All Related Articles

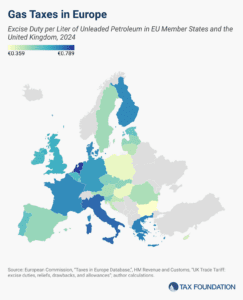

Diesel and Gas Taxes in Europe, 2024

Gas and diesel taxes continue to be prominent policy issues throughout Europe. As the EU undergoes sweeping changes for its green transition, fuel taxes are likely to be a crucial aspect of policy discussions.

3 min read

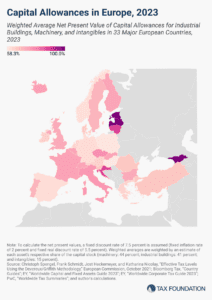

Capital Allowances in Europe, 2024

Although sometimes overlooked in discussions about corporate taxation, capital allowances play an important role in a country’s corporate tax base and can impact investment decisions—with far-reaching economic consequences.

4 min read

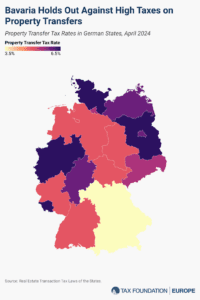

Real Estate Transaction Tax Rates in German States

The real estate transaction tax is levied on the gross sales value of a property when it changes ownership, without deductions for investment or purchasing costs. This makes the tax particularly harmful to investment in buildings and structures.

3 min read

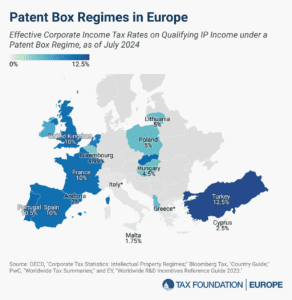

Patent Box Regimes in Europe, 2024

The aim of patent boxes is generally to encourage and attract local research and development (R&D) and to incentivize businesses to locate IP in the country. However, patent boxes can introduce another level of complexity to a tax system, and some recent research questions whether patent boxes are actually effective in driving innovation.

3 min read

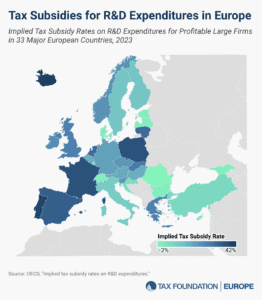

Tax Subsidies for R&D Expenditures in Europe, 2024

Many countries incentivize business investment in research and development (R&D), intending to foster innovation. A common approach is to provide direct government funding for R&D activity. However, a significant number of jurisdictions also offer R&D tax incentives.

3 min read

The Impact of High Inflation on Tax Revenues across Europe

The European Union’s experience with high inflation highlights the critical need for adaptive fiscal policies. Best practices drawn from the academic literature recommend implementing automatic adjustment mechanisms with a certain periodicity and based on price increases.

31 min read

The High Cost of Wealth Taxes

Many developed countries have repealed their wealth taxes in recent years for a variety of reasons. They raise little revenue, create high administrative costs, and induce an outflow of wealthy individuals and their money. Many policymakers have also recognized that high taxes on capital and wealth damage economic growth.

30 min read

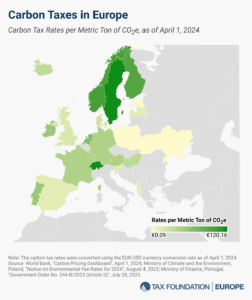

Carbon Taxes in Europe, 2024

23 European countries have implemented carbon taxes, ranging from less than €1 per metric ton of carbon emissions in Ukraine to more than €100 in Sweden, Liechtenstein, and Switzerland.

3 min read

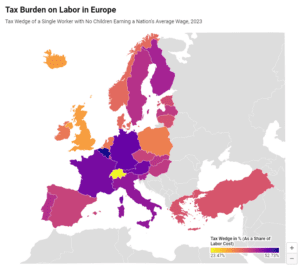

Tax Burden on Labor in Europe, 2024

To make the taxation of labor more efficient, policymakers should understand the inputs into the tax wedge, and taxpayers should understand how their tax burden funds government services.

4 min read

Overview and Analysis of the Impact of Marginal Taxes on High Incomes in the European Union

The recent push to increase taxes on the wealthy has gained significant traction across Europe. This report highlights the obstacles and complex interplay between tax policy and economic behavior, suggesting that simply raising tax rates on the wealthy might not yield the intended social benefits.

