All Related Articles

Fiscal Forum: Future of the EU Tax Mix with Dr. Christoph Spengel

Tax Foundation Europe’s Sean Bray had the opportunity to interview Professor of International Taxation at the University of Mannheim Business School, Christoph Spengel, about the future of the EU tax mix.

15 min read

The Fiscal Consequences of Increased German Spending

Without aligning fiscal discipline with pro-growth tax policies, Germany and the EU risk high deficits, mounting debt, and sustained inflation.

5 min read

Fiscal Forum: Tax Foundation Europe Interview with Italian Vice-Minister Maurizio Leo

Daniel Bunn had the opportunity to interview the Vice-Minister for Economy and Finance of Italy, Maurizio Leo, about the tax policy priorities of the Italian government. The conversation shows a commitment to reforming rules that create legal uncertainty and support competitiveness.

5 min read

Businesses Pay and Remit 87 Percent of All Taxes Collected in Europe

Without businesses as their taxpayers and tax collectors, governments would not have the resources to provide even the most basic services.

5 min read

Taxing Powerhouses: The Systematic Role of Businesses in Collecting Government Revenue

On average, businesses in the OECD are liable for collecting, paying, and remitting more than 85 percent of the total tax collection.

15 min read

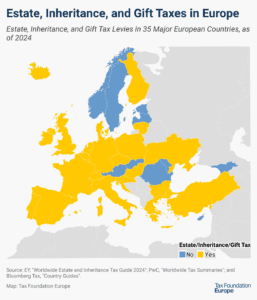

Estate, Inheritance, and Gift Taxes in Europe, 2025

Twenty-four out of the 35 European countries covered in this map currently levy estate, inheritance, or gift taxes.

3 min read

Discrimination vs. Neutrality: A Case Study in the Middle of a Trade War

Policymakers should aim for neutral tax policies that support stable revenues like VATs and avoid inviting trade conflicts with discriminatory and economically harmful policies like DSTs.

6 min read

Effects of the Federal Constitutional Court’s Judgment on Germany’s Solidarity Surtax

Surtaxes such as Germany’s solidarity surtax run counter to the principles of simplicity and transparency of the tax system because they impose an additional layer of tax on taxpayers and create a more complex tax structure that often obscures the actual tax burden.

4 min read

As Trump’s “Liberation Day” of Global Tariffs Nears, Europe Is in a Tight Spot

With the imposition of American tariffs on steel and aluminum imports on March 12th, the European Union was officially pulled into the global trade war.

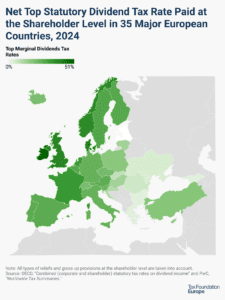

Dividend Tax Rates in Europe, 2025

Many countries’ personal income tax systems tax various sources of individual income—including investment income such as dividends and capital gains.

4 min read