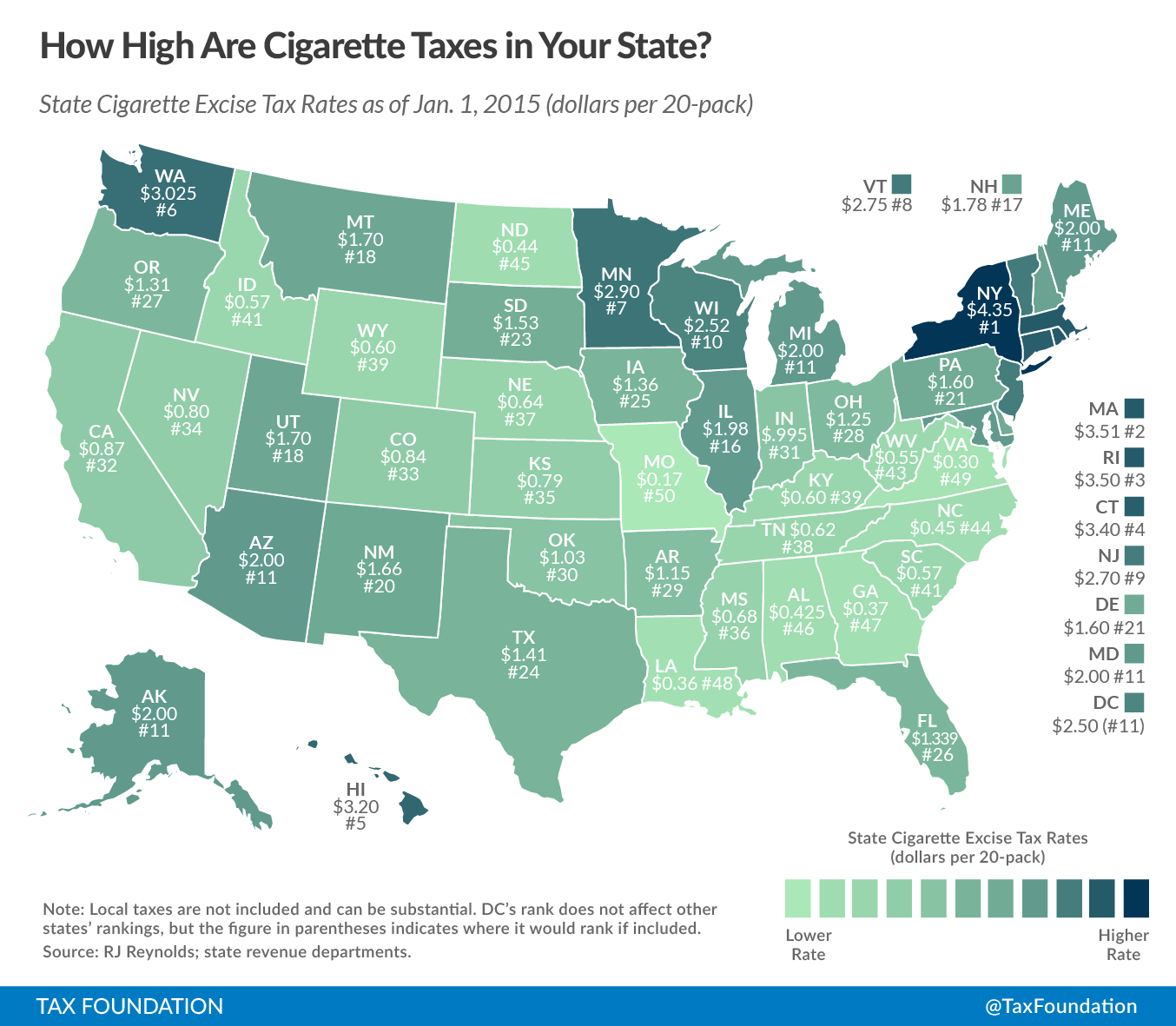

For this week’s tax map, we take a look at cigarette taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rates across the country, which vary widely from state to state and are levied on top of a federal rate of $1.0066 per 20-pack of cigarettes.

(Click on the map to enlarge it. Reposting policy)

Cigarettes are taxed the highest in New York, at $4.35 per pack. New England states round out the remaining top four, with Massachusetts charging $3.51 per pack, followed by Rhode Island ($3.50) and Connecticut ($3.40). On the other end of the spectrum, Missouri levies the lowest tax on cigarettes at 17 cents per pack – trailed closely by Virginia ($0.30), Louisiana ($0.36), and Georgia ($0.37).

Not shown here are local cigarette taxes, which can be substantial. In Chicago, Illinois, the combined state, county, and municipal taxes total to $6.16, while in New York City, smokers pay $5.85 per pack.

States didn’t start taxing tobacco until the 1920s, but by 1969, each state and the District of Columbia had followed suit. Although cigarettes are already one of the most heavily taxed consumer goods in the U.S., many states continue to target smokers with increased rates.

Many states use collections from tobacco taxes to fund their public school systems, which we have pointed out could cause budgetary problems as cigarette tax revenues are on the decline as less and less people smoke. Moreover, evidence shows that wide differentials in cigarette taxes across states have opened up a black market for smuggling, with criminals obtaining cigarettes in low-tax states and selling them in high-tax states. Finally, taxes on cigarettes disproportionately affect low-income residents.

Read more about cigarette taxes here.

Follow Scott on Twitter.

Share this article