42 min read

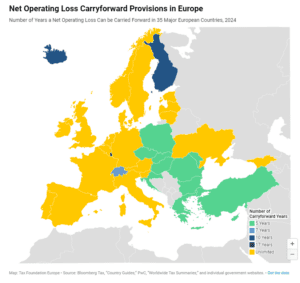

Net Operating Loss Carryforward and Carryback Provisions in Europe, 2024

Carryover provisions help businesses “smooth” their risk and income, making the tax code more neutral across investments and over time.

3 min read

Trade Tax Rates in Germany

Varying local trade tax rates impact business investment and local government revenue across Germany’s municipalities.

4 min read

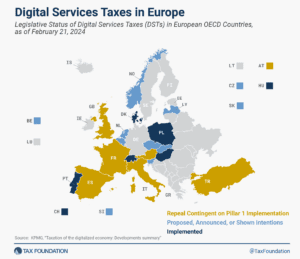

Digital Services Taxes in Europe, 2024

About half of all European OECD countries have either announced, proposed, or implemented a DST. Because these taxes mainly impact U.S. companies and are thus perceived as discriminatory, the United States responded to the policies with retaliatory tariff threats, urging countries to abandon unilateral measures.

4 min read

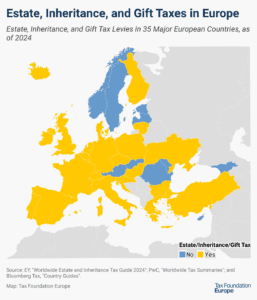

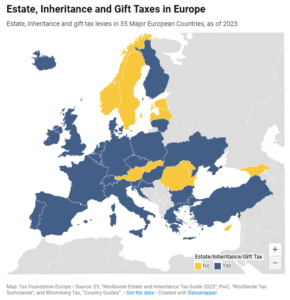

Estate, Inheritance, and Gift Taxes in Europe, 2024

As tempting as inheritance, estate, and gift taxes might look—especially when the OECD notes them as a way to reduce wealth inequality—their limited capacity to collect revenue and their negative impact on entrepreneurial activity, saving, and work should make policymakers consider their repeal instead of boosting them.

2 min read

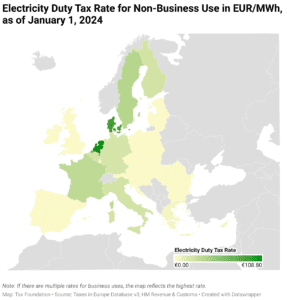

Excise Duties on Electricity in Europe, 2024

EU Member States should seek to minimize the rate and broaden the base of electricity duties, consolidating their rates to the required minimum rate.

3 min read

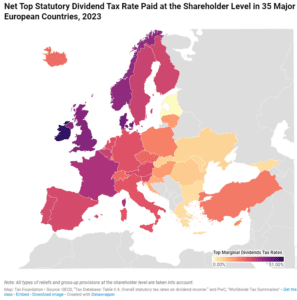

Dividend Tax Rates in Europe, 2024

In many countries, corporate profits are subject to two layers of taxation: the corporate income tax at the entity level when the corporation earns income, and the dividend tax or capital gains tax at the individual level when that income is passed to its shareholders as either dividends or capital gains.

2 min read

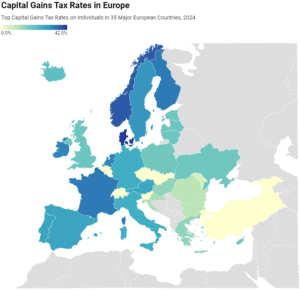

Capital Gains Tax Rates in Europe, 2024

In many European countries, investment income, such as dividends and capital gains, is taxed at a different rate than wage income.

2 min read

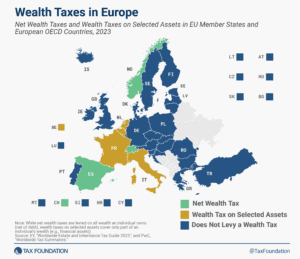

Wealth Taxes in Europe, 2024

Only three European countries levy a net wealth tax—Norway, Spain, and Switzerland. France and Italy levy wealth taxes on selected assets.

4 min read

Savings and Investment: The Tax Treatment of Stock and Retirement Accounts in the OECD and Select EU Countries

Tax-preferred private retirement accounts often have complex rules and limitations. Universal savings accounts could be a simpler alternative—or addition—to many countries’ current system of private retirement savings accounts.

19 min read

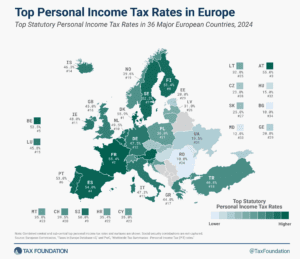

Top Personal Income Tax Rates in Europe, 2024

Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) have the highest top statutory personal income tax rates among European OECD countries.

3 min read