In November 2020, the Joint Committee on Taxation (JCT) released its annual report on expenditures in the taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. code, showing a total of almost $1.8 trillion in 2020, up from $1.5 trillion in 2018. Much of that roughly $1.8 trillion was due to tax relief provided by the CARES Act—and reflect the policy choice to administrate pandemic relief through the tax code.

Furthermore, it’s important to note that the report was released before the second major COVID-19 relief act passed in December 2020, which featured additional stimulus checks. Nor does it include the significant child tax creditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income rather than the taxpayer’s tax bill directly. expansions and stimulus payments passed this March in the American Rescue Plan Act (ARPA), which would impact 2021 tax expenditures.

Tax expenditures can include almost any provision that changes a person’s tax liability. Of the tax expenditures in 2020, the initial $1,200 stimulus checks (technically refundable tax credits) had a cost of $269 billion, making them the largest single tax expenditureTax expenditures are a departure from the “normal” tax code that lower the tax burden of individuals or businesses, through an exemption, deduction, credit, or preferential rate. Expenditures can result in significant revenue losses to the government and include provisions such as the earned income tax credit (EITC), child tax credit (CTC), deduction for employer health-care contributions, and tax-advantaged savings plans. in the tax code—and they were not the only tax expenditure changed in that package.

| 2018 | 2020 | |

|---|---|---|

| Corporate Tax Expenditures | $200 billion | $172 billion |

| Individual Tax Expenditures | $1.3 trillion | $1.62 trillion |

| Total | $1.5 trillion | $1.795 trillion |

|

Sources: Joint Committee on Taxation, “Estimates of Federal Tax Expenditures for Fiscal Years 2018-2022”; Joint Committee on Taxation, “Estimates of Federal Tax Expenditures for Fiscal Years 2020-2024”; Robert Bellafiore, “Tax Expenditures Before and After the Tax Cuts and Jobs Act,” Tax Foundation, Dec. 18, 2018; and author’s calculations. |

||

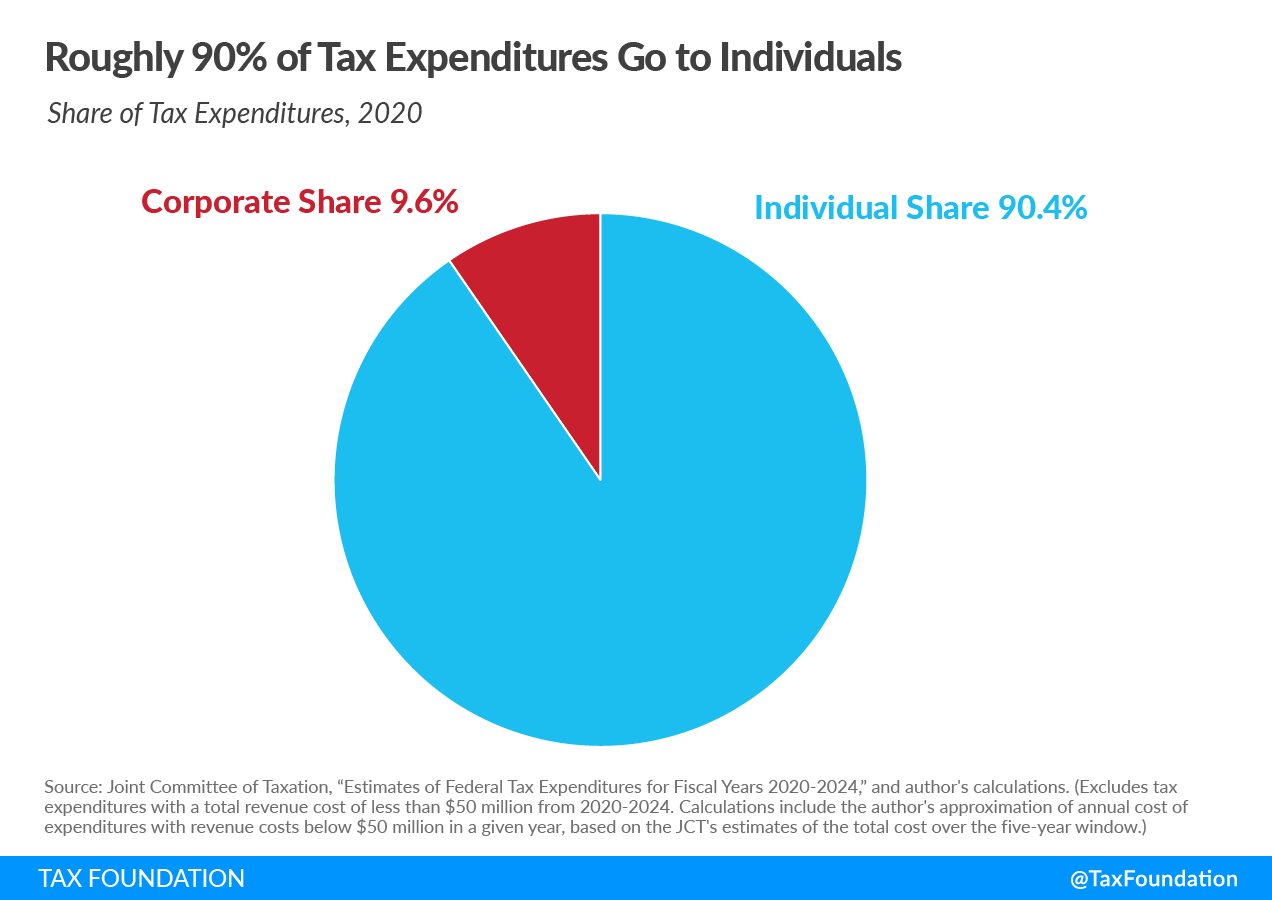

The CARES Act also changed the balance of who benefits from tax expenditures, primarily through the stimulus payments. Just over 90 percent of tax expenditures in 2020 went to individuals, as opposed to 10 percent to corporations. That’s a 4 percentage-point increase from 2018, when individuals received 86 percent of tax expenditure benefits.

A tax expenditure is a deviation from a “normal” tax code; however, this depends on what one considers “normal” tax treatment.

Consider Alice, who earned $50,000 last year and invested $10,000 of it in a savings account. Under the Haig-Simons definition of income, which is consumption plus change in net worth, Alice should pay income tax on the full $50,000 of salary this year, as well as on the returns to the savings in future years. However, under a definition of income that is neutral between present and future consumption, Alice would pay taxes on either the full $50,000 this year (without paying tax on the future return to her savings), or on only $40,000 this year plus the returns in future years.

Using Haig-Simons, one would consider Roth IRAs—taxing income when it is saved but exempting returns—or traditional 401(k)s—exempting income when saved but taxing returns—as examples of tax expenditures that deviate from a normal baseline. But under a savings-consumption neutral definition of income, Roths and 401(k)s are basic parts of the system and do not constitute a “special” tax break.

The JCT report relies on Haig-Simons, so it counts certain provisions as expenditures (in particular, accelerated depreciation provisions that allow companies to deduct the cost of their investments faster) that should not be thought of as preferential treatment or equivalent to a spending program. Nonetheless, the report does show some interesting trends.

| Individual Tax Expenditures | Corporate Tax Expenditures |

|---|---|

| Advanceable and refundable recovery rebate tax credit for eligible individuals for 2020 ($269 billion) | Reduced tax rate on active income of controlled foreign corporations ($45.4 billion) |

| Exclusion of employer contributions for health care, health insurance premiums, and long-term care insurance premiums ($169.6 billion) | Depreciation of equipment in excess of the Alternative Depreciation System ($43.2 billion) |

| Net exclusion of pension contributions and earnings: defined benefit plans ($153.6 billion) | Credit for increasing research activities ($13.2 billion) |

|

Sources: Joint Committee of Taxation, “Estimates of Federal Tax Expenditures for Fiscal Years 2020-2024,” and author’s calculations. |

|

While it may be inaccurate to classify specific tax expenditures as tax breaks, the report provides a useful way to see how the tax code has changed over the past few years, and in particular, the changes to tax expenditures driven by the CARES Act. The increase in expenditures associated with COVID-19 relief is another illustration of using the tax code to administer social spending.

Share this article