Note: The following is the testimony of Garrett Watson, Senior Policy Analyst and Modeling Manager at the Tax Foundation, prepared for U.S. Senate Committee on Finance hearing on March 7, 2023, titled, “Tax Policy’s Role in Increasing Affordable Housing Supply for Working Families.”

Reforming the Low-Income Housing TaxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. Credit and Improving Cost RecoveryCost recovery is the ability of businesses to recover (deduct) the costs of their investments. It plays an important role in defining a business’ tax base and can impact investment decisions. When businesses cannot fully deduct capital expenditures, they spend less on capital, which reduces worker’s productivity and wages. for Structures is Vital for Expanding Affordable Housing

Chairman Wyden, Ranking Member Crapo, and distinguished members of the Senate Finance Committee, thank you for the opportunity to provide testimony on how to improve tax policy to increase affordable housing supply and serve working families. I am Garrett Watson, Senior Policy Analyst at the Tax Foundation, where I focus on how we can improve our federal tax code.

Today, I will recommend ways to improve the low-income housing tax creditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income, rather than the taxpayer’s tax bill directly. (LIHTC) to ensure it is effective at providing affordable housing to low-income Americans. I will also discuss how broader improvements to the tax code, such as providing better cost recovery for residential structures, would be an effective way to grow the supply of affordable housing.

Reforming the Low-Income Housing Tax Credit to Help Vulnerable Americans

LIHTC is the largest source of affordable housing financing in the United States, using about $13.5 billion in forgone revenue each year on average. LIHTC has supported the construction of more than 3 million housing units since its creation in 1986 through 2020.[1]

