Beer Taxes in Europe, 2022

3 min readBy:’Tis the season to crack open a cold one. Ahead of International Beer Day on August 5th, let’s take a minute to discover how much of your cash is actually going toward the cost of a brew with this week’s tax map, which explores excise duties on beer.

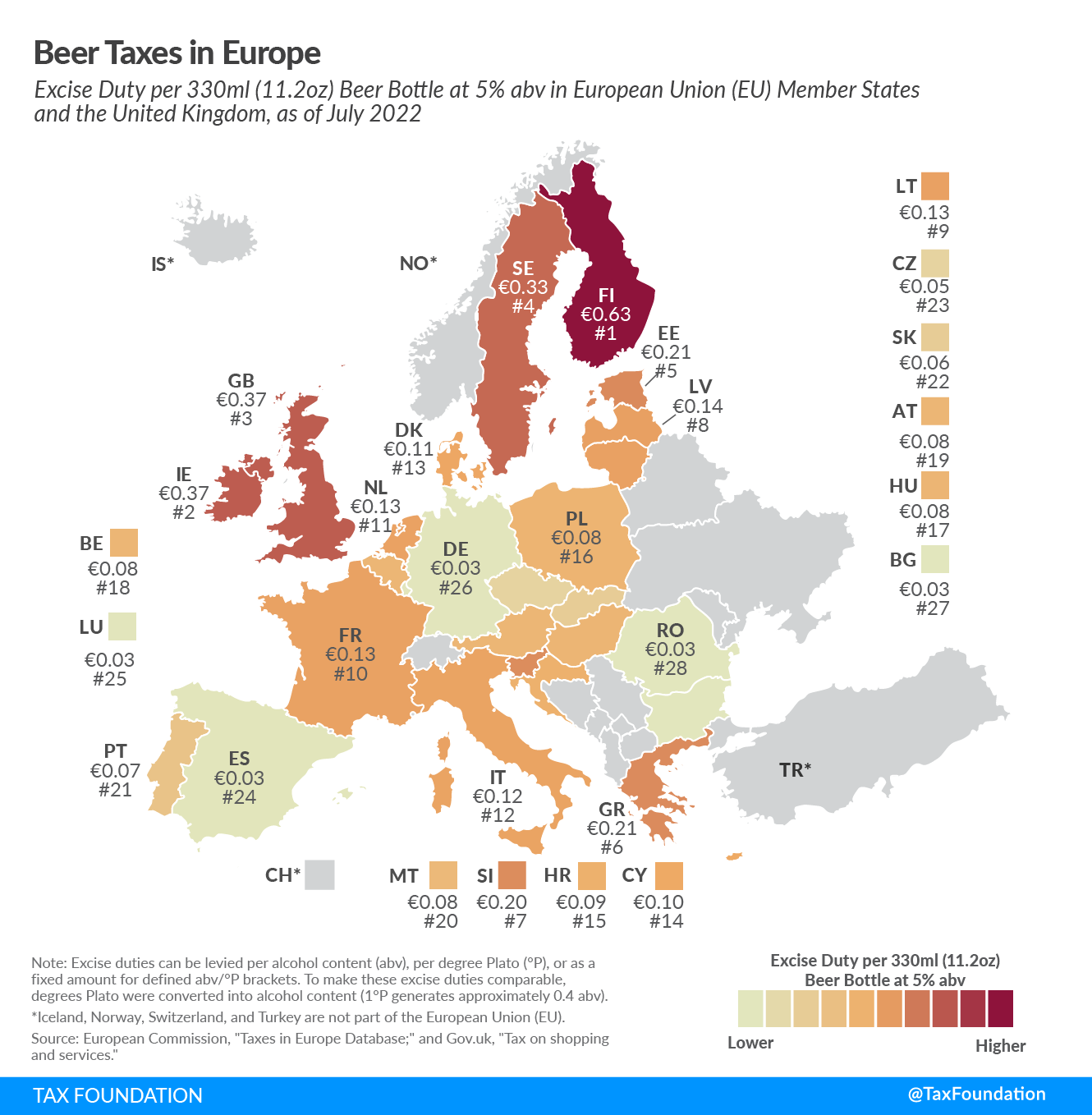

EU law requires every EU country to levy an excise duty on beer of at least €1.87 per 100 liters (26.4 gal) and degree of alcohol content. That amounts to a minimum tax of €0.03 (US $0.04) for a 330ml (11.2 oz) beer bottle with 5% alcohol content. As this map illustrates, only a few EU countries stick close to the minimum rate; most levy on much higher excise duties.

Finland, Ireland, and the United Kingdom levy the highest excise duties on beer. Finland levies a taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. of €0.63 ($0.74) per 330ml beer bottle. Ireland and the United Kingdom both levy rates of €0.37 ($0.44) per beer.

Bulgaria, Germany, Luxembourg, Romania, and Spain each levy approximately the EU’s minimum rate of €0.03 ($0.04) per beer bottle.

All European countries covered also levy a value-added tax (VAT) on beer, which is charged on the sales value of a beer bottle. The excise amounts shown in the map relate only to excise taxes and do not include the VAT.

| Country | Excise Duty per 330ml (11.2oz) Beer Bottle at 5% abv | |

|---|---|---|

| Euros | US Dollars | |

| Austria (AT) | € 0.08 | $0.10 |

| Belgium (BE) | € 0.08 | $0.10 |

| Bulgaria (BG) | € 0.03 | $0.04 |

| Croatia (HR) | € 0.09 | $0.10 |

| Cyprus (CY) | € 0.10 | $0.12 |

| Czech Republic (CZ) | € 0.05 | $0.06 |

| Denmark (DK) | € 0.11 | $0.13 |

| Estonia (EE) | € 0.21 | $0.25 |

| Finland (FI) | € 0.63 | $0.74 |

| France (FR) | € 0.13 | $0.15 |

| Germany (DE) | € 0.03 | $0.04 |

| Greece (GR) | € 0.21 | $0.24 |

| Hungary (HU) | € 0.08 | $0.10 |

| Ireland (IE) | € 0.37 | $0.44 |

| Italy (IT) | € 0.12 | $0.14 |

| Latvia (LV) | € 0.14 | $0.16 |

| Lithuania (LT) | € 0.13 | $0.15 |

| Luxembourg (LU) | € 0.03 | $0.04 |

| Malta (MT) | € 0.08 | $0.09 |

| Netherlands (NL) | € 0.13 | $0.15 |

| Poland (PL) | € 0.08 | $0.10 |

| Portugal (PT) | € 0.07 | $0.08 |

| Romania (RO) | € 0.03 | $0.04 |

| Slovakia (SK) | € 0.06 | $0.07 |

| Slovenia (SI) | € 0.20 | $0.24 |

| Spain (ES) | € 0.03 | $0.04 |

| Sweden (SE) | € 0.33 | $0.39 |

| United Kingdom (GB) | € 0.37 | $0.44 |

|

Notes: Some countries levy reduced excise duties for independent small breweries. The excise duties were converted into USD using the average 2021 USD-EUR exchange rate (0.846), see IRS, “Yearly Average Currency Exchange Rates,” https://www.irs.gov/individuals/international-taxpayers/yearly-average-currency-exchange-rates. Source: European Commission, “Taxes in Europe Database,” accessed July 5, 2022, https://ec.europa.eu/taxation_customs/tedb/splSearchForm.html; and Gov.uk, “Tax on shopping and services: Alcohol and tobacco duties,” https://www.gov.uk/tax-on-shopping/alcohol-tobacco. |

||

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe