Estate, Inheritance, and Gift Taxes in Europe, 2025

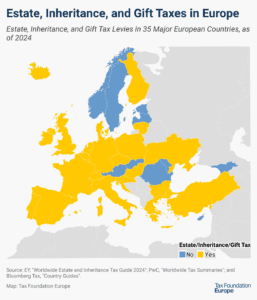

Twenty-four out of the 35 European countries covered in this map currently levy estate, inheritance, or gift taxes.

3 min read

Twenty-four out of the 35 European countries covered in this map currently levy estate, inheritance, or gift taxes.

3 min read

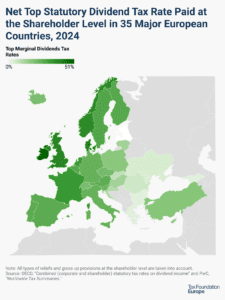

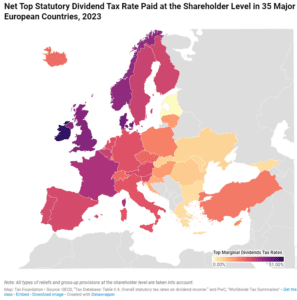

Many countries’ personal income tax systems tax various sources of individual income—including investment income such as dividends and capital gains.

4 min read

In many countries, corporate profits are subject to two layers of taxation: the corporate income tax at the entity level when the corporation earns income, and the dividend tax or capital gains tax at the individual level when that income is passed to its shareholders as either dividends or capital gains.

2 min read

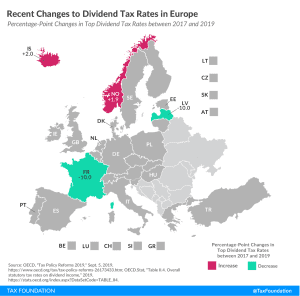

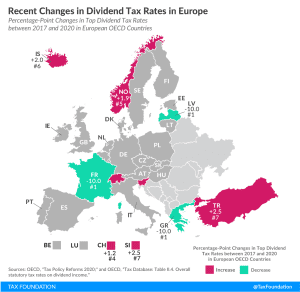

Over the last three years, eight European OECD countries have made changes to their dividend tax rates. Iceland, Norway, Slovenia, Switzerland, and Turkey increased their rates, each between roughly one and three percentage points. France, Greece, and Latvia cut their rates by 10 percentage points.

2 min read