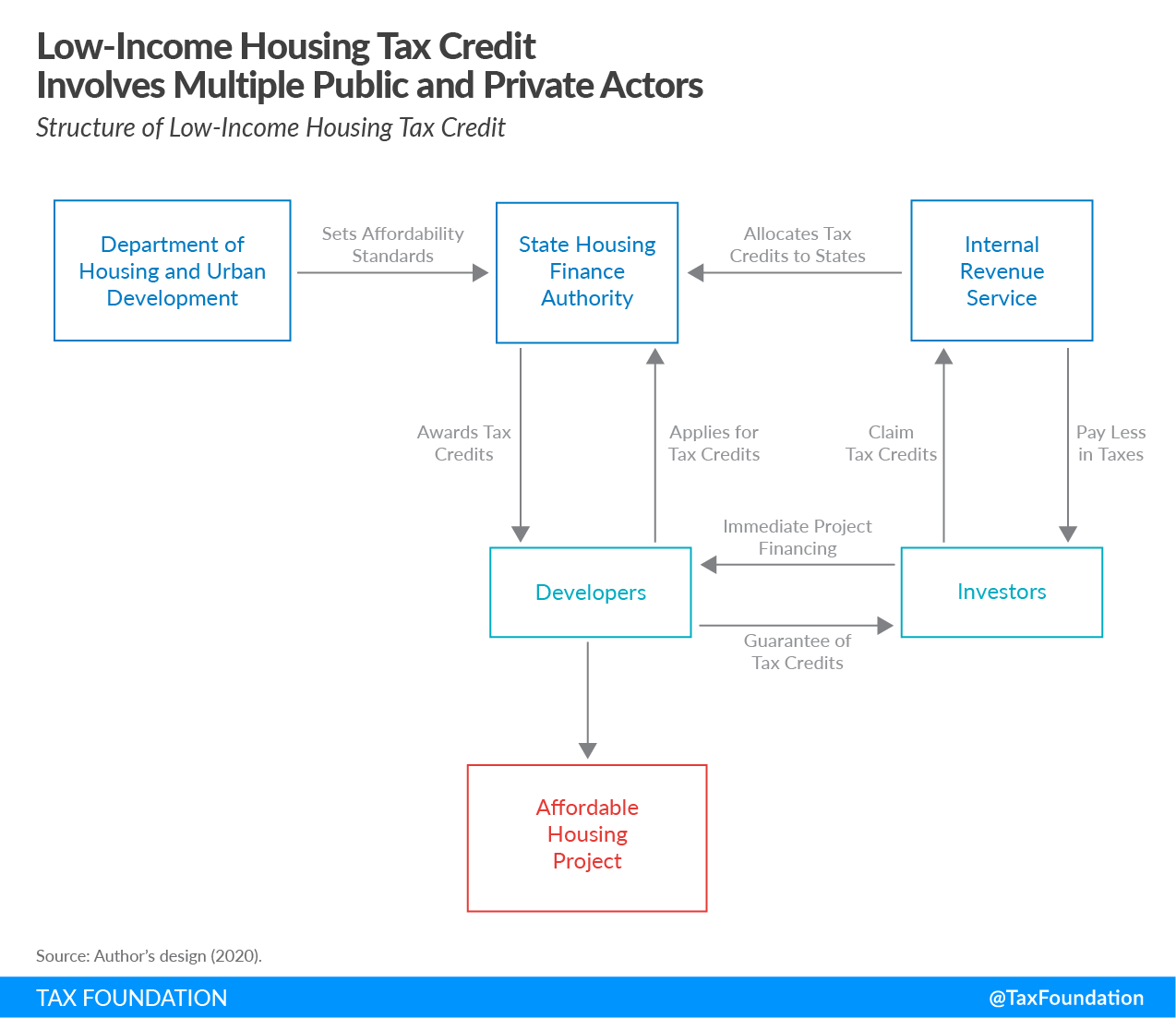

LIHTC provides developers with transferable, nonrefundable tax credits for the construction of housing developments, which include limits on tenant income and housing costs.[2]

We should consider three big-picture points when evaluating the effectiveness of LIHTC as a tool to help working families and low-income households.

First, while LIHTC has helped expand housing affordability, the credit’s administration could be improved. More detailed information should be provided on the credit’s effectiveness, as recommended in a 2018 report by the Government Accountability Office (GAO).[3]

Notably, GAO recommends that policymakers designate an agency to collect data to better understand project development costs. Such data would help inform future reform efforts, ensuring agencies impose limits on costs, root out fraud, and reform opaque and discretionary credit allocation processes. The data we have so far has shown, for example, that developments supported by the credit tend to suffer from higher-than-average construction costs. A 2017 GAO study found that only 30 percent of allocating agencies at the state level put limits on development costs, potentially undercutting the credit’s efficiency.[4]

While the Department of Housing and Urban Development (HUD) provides valuable project-level data, additional data such as information on fees paid to developers and syndicators as well as outcomes for properties and tenants over time would be valuable for assessing LIHTC.[5]

Second, it is important to evaluate LIHTC’s broader policy effectiveness before considering options to expand LIHTC. One area of concern is how much of the LIHTC’s benefit goes to low-income households. Several studies have found that between one-third and three-quarters of the subsidy provided by LIHTC go to low-income households, with the rest accumulates to other stakeholders such as developers and investors.[6]

Similarly, LIHTC projects tend to be located in higher-poverty neighborhoods, depriving tenants of the benefits of living in places with more opportunities and amenities.[7][8]

Finally, many of LIHTC’s administrative challenges are rooted in using the tax code to tackle important social problems that may be outside the proper scope of the tax system. The array of programs supporting housing, ranging from federal grants, tax credits for historic rehabilitation, and tenant-facing assistance, all overlap with LIHTC both in policy goals and benefiting stakeholders. That overlap makes it harder to evaluate the effectiveness of the credit compared to alternatives, such as housing vouchers, an option considered by the Congressional Budget Office as far back as 1992.[9]

While it is important to consider options to improve LIHTC’s administration, oversight, and efficiency, many challenges could be resolved by reconsidering whether the tax code is specifically the best place to support housing projects and low-income tenants.

Pro-Growth Tax Policy as a Tool to Expand the Supply of Affordable Housing

In addition to reforms to LIHTC, a supplementary approach to expanding the supply of affordable housing is to reduce the tax burden on investment in housing. One way to reduce the tax burden is improving the cost recovery of structures in the federal tax code.

Currently, investors in residential structures must depreciate structures over periods up to 27.5 years long, limiting the economic value of the depreciationDepreciation is a measurement of the “useful life” of a business asset, such as machinery or a factory, to determine the multiyear period over which the cost of that asset can be deducted from taxable income. Instead of allowing businesses to deduct the cost of investments immediately (i.e., full expensing), depreciation requires deductions to be taken over time, reducing their value and discouraging investment. allowances. Ideally, all investments would be fully and immediately deducted from taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. For both individuals and corporations, taxable income differs from—and is less than—gross income. , but this can pose a challenge for structures that create a net operating loss for investors given the large size of the investment.

One solution is to provide neutral cost recovery, which adjusts depreciation deductions to maintain their value in real terms. This would improve the economic incentive to invest in structures, expanding housing supply, while also avoiding challenges posed from fully expensing such large investments.

According to the Tax Foundation’s estimates, providing neutral cost recovery to residential structures would lead to the construction of up to 2.3 million housing units in the long run, lower construction costs by about 11 percent, and raise long-run economic output by 1.2 percent.[10]

Pairing better cost recovery with efforts to improve land use and zoning rules at the state and local levels would magnify the positive effect of neutral cost recovery.

Conclusion

Reforming the low-income housing tax credit (LIHTC) and providing neutral cost recovery for residential structures would tackle the problem of housing affordability in a complementary fashion. Neutral cost recovery expands housing supply and lowers costs of construction and rents, which can help LIHTC fund more below-market-rate projects.

These reforms are two important steps that policymakers can take to ensure the federal tax code is not a barrier to solving America’s affordable housing challenge.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe[1] U.S. Congress, “Estimates of Federal Tax Expenditures for Fiscal Years 2022-2026,” Joint Committee on Taxation, Dec. 22, 2022, https://www.jct.gov/publications/2022/jcx-22-22/. See also Mark P. Keightley, “An Introduction to the Low-Income Housing Tax Credit,” Congressional Research Service, Jan. 6, 2023, https://sgp.fas.org/crs/misc/RS22389.pdf and Department of Housing and Urban Development, Office of Policy Development and Research, “Low-Income Housing Tax Credits,” June 5, 2020, https://huduser.gov/portal/datasets/lihtc.html.

[2] Everett Stamm and Taylor LaJoie, “An Overview of the Low-Income Housing Tax Credit,” Tax Foundation, Aug. 11, 2020, https://taxfoundation.org/low-income-housing-tax-credit-lihtc/.

[3] Daniel Garcia-Diaz, “Low-Income Housing Tax Credit: Improved Data and Oversight Would Strengthen Cost Assessment and Fraud Risk Management,” Government Accountability Office, September 2018, https://gao.gov/assets/700/694541.pdf.

[4] Michael Eriksen, “The Market Price of Low-Income Housing Tax Credits,” Journal of Urban Economics 66:2 (September 2009), 141–49 and Garcia-Diaz, “Low-Income Housing Tax Credit: Improved Data and Oversight Would Strengthen Cost Assessment and Fraud Risk Management.”

[5] Congressional Research Service, “The Low-Income Housing Tax Credit: Policy Issues,” Oct. 17, 2019, https://crsreports.congress.gov/product/pdf/IF/IF11335.

[6] Ed Olsen, “Does Housing Affordability Argue for Subsidizing the construction of Tax Credit Projects?,” American Enterprise Institute, March 24, 2017, https://www.aei.org/wp-content/uploads/2017/07/Ed-Olsen-AEI-Housing-Affordability.pdf and Gregory S. Burge, “Do Tenants Capture the Benefits from Low-Income Housing Tax Credit Program?,”” Dec. 1, 2010, https://onlinelibrary.wiley.com/doi/abs/10.1111/j.1540-6229.2010.00287.x.

[7] Congressional Research Service, “The Low-Income Housing Tax Credit: Policy Issues.”

[8] A related policy concern is to what extent LIHTC crowds out development that would have happened absent the credit: a 2005 study found that 30 to 70 percent of LIHTC-supported housing would have been built without the program, a finding echoed by a separate 2010 study identifying similar displacement of private construction.

[9] Congressional Budget Office, “The Cost-Effectiveness of the Low-Income Housing Tax Credit Compared with Housing Vouchers,” April 1, 1992, https://www.cbo.gov/publication/16375.

[10] Erica York, Alex Muresianu, and Everett Stamm, “Estimating Neutral Cost Recovery’s Impact on Affordable Housing,” Tax Foundation, Aug. 7, 2020, https://taxfoundation.org/estimating-neutral-cost-recoverys-impact-on-affordable-housing/. See also Erica York, “Options for Improving the Tax Treatment of Structures,” Tax Foundation, May 19, 2020, https://taxfoundation.org/neutral-cost-recovery-for-buildings/.

Share