All Related Articles

Excise Duties on Electricity in Europe, 2024

EU Member States should seek to minimize the rate and broaden the base of electricity duties, consolidating their rates to the required minimum rate.

3 min read

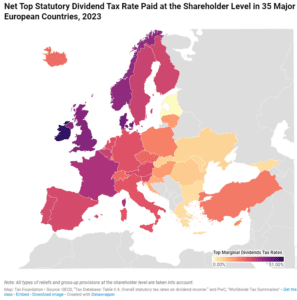

Dividend Tax Rates in Europe, 2024

In many countries, corporate profits are subject to two layers of taxation: the corporate income tax at the entity level when the corporation earns income, and the dividend tax or capital gains tax at the individual level when that income is passed to its shareholders as either dividends or capital gains.

2 min read

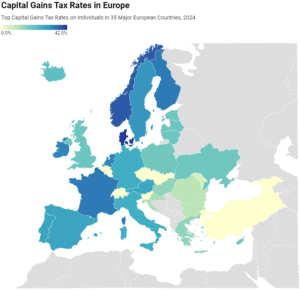

Capital Gains Tax Rates in Europe, 2024

In many European countries, investment income, such as dividends and capital gains, is taxed at a different rate than wage income.

2 min read

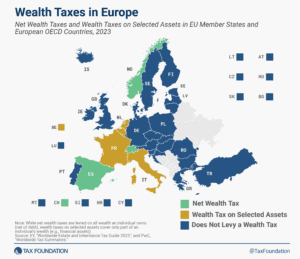

Wealth Taxes in Europe, 2024

Only three European countries levy a net wealth tax—Norway, Spain, and Switzerland. France and Italy levy wealth taxes on selected assets.

4 min read

Savings and Investment: The Tax Treatment of Stock and Retirement Accounts in the OECD and Select EU Countries

Tax-preferred private retirement accounts often have complex rules and limitations. Universal savings accounts could be a simpler alternative—or addition—to many countries’ current system of private retirement savings accounts.

19 min read

Top Personal Income Tax Rates in Europe, 2024

Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) have the highest top statutory personal income tax rates among European OECD countries.

3 min read

VAT Rates in Europe, 2024

A few European countries have made changes to their VAT rates, including the Czech Republic, Estonia, Switzerland, and Turkey.

3 min read

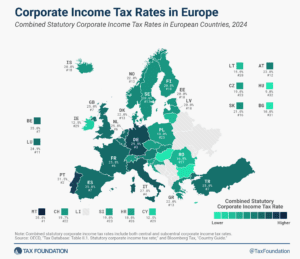

Corporate Income Tax Rates in Europe, 2024

Like most regions around the world, European countries have experienced a decline in corporate income tax rates over the past four decades, but the average corporate income tax rate has leveled off in recent years.

2 min read

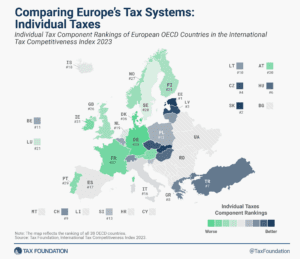

Comparing Europe’s Tax Systems: Individual Taxes

Estonia has the most competitive individual tax system in the OECD for the 10th consecutive year.

2 min read

Investment in the United Kingdom Increased following Pro-Investment Tax Reforms

The UK economy is experiencing an upsurge in business fixed investment following two pro-growth tax changes. In the second quarter of 2023, business investment was 9.4 percent higher than the same quarter last year.

10 min read

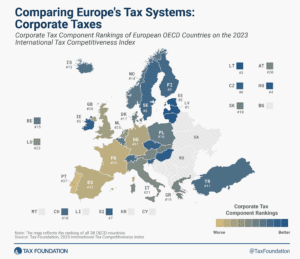

Comparing Europe’s Tax Systems: Corporate Taxes

According to the corporate tax component of the 2023 International Tax Competitiveness Index, Latvia and Estonia have the best corporate tax systems in the OECD.

2 min read

2023 European Tax Policy Scorecard

The variety of approaches to taxation among European countries creates a need to evaluate these systems relative to each other. For that purpose, we have developed the European Tax Policy Scorecard—a relative comparison of European countries’ tax systems.

52 min read

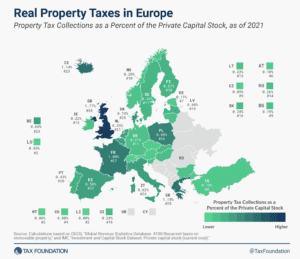

Real Property Taxes in Europe, 2023

High property taxes levied not only on land but also on buildings and structures can discourage investment in infrastructure, which businesses would have to pay additional tax on.

2 min read

2023 Spanish Regional Tax Competitiveness Index

The 2023 Spanish Regional Tax Competitiveness Index allows policymakers and taxpayers to evaluate and measure how their regions’ tax systems compare.

6 min read

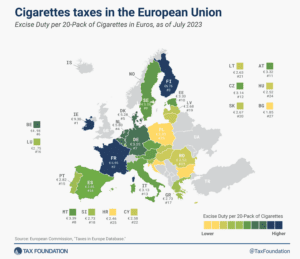

Cigarette Taxes in Europe, 2023

3 min read

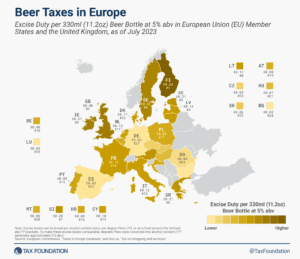

Beer Taxes in Europe, 2023

As Oktoberfest celebrations kick off around the world, let’s look at how much tax European Union (EU) countries add to the world’s favorite alcoholic beverage.

2 min read

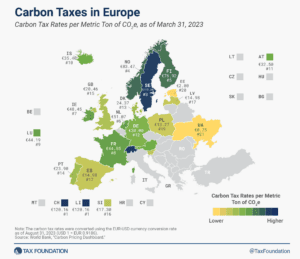

Carbon Taxes in Europe, 2023

In recent years, several countries have taken measures to reduce carbon emissions, including instituting environmental regulations, emissions trading systems, and carbon taxes. In 1990, Finland was the world’s first country to introduce a carbon tax.

4 min read

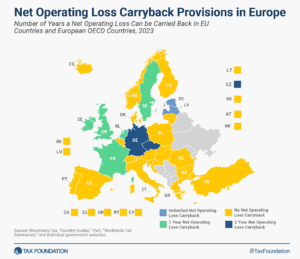

Net Operating Loss Carryforward and Carryback Provisions in Europe, 2023

Carryover tax provisions help businesses “smooth” their risk and income, making the tax code more neutral across investments and over time.

3 min read

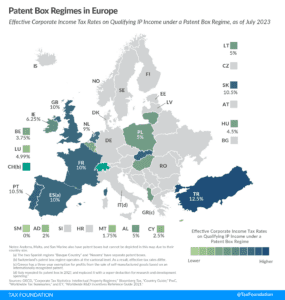

Patent Box Regimes in Europe, 2023

The aim of patent boxes is generally to encourage and attract local research and development (R&D) and to incentivize businesses to locate IP in the country. However, patent boxes can introduce another level of complexity to a tax system, and some recent research questions whether patent boxes are actually effective in driving innovation.

3 min read

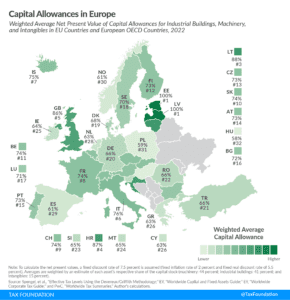

Capital Allowances in Europe, 2023

Capital allowances play an important role in a country’s corporate tax base and can impact investment decisions—with far-reaching economic consequences.

4 min read