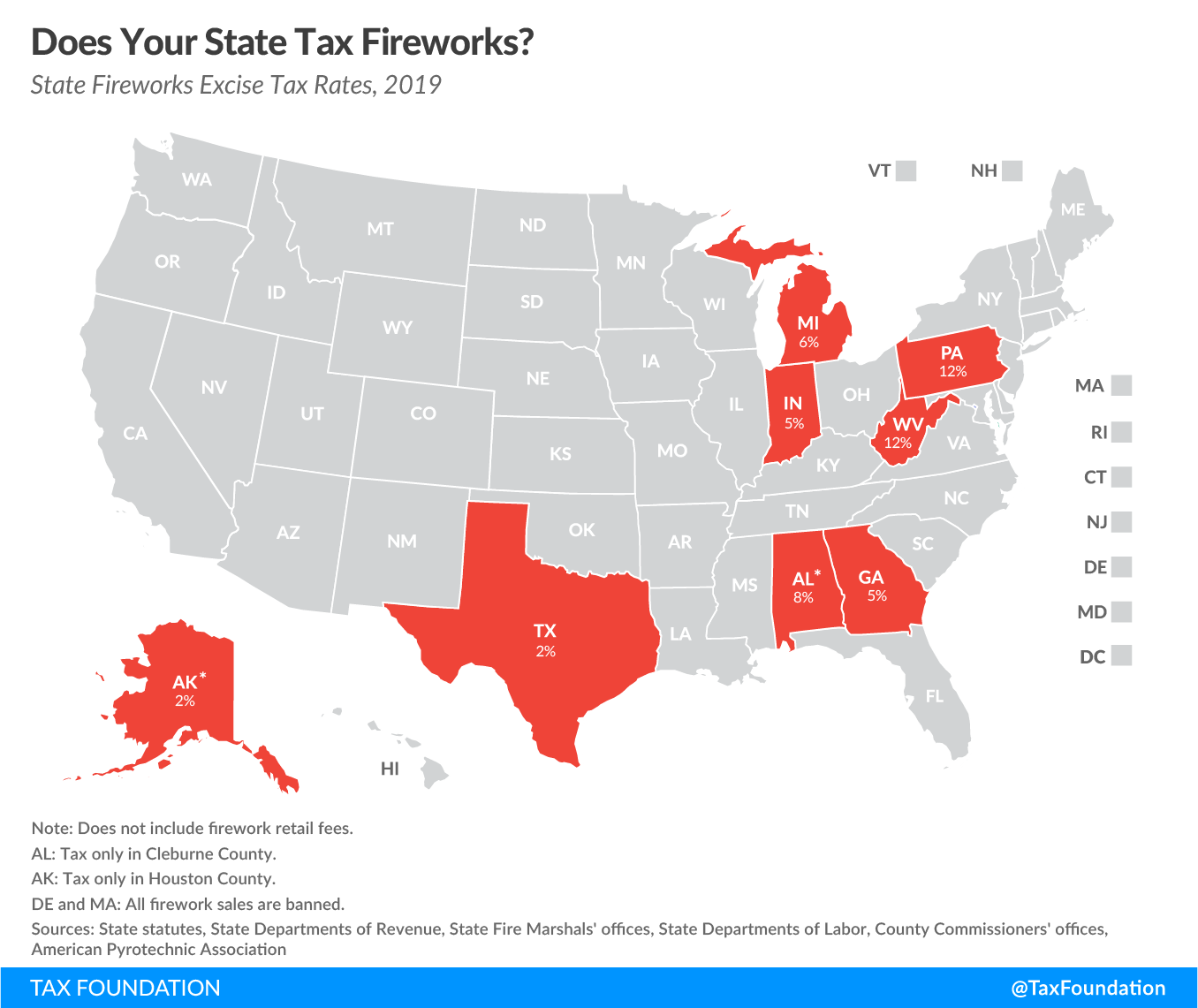

Currently, six states impose statewide excise taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. es on fireworks sales, and another two permit excise taxes in select localities. These taxes are imposed on top of each state’s existing sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. , and range from 2 percent in Texas and in Houston, Alaska (just north of Anchorage), to 12 percent in West Virginia and Pennsylvania. Check out this week’s map to see if your state taxes fireworks.

Pennsylvania’s 12 percent tax was built into Act 43, which legalized the sale of consumer-grade fireworks statewide in 2017. A portion of the law was recently reversed in the court case Phantom Fireworks Showrooms, LLC v. Tom Wolf, Governor of the Commonwealth of Pennsylvania, which outlawed the sale of aerial fireworks at roadside tents, but continued to allow such sales at permanent buildings. Both iterations of the law snuff out the state’s historical practice of selling consumer-grade fireworks tax-free to nonresidents.

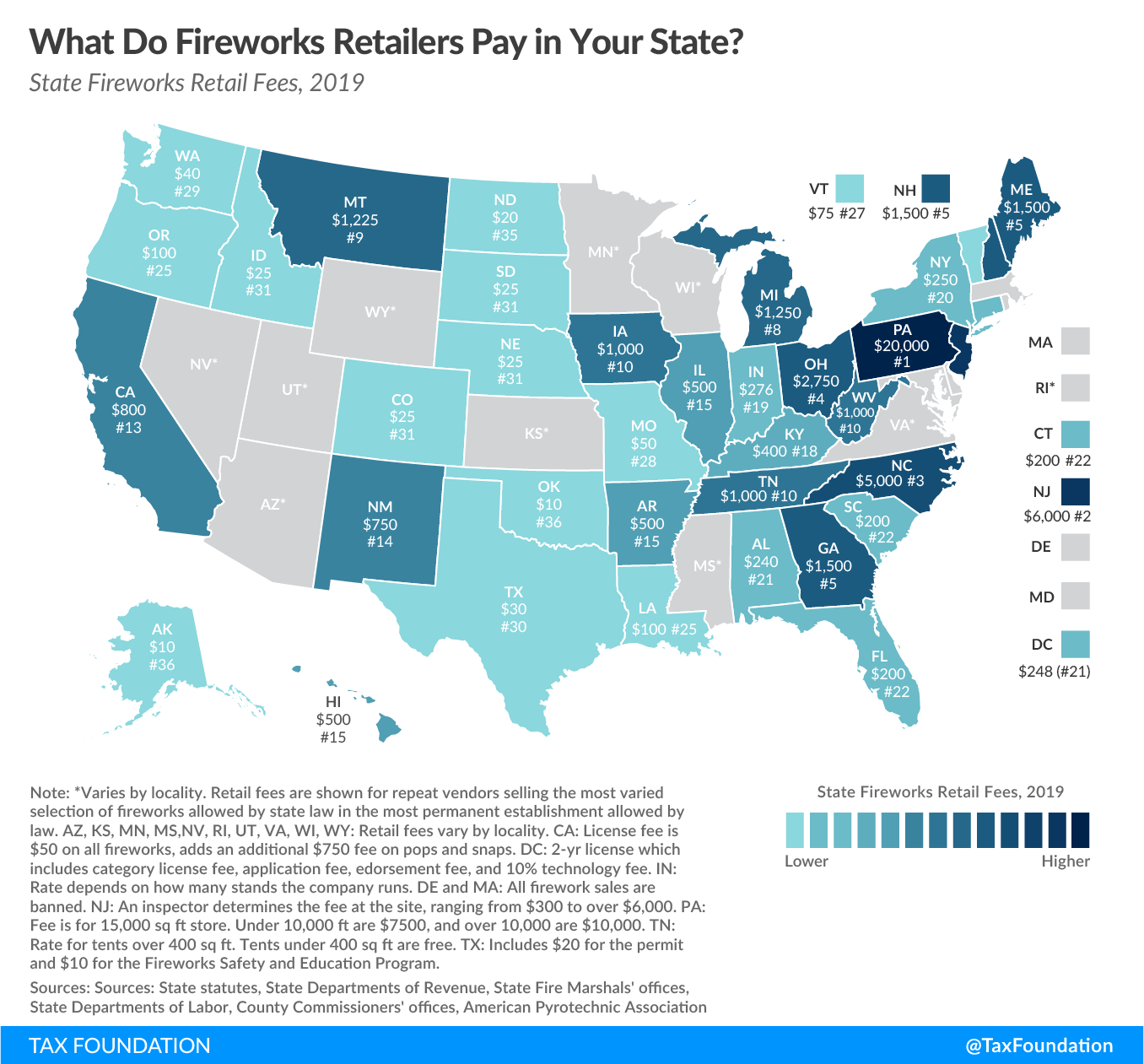

Other than Maryland, all states which permit the sale of fireworks—from only the modest sparklers and Pop-Its, to the 500-gram repeaters with names like “Hypersonic X-Celerator” and “Wizard of Ahhhs”—charge sellers a retail registration fee. This is essentially a license for the privilege of selling fireworks. These fees are as varied as fireworks themselves and range from trivial $5 paperwork charges in Coventry, Rhode Island, to $20,000 permits for 15,000-square foot stores in Pennsylvania. These license and permit fees are hidden costs that consumers end up paying in the form of higher prices.

The following map shows fireworks retail license fees for all states.

In some areas, nonprofits sell fireworks as fund-raisers. Licensing fees can be particularly burdensome in such situations. For example, if a community organization wanted to sell fireworks in Maine to raise revenue, it would have to pay a $5,000 fee—a hefty amount which could cause that organization, and many others, to forgo the project altogether. By contrast, Guernsey, Wyoming (100 miles north of Cheyenne), takes this into account and sets a discounted fee of $25 for nonprofits.

How much will your Independence Day celebrations be taxed?

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe