In many countries, investment income, such as dividends and capital gains, is taxed at a different rate than wage income. Today’s map focuses on how capital gains taxA capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate income taxes, frequently resulting in double taxation. These taxes create a bias against saving, leading to a lower level of national income by encouraging present consumption over investment. rates differ across Europe.

When a person realizes a capital gain—that is, sells an asset for a profit—they face a taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. on that gain. For example, if you buy a share for €100 and sell it for €120, you pay capital gains tax on your €20 gain.

These taxes create a bias against saving, leading to a lower level of national income by encouraging present consumption over investment. Higher taxes also cause investors to sell their assets less frequently, which leads to fewer taxes being assessed. This is known as the realization or lock-in effect.

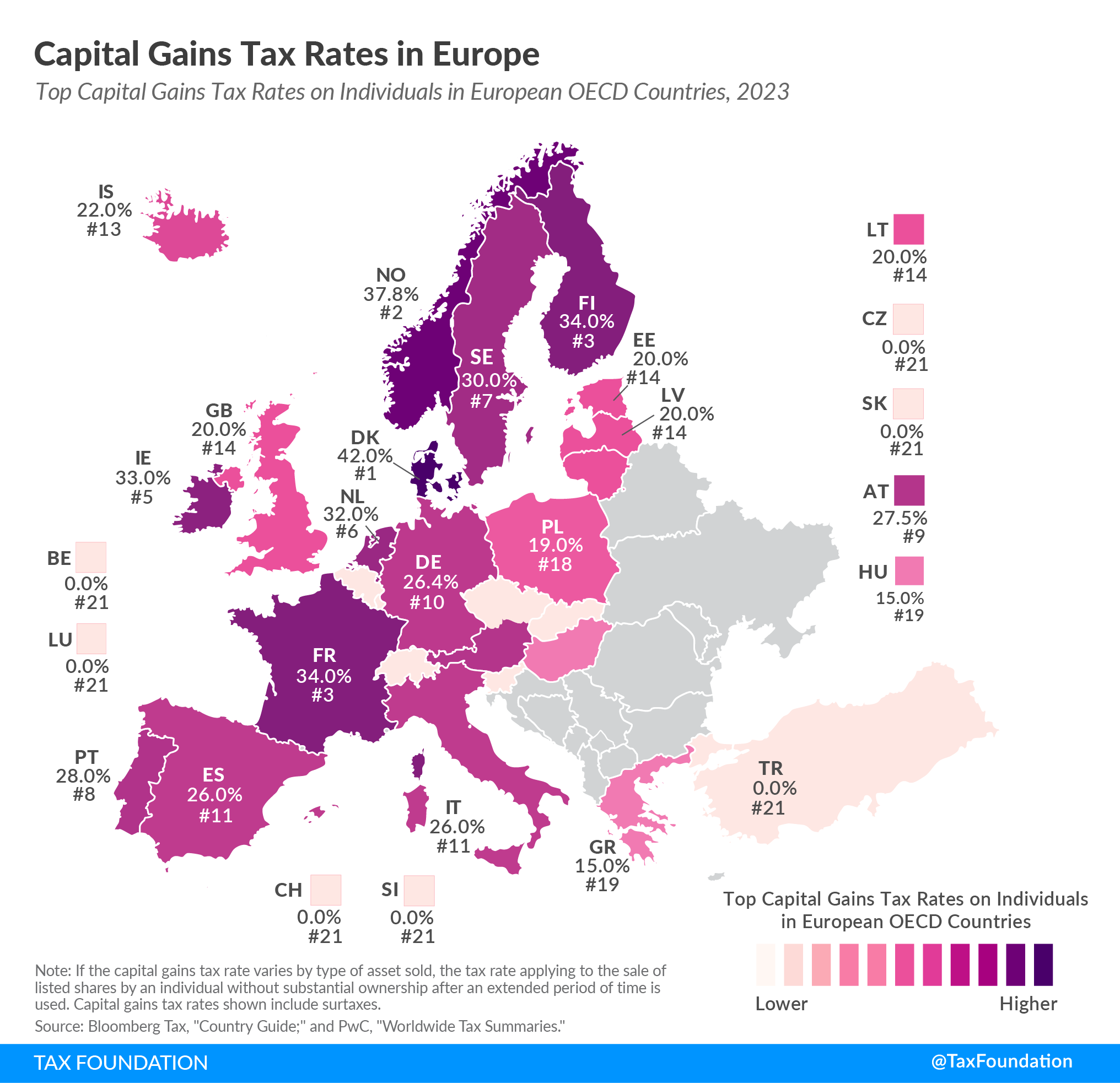

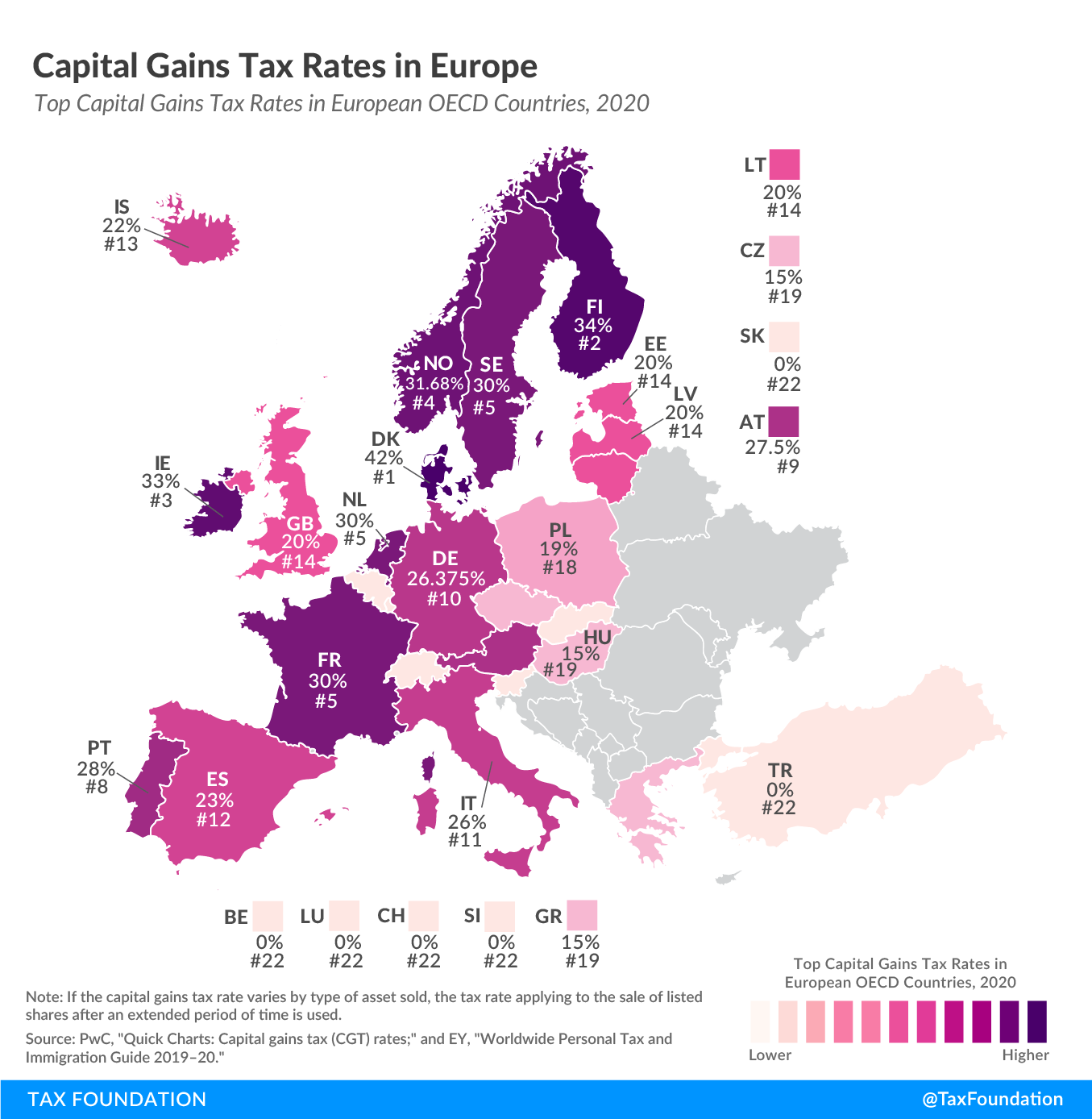

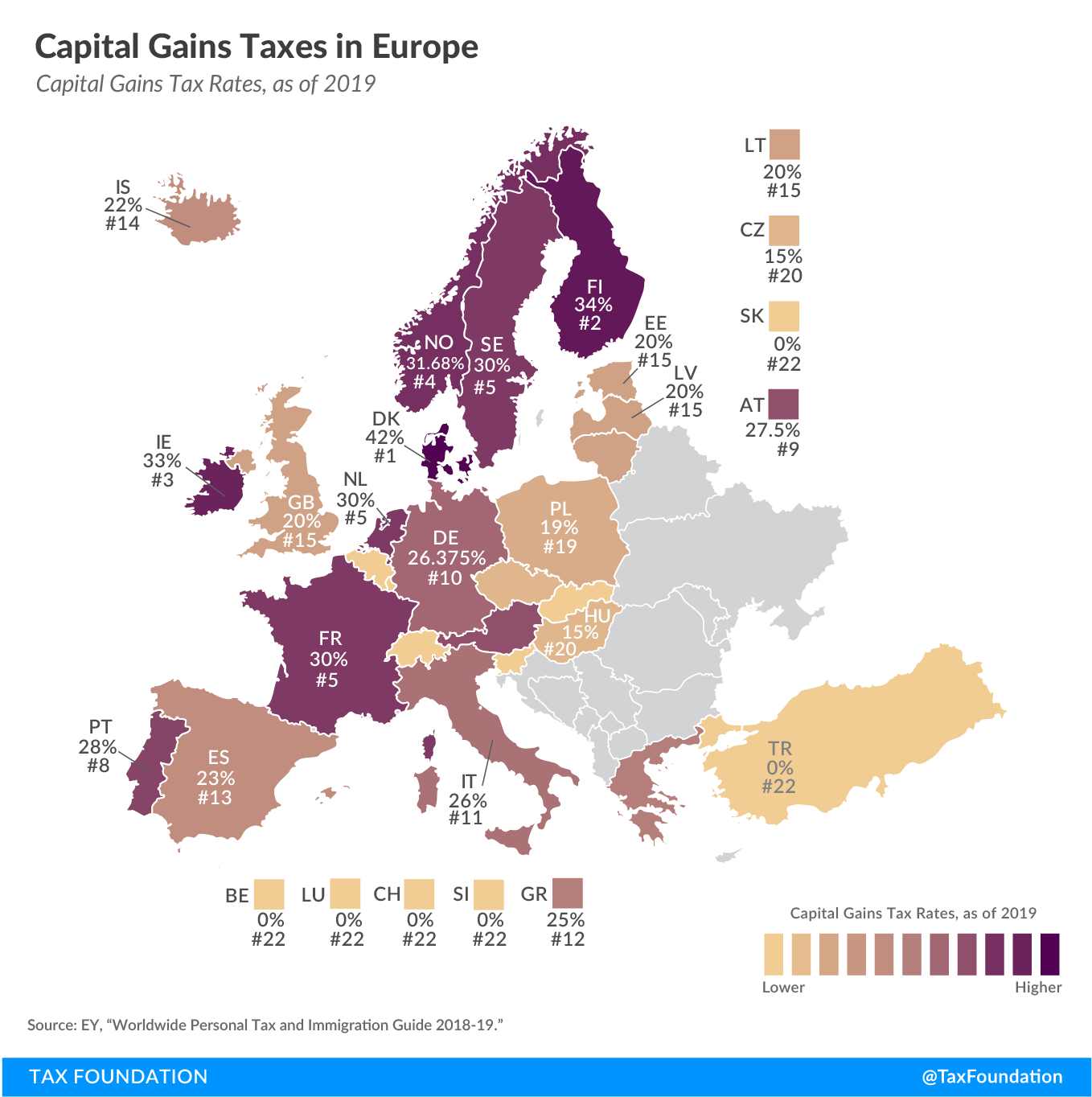

The capital gains tax rates shown in the map are the top marginal capital gains tax rates levied on individuals, taking into account exemptions and surtaxes. If the capital gains tax rate varies in a country by type of asset sold, the tax rate applying to the sale of listed shares after an extended period of time is used.

Explore our interactive map below to see how your country compares.

2025 Capital Gains Tax Rates in Europe

Top Marginal Capital Gains Tax Rates on Individuals Owning Long-Held Listed Shares without Substantial Ownership (Includes Surtaxes) in European OECD Countries, as of March 2025

| Country | Top Marginal Capital Gains Tax Rate | Additional Comments |

|---|---|---|

| Austria (AT) | 27.5% | - |

| Belgium (BE) | 0.0% | Capital gains are only taxed if they are regarded as professional income. |

| Bulgaria (BG) | 10.0% | Capital gains are subject to flat PIT rate at 10%. |

| Croatia (HR) | 12.0% | - |

| Cyprus (CY) | 0.0% | Shares listed on any recognised stock exchange are excluded from CGT. |

| Czech Republic (CZ) | 23.0% | Capital gains included in PIT but exempt if shares of a joint stock company were held for at least three years (five years if limited liability company). As of 2025, this exemption is limited by an annual cap for gross proceeds (i.e. sales price of the securities + other shares) of CZK 40 million; proceeds above the cap will be subject to standard progressive taxation. |

| Denmark (DK) | 42.0% | Capital gains are subject to the normal PIT rate. |

| Estonia (EE) | 22.0% | Capital gains are subject to PIT. |

| Finland (FI) | 34.0% | - |

| France (FR) | 34.0% | Flat 30% tax on capital gains, plus 4% for high-income earners. |

| Germany (DE) | 26.4% | Flat 25% tax on capital gains, plus a 5.5% solidarity surcharge. |

| Georgia (GE) | 0.0% | Capital gains from shares held for more than two years is generally exempt from PIT. |

| Greece (GR) | 0.0% | Capital gains tax applies at a 15% rate if an individual holds at least 0.5% of the share capital of the listed entity. |

| Hungary (HU) | 15.0% | Capital gains are subject to flat PIT rate at 15%. |

| Iceland (IS) | 22.0% | - |

| Ireland (IE) | 33.0% | - |

| Italy (IT) | 26.0% | - |

| Latvia (LV) | 28.5% | Flat 25.5% on capital gains, plus 3% for high-income earners. |

| Lithuania (LT) | 20.0% | Capital gains are subject to PIT, with a top rate of 20%. |

| Luxembourg (LU) | 0.0% | Capital gains are tax-exempt if a movable asset (such as shares) was held for at least six months and is owned by a non-large shareholder. Taxed at progressive rates if held <6 months. a dependency contribution of 1.4 percent is due for individuals subject to the Luxembourg social security system on the taxable part of the gains. |

| Malta (MT) | 0.0% | Transfers of shares listed on recognized stock exchanges are usually exempt from PIT. |

| Moldova (MD) | 6.0% | Capital gains are taxed at 50% of the PIT rate. |

| Netherlands (NL) | 36.0% | Net asset value is taxed at a flat rate of 36% on a deemed annual return (the deemed annual return varies by the total value of assets owned). |

| Norway (NO) | 37.8% | Capital gains are taxed at a 22% rate. A multiplier of 1.72 before taxation applies to gains from the sale of shares. |

| Poland (PL) | 19.0% | - |

| Portugal (PT) | 19.6% | PIT applies if the assets were held for less than one year. Otherwise, a flat capital gains tax rate of 28 percent from the sale of shares and other securities. Capital gains income is 10 percent tax-free for holding periods between 2 and 5 years, 20 percent for 5 to 8 years, and 30 percent after 8 years. |

| Romania (RO) | 1.0% | Gains derived from the transfer of securities and from operations with derivative financial instruments through intermediaries are taxed at 3 percent for holding periods less than 356 days and at 1 percent thereafter. |

| Slovakia (SK) | 0.0% | Shares are exempt from capital gains tax if they were held for more than one year and are not part of the business assets of the taxpayer. |

| Slovenia (SI) | 0.0% | Capital gains rate of 0% if the asset was held for more than 15 years (rate up to 25% for periods less than 15 years). |

| Spain (ES) | 30.0% | - |

| Sweden (SE) | 30.0% | - |

| Switzerland (CH) | 0.0% | Capital gains on movable assets such as shares are normally tax-exempt. |

| Turkey (TR) | 0.0% | Shares that are traded on the Stock Exchange and that have been held for at least one year are tax-exempt (two years for joint stock companies). |

| Ukraine (UA) | 19.5% | Capital gains are subject to PIT. |

| United Kingdom (GB) | 24.0% | - |

Sources: Bloomberg Tax, “Country Guide,” https://bloomberglaw.com/product/tax/toc_view_menu/3380/; and PwC, “Worldwide Tax Summaries Online,” https://taxsummaries.pwc.com/.

Denmark levies the highest top capital gains tax of all countries covered, at a rate of 42 percent. Norway levies the second-highest top capital gains tax at 37.8 percent. The Netherlands follows at 36 percent.

Several European countries do not levy capital gains taxes on the sale of long-held shares. These include Belgium, Cyprus, Georgia, Greece, Luxembourg, Malta, Slovakia, Slovenia, Switzerland, and Turkey. Of the countries that do levy a capital gains tax, Romania levies the lowest rate, at 1 percent, followed by Moldova at 6 percent and Bulgaria at 10 percent.

On average, the European countries covered tax capital gains arising from the sale of listed shares at 16.4 percent. Across EU Member States, the average lies at 17.6 percent.

For comparison, the population-weighted average of combined state and federal capital gains tax rates for the 50 US states and the District of Columbia lies at 25.4 percent in 2025, with rates ranging from 20 percent in states without a state capital gains tax to 33.3 percent in California.

Notable Changes

Several European countries have changed their capital gains tax rates in the last year or are planning to do so. The Czech Republic imposed an annual cap on its exemption for long-term capital gains, imposing a top marginal tax rateThe marginal tax rate is the amount of additional tax paid for every additional dollar earned as income. The average tax rate is the total tax paid divided by total income earned. A 10 percent marginal tax rate means that 10 cents of every next dollar earned would be taken as tax. of 23 percent. Latvia increased its flat taxAn income tax is referred to as a “flat tax” when all taxable income is subject to the same tax rate, regardless of income level or assets. rate on capital gains from 20 to 25.5 percent and introduced a 3 percent additional rate for high-income individuals in 2025. The Netherlands increased its tax rate on box 3 income from 33 to 36 percent in 2024. In late 2024, Portugal introduced a stepwise tax exemptionA tax exemption excludes certain income, revenue, or even taxpayers from tax altogether. For example, nonprofits that fulfill certain requirements are granted tax-exempt status by the Internal Revenue Service (IRS), preventing them from having to pay income tax. of capital gains income of up to 30 percent for holding periods longer than eight years, decreasing the tax rate on long-term capital gains to 19.6 percent. Spain increased its top capital gains tax rate from 28 to 30 percent starting in 2025. The United Kingdom increased its top tax rate on capital gains from 20 to 24 percent from 2025.

Estonia is set to introduce a 2 percent defence tax on personal income, increasing its capital gains tax rate from 22 to 24 percent in 2026.