All Related Articles

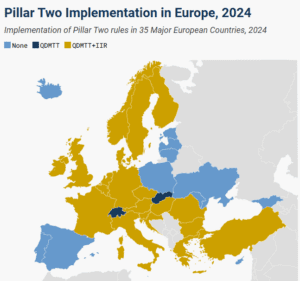

Pillar Two Implementation in Europe, 2024

18 of the 27 EU Member States have implemented both the income inclusion rule and the qualified domestic minimum top-up tax in 2024.

4 min read

Wartime Taxes Are Waging War on Sound Policy Choices

Spain’s central government is considering making its windfall taxes on energy companies and the banking sector permanent.

6 min read

What Does Moving Toward a More Competitive EU Tax System Mean?

As the geopolitical scene continues to change, policymakers in Europe should focus on lowering effective marginal tax rates to drive much-needed investment and long-term economic growth.

6 min read

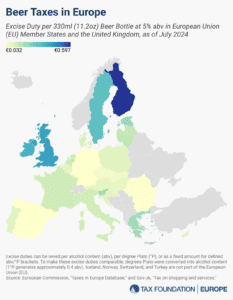

Beer Taxes in Europe, 2024

As Oktoberfest celebrations wrap up across the continent, now is a great time to examine beer taxes in the European Union. Hefty beer taxes add to the price of every drink consumed.

5 min read

The French Budget: Moving from Public Debate to Principled Solutions

Focusing on competitiveness, neutrality, and efficient policies to raise revenue would go a long way in increasing economic growth and stabilizing public finances over the long term.

7 min read

2024 Spanish Regional Tax Competitiveness Index

The 2024 Spanish Regional Tax Competitiveness Index allows policymakers and taxpayers to evaluate and measure how their regions’ tax systems compare.

7 min read

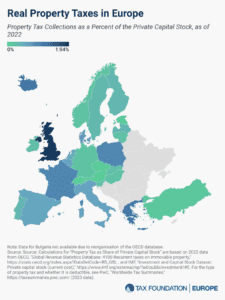

Real Property Taxes in Europe, 2024

High property taxes levied not only on land but also on buildings and structures can discourage investment in infrastructure, which businesses would have to pay additional tax on.

3 min read

Bob Stack Unpacks US Challenges in Global Tax

Bob Stack, an international tax expert, explores the implications of the EU’s adoption of Pillar Two and the potential for streamlining overlapping policies. He also addresses the issues that the US faces in global tax policy with the upcoming elections.

Statutory vs. Effective Tax Rates: Why Do Higher Taxes Not Necessarily Lead to Increased Revenues?

The gap between statutory rates and average effective tax rates for personal income tax in the European Union varies significantly, affecting the efficiency and simplicity of the tax system.

32 min read

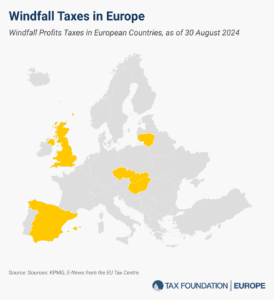

Windfall Profit Taxes in Europe, 2024

The flawed design of these windfall profits taxes has created problems in countries that implemented them.

4 min read