One relatively easy but meaningful step policymakers can take to make future tax seasons less burdensome is to modernize their state’s nonresident income tax filing, withholding, and reciprocity laws.

7 min read

The global landscape of international corporate taxation is undergoing significant transformations as jurisdictions grapple with the difficulty of defining and apportioning corporate income for the purposes of tax.

22 min read

Over the next 10 years, the IRA’s energy tax credits are projected to cost north of $1 trillion, adding to the federal government’s budgetary challenges and burgeoning debt.

6 min read

Despite taxes playing a significant role in personal finances and being levied on a sizable portion of the U.S. population, most Americans are not just unhappy with the current tax code but also do not understand it.

4 min read

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

Given that U.S. debt is roughly the size of our annual economic output, policymakers will face many tough fiscal choices in the coming years. The good news is there are policies that both support a larger economy and avoid adding to the debt.

6 min read

President Biden is proposing extraordinarily large tax hikes on businesses and the top 1 percent of earners that would put the U.S. in a distinctly uncompetitive international position and threaten the health of the U.S. economy.

19 min read

The 2021 tax year was the fourth since the Tax Cuts and Jobs Act (TCJA) made many significant, but temporary, changes to the individual income tax code to lower tax rates, widen brackets, increase the standard deduction and child tax credit, and more.

9 min read

We’re examining the differences between the broad incentives provided by the Tax Cuts and Jobs Act and the targeted approach of the Inflation Reduction Act and the CHIPS and Science Act.

In his FY 2025 budget, Illinois Gov. Pritzker outlined a number of proposed tax changes, including to individual and corporate income taxes, state sales taxes, and sports betting excise taxes.

7 min read

While the approaches differ, they share a reliance on similar linkages: new capital investment drives productivity growth, which grows the economy and raises wages for workers.

37 min read

Though providing permanent R&D expensing alone would not be a China-competition magic bullet, it is a no-brainer place to start. In this technological race, we should first make sure we have not tied our own shoes together.

4 min read

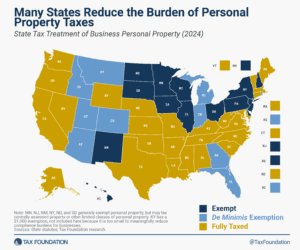

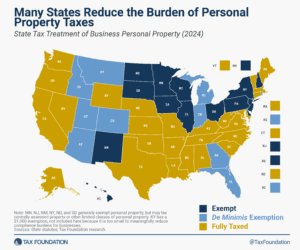

Does your state have a small business exemption for machinery and equipment?

3 min read

Portugal has the second highest top corporate tax rate in the OECD at 31.5 percent, including multiple top-up taxes. Unlike most OECD countries, Portugal imposes a highly progressive tax structure on corporate income.

6 min read

As the world of tax policy becomes more interconnected, the Tax Foundation is stepping up, recognizing the pressing need for informed and principled tax policy education in an ever-evolving landscape.

Pillar Two, the international global minimum tax agreement, has a considerable chance of failing and may ultimately allow the same problems it was designed to address.

6 min read

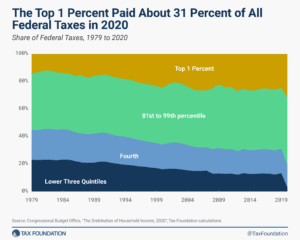

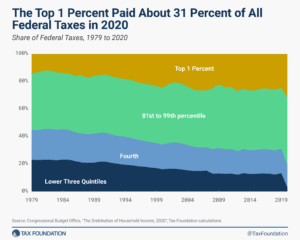

The pandemic led to one of the largest fiscal responses in U.S. history, impacting households across the income distribution.

4 min read

Working from home is great. The tax complications? Not so much.

4 min read

Sales taxes go beyond a few extra bucks at the register. It’s not just about what you pay, but who pays. What are the implications of state sales tax bases across the U.S.?