All Related Articles

233 Results

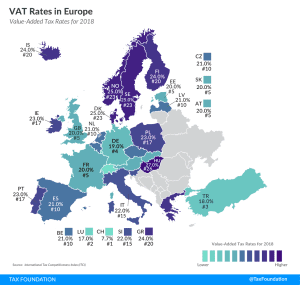

VAT Rates in Europe, 2020

4 min read

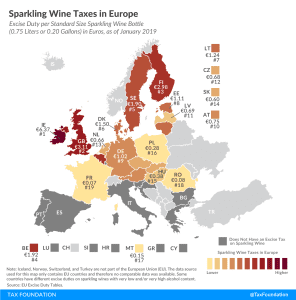

Sparkling Wine Taxes in Europe

1 min read

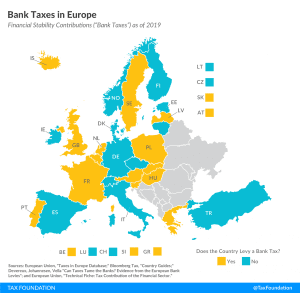

Bank Taxes in Europe

2 min read

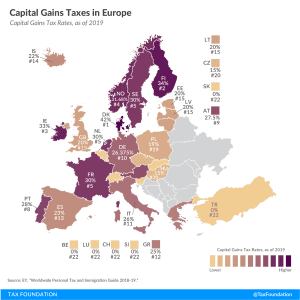

Capital Gains Taxes in Europe, 2019

2 min read

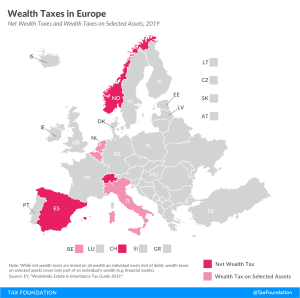

Wealth Taxes in Europe, 2019

Only three European countries levy a net wealth tax, namely Norway, Spain, and Switzerland. Belgium, Italy, and the Netherlands levy wealth taxes on selected assets, but not on an individual’s net wealth per se.

3 min read

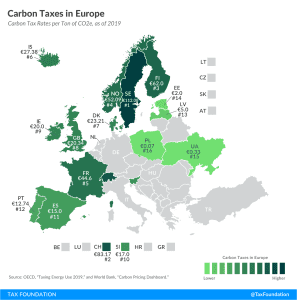

Carbon Taxes in Europe, 2019

3 min read

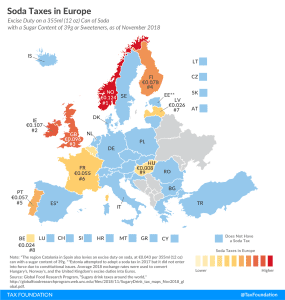

Soda Taxes in Europe

2 min read

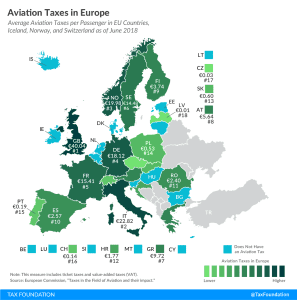

Aviation Taxes in Europe

1 min read

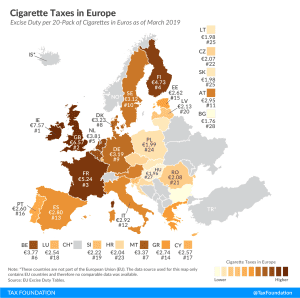

Cigarette Taxes in Europe, 2019

Today, Ireland and the United Kingdom levy the highest excise duties on cigarettes in the European Union (EU), at €7.57 (US $8.93) and €6.57 ($7.75) per 20-cigarette pack, respectively. This compares to an EU average of €3.09 ($3.64). In contrast, Bulgaria (€1.76 or $2.07) and Hungary (€1.96 or $2.31) levy the lowest excise duties.

3 min read

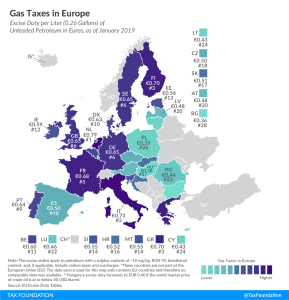

Gas Taxes in Europe, 2019

4 min read