On Thursday, U.S. Senators Marco Rubio (R-FL), Bill Cassidy (R-LA), Steve Daines (R-MT), and Mitt Romney (R-UT) released the Coronavirus Assistance for American Families Act (CAAF). This bill would change the way the economic impact payments—commonly known as recovery rebates or stimulus payments—could work in the next round of pandemic-driven relief for households. The bill’s co-sponsors argue this rebate design is needed because households with children and other dependents faced additional economic hardship due to the coronavirus pandemic.

This proposal would provide payments of $1,000 to adults and children with Social Security numbers, subject to income limits used in the original round of rebates. It would be more generous to households and families with children when compared to the original rebates distributed under the Coroanvirus Aid, Relief, and Economic Security (CARES) Act. Additionally, U.S. citizens married to foreign nationals would be eligible for rebates, but foreign nationals and filers with only an individual taxpayer identification number (ITIN) would not be eligible for a rebate.

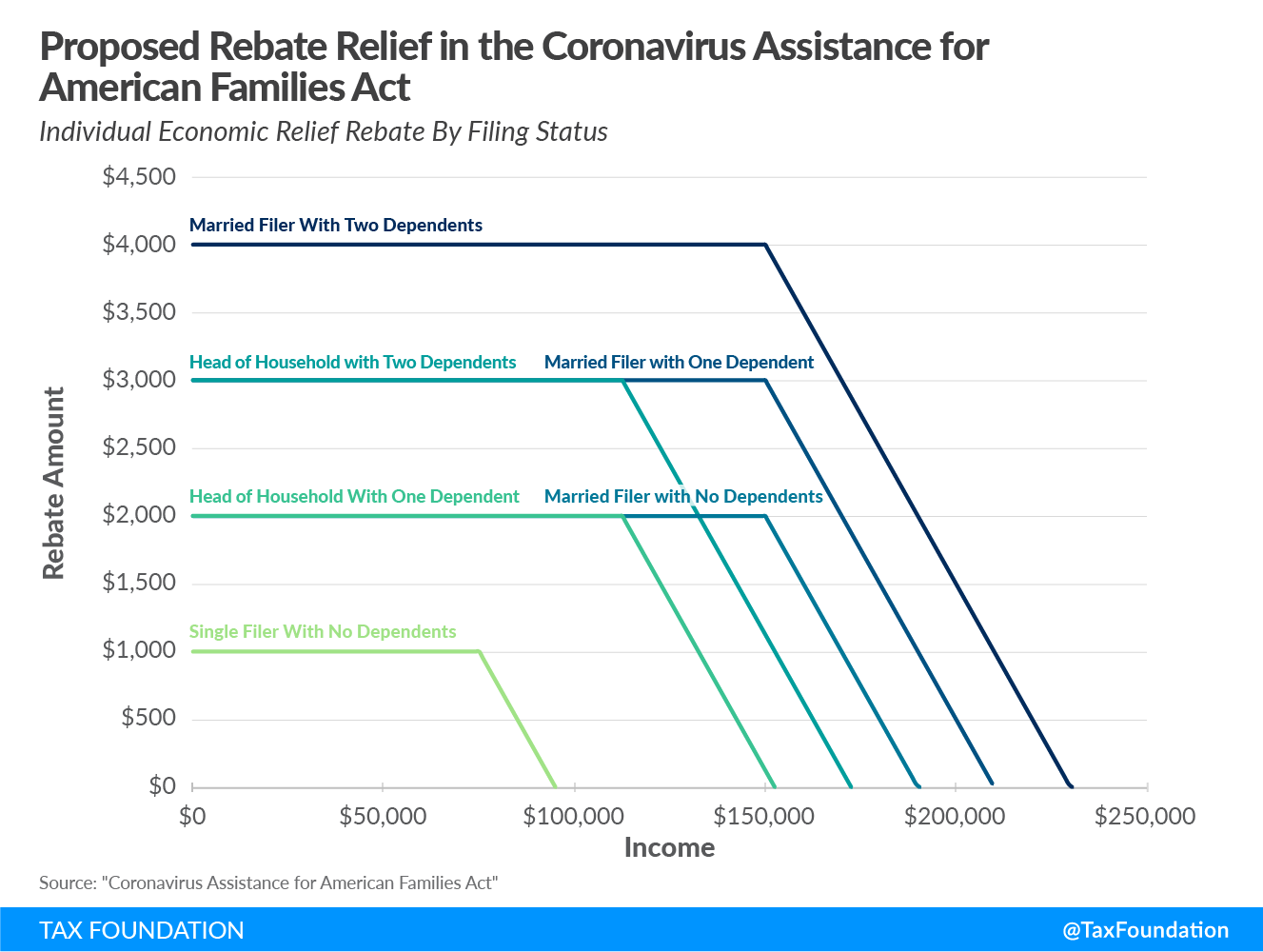

The payments would phase out for high earners using the same formula as the CARES Act. Those earning above $75,000 (single), $112,500 (heads of household), and $150,000 (married filing jointly) in the 2018 or 2019 taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. year would see their total rebate phase out at 5 percent for each dollar earned above those thresholds (or $50 for every $1,000 earned).

This proposed rebate adopts the design for dependents proposed in both the Senate Republican Health, Economic Assistance, Liability Protection and Schools (HEALS) Act and the House Democratic Health and Economic Recovery Omnibus Emergency Solutions (HEROES) Act by expanding the type of dependents eligible for a rebate to include adult dependents, such as college students and disabled adults relying on family members for support. This, according to the American Enterprise Institute’s Kyle Pomerleau, would increase the number of eligible dependents by about 26 million people.

Taxpayers with eligible dependents, including children, would see an additional $500 payment for each dependent when compared to the CARES Act rebates. Taxpayers would receive a slightly smaller payment for themselves, at $1,000 (single) or $2,000 (filing jointly) compared to the $1,200 (single) or $2,400 (filing jointly) payments in the CARES Act.

These proposed changes mean that taxpayers with dependents would receive a higher total rebate when compared to the first round, while taxpayers with no dependents would receive slightly less. For example, married filers with no children earning below $150,000 would receive $2,000, compared to $2,400 from the CARES Act rebate. However, a single filer with one child earning less than $75,000 would receive $2,000 under this proposal, compared to $1,700 under the CARES Act.

The income level where the proposed rebates phase out entirely differs depending on a taxpayer’s filing status and number of dependents. Single taxpayers with no dependents would see no rebate if they have an income above $95,000, compared to $99,000 under the CARES Act. This is also true of joint filers with no dependents, who would see no rebate if their income exceeds $190,000 (it was $198,000 under CARES). Higher earners with dependents, by contrast, could receive a rebate when they were ineligible last time. For example, joint filers with two dependents did not receive a rebate if they earned over $218,000 under the CARES Act; that limit increases to $230,000 this time.

The proposal’s changes to dependent rebate amount would be less generous than under the HEROES Act, which proposes a $1,200 rebate for each dependent for households (up to a maximum of three dependents), with a maximum payment of $6,000 for households of five or more people.

Revenue Effect

Using the Tax Foundation General Equilibrium Model, we estimate that the proposal’s economic impact payments would reduce federal revenue by about $311 billion, compared to the CARES Act’s rebate cost of about $292 billion according to the Joint Committee on Taxation (JCT). This compares to an estimated $412.5 billion cost for rebates under the HEROES Act as projected by JCT and the HEAL’s Act’s rebate revenue impact of about $300 billion.

The proposal’s more generous rebate amount for eligible dependents increases the total cost of the proposal relative to the CARES Act rebates, but this added cost is slightly offset by the decreased rebate amount for taxpayers without dependents. This means the proposal’s rebate would impact federal revenue slightly more than the proposed rebates under the HEALS Act but remain below the cost of the HEROES Act’s proposed rebates.

Distributional Effect

The proposal’s rebates follow a similar distribution as the CARES Act recovery rebates, owing to the proposal’s identical income thresholds and phaseout design. On average, the proposed rebates would be slightly larger—$1,584 on average when compared to $1,523 on average as part of the CARES Act. Household incomes would also go up slightly, at 2.7 percent (compared to 2.59 percent for the CARES Act rebates).

| Income level | Percent Change in After-Tax Income | Average Rebate (Refundable and Nonrefundable Credit) | Share of Filers with a Rebate |

|---|---|---|---|

| 0% to 20% | 17.41% | $1,532 | 100% |

| 20% to 40% | 7.58% | $1,778 | 100% |

| 40% to 60% | 4.50% | $1,707 | 100% |

| 60% to 80% | 2.99% | $1,863 | 99.9% |

| 80% to 90% | 1.84% | $1,680 | 98.6% |

| 90% to 95% | 0.62% | $778 | 61.4% |

| 95% to 99% | 0.01% | $27 | 5.1% |

| 99% to 100% | 0.00% | $0 | 0.1% |

| Total | 2.70% | $1,584 | 93.3% |

|

Source: Tax Foundation General Equilibrium Model, January 2020. |

|||

Households in the bottom 40 percent of the income distribution would experience higher changes in after-tax incomeAfter-tax income is the net amount of income available to invest, save, or consume after federal, state, and withholding taxes have been applied—your disposable income. Companies and, to a lesser extent, individuals, make economic decisions in light of how they can best maximize their earnings. , ranging from 17.41 percent for those in the bottom 20 percent and 7.58 percent for those between the 20th and 40th percentiles. These groups saw a 16.33 percent and a 6.73 percent increase in after-tax income, respectively, from the CARES Act. High earners would not see as much benefit from the rebates due to the income thresholds and phaseout rules.

Conclusion

The Coronavirus Assistance for American Families Act would provide $1,000 rebates to each taxpayer and their dependents subject to income limits identical to those imposed under the CARES Act. The proposal would make adult dependents eligible for rebates while increasing the rebate amount for dependents from $500 under the CARES Act rebates to $1,000 per dependent. We find that the rebates would reduce federal revenue by about $311 billion in the long run but would increase an average filer’s after-tax income by 2.7 percent.

We estimate that this proposal makes the rebates more generous than the CARES Act rebates on average, though at the cost of reducing rebates slightly for taxpayers without dependents. Policymakers will have to weigh the trade-offs in design, including the desire to target relief to households with families and dependents, with the perceived reduction in generosity to taxpayers without dependents.

Pairing the second round of rebates with additional measures that protect vulnerable households and encourage a robust economic recovery should also be an important part of the conversation as policymakers search for a final Phase 4 relief deal.

Share this article