Yesterday, House Democrats released the Take Responsibility for Workers and Families Act, which is proposed legislation for tackling the coronavirus public health emergency and related economic downturn. The bill can be contrasted with the Senate Republican CARES Act, although they share some similarities by providing individual taxpayers with a rebate and modifying business taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. provisions to provide liquidity for struggling firms.

Here are the highlights of the individual tax provisions in the House Democratic bill:

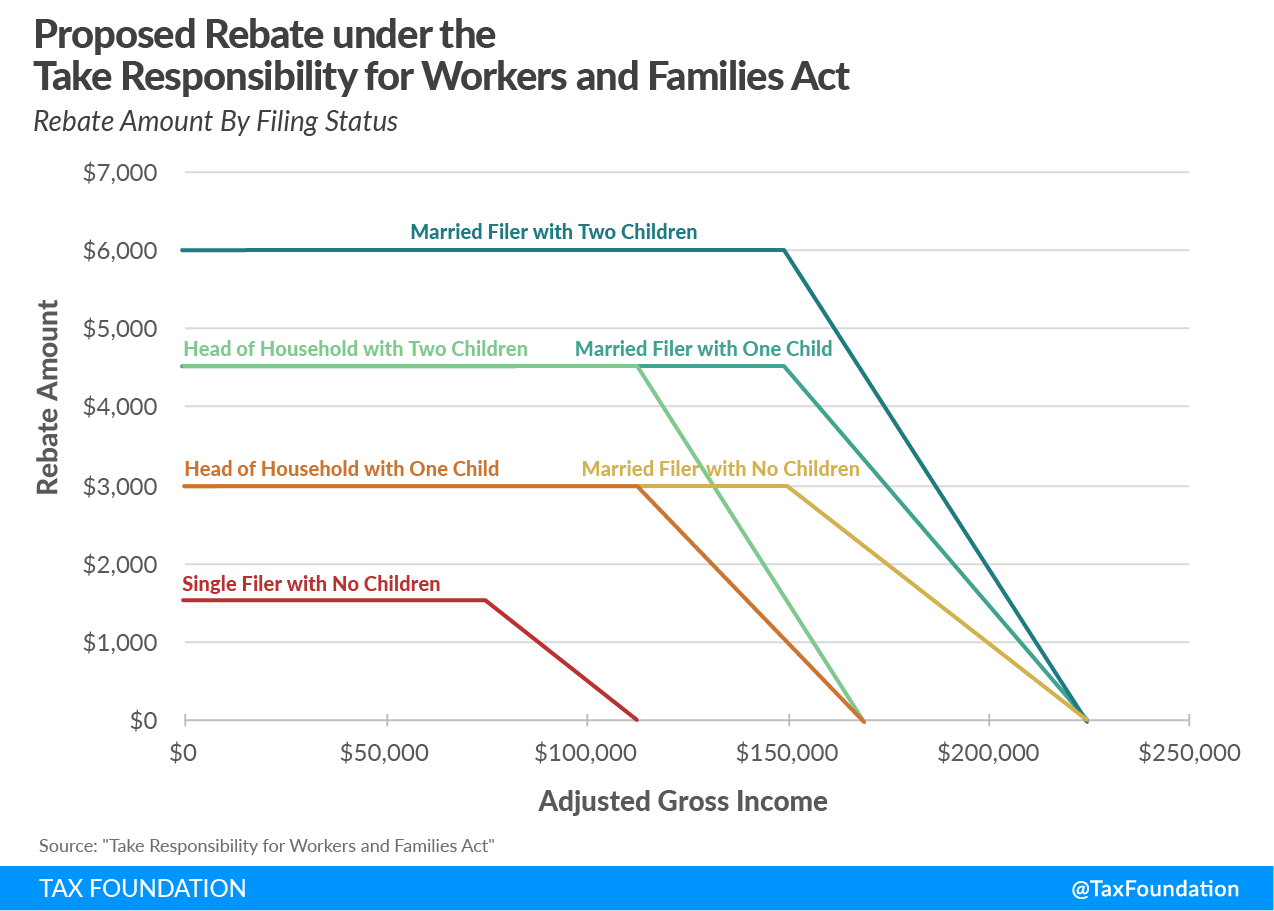

Economic Assistance Payments equal to $1,500 for single filers ($3,000 for taxpayers filing jointly), plus $1,500 for each child. We estimate that this rebate would cost about $449 billion in 2020 using the Tax Foundation General Equilibrium Model.

The rebate phaseout begins at $75,000 for single filers, $150,000 filing jointly, and $112,500 for head of households. To calculate the rebate above the phaseout limit, one uses the following formula:

(AGI over phaseout limit) / (50% * phaseout limit) = percentage reduction in eligible rebate

The rebate amount is reduced by the percentage amount calculated in the formula. For example, joint taxpayers with no children making $200,000 would see their credit reduced by $50,000 divided by ($150,000 * 50%), or 66 percent. They would therefore receive 33 percent of the credit, or about $990 (see Chart 1).

The rebate would be calculated using 2020 income and is refundable. Taxpayers receiving an advance credit above the amount they are eligible for may spread their repayment over three years. Individuals with Supplemental Security Income (SSI) or Social Security benefits are also eligible for the rebate.

We estimate that the rebate will be progressive (see Table 1) and will increase taxpayer after-tax incomes by 24.75 percent for those in the bottom quintile. Taxpayers in the top 10 percent would see a smaller benefit, ranging from 1.08 percent in after-tax incomeAfter-tax income is the net amount of income available to invest, save, or consume after federal, state, and withholding taxes have been applied—your disposable income. Companies and, to a lesser extent, individuals, make economic decisions in light of how they can best maximize their earnings. to no change for those in the top 1 percent of income. The average rebate is estimated to be about $2,312, and about 94.8 percent of filers would receive a rebate.

| Income level | Percent Change in After-Tax Income | Average Rebate (Refundable and Non-Refundable Credit) | Share of Filers with a Rebate |

|---|---|---|---|

| 0% to 20% | 24.75% | $2,177 | 100% |

| 20% to 40% | 10.62% | $2,491 | 100% |

| 40% to 60% | 6.59% | $2,501 | 100% |

| 60% to 80% | 4.42% | $2,750 | 99.9% |

| 80% to 90% | 2.78% | $2,536 | 99.4% |

| 90% to 95% | 1.08% | $1,354 | 79.8% |

| 95% to 99% | 0.08% | $159 | 18.3% |

| 99% to 100% | 0.00% | $0 | 0.1% |

| Total | 3.94% | $2,312 | 94.8% |

|

Source: Tax Foundation General Equilibrium Model, November 2019. |

|||

The Earned Income Tax CreditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income rather than the taxpayer’s tax bill directly. (EITC) is modified in 2020 and 2021 by decreasing the minimum age to receive the credit to 19 from 25 for individuals who are not-full time students and to 18 for former foster or homeless youth, and by increasing the maximum age to 66 from 65. The modified EITC also has a more generous phase-in for childless adults (up to 15.3 percent from 7.65 percent) and increases the earned income amount from $4,220 to $9,570 and the phaseout amount from $5,280 to $11,310. The effect of these changes would be to provide a larger credit that scales up faster and scales down later than under current law.

Married but separated spouses would become eligible for the EITC, and the credit is expanded in Puerto Rico.

The Child Tax Credit (CTC) is made fully refundable for 2020 through 2025, and expanded in Puerto Rico. For children under the age of 6, the credit is increased to $3,600, and for all other children to $3,000 from the current $2,000. The child and dependent care credit is also made fully refundable for 2020 and 2021 and is made more generous.

Paid family and sick leave enacted through the Families First Coronavirus Response Act is extended through 2021.

The tax filing deadline for 2020 would be moved to July 15, and individual estimated quarterly payments would be delayed until October 15.

Changes are made to premium tax credits created under the Affordable Care Act (ACA) and to rules governing health insurance premium affordability.

Retirement withdrawal rules are loosened as individuals may withdraw up to $100,000 from retirement accounts without penalty if the distribution is related to health or financial consequences of coronavirus. Distributions may be repaid over three years. Required minimum distribution rules are also waived for calendar year 2020.

Business provisions:

- Net operating loss deductions (NOLs) are expanded by permitting five-year carrybacks for 2018, 2019, and 2020 and by temporarily suspending the 80 percent taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. For both individuals and corporations, taxable income differs from—and is less than—gross income. limit for the deduction for the same years. This expansion of NOL deductions is limited for corporations engaging in share buybacks after December 31, 2017.

- For qualified wages paid between January 21, 2020 and December 31, 2020, firms that retain their workers earn a Social Security payroll taxA payroll tax is a tax paid on the wages and salaries of employees to finance social insurance programs like Social Security, Medicare, and unemployment insurance. Payroll taxes are social insurance taxes that comprise 24.8 percent of combined federal, state, and local government revenue, the second largest source of that combined tax revenue. credit of up to 80 percent of a worker’s qualified wages, subject to a $10,000 limit per calendar quarter. This credit is limited for firms with less than 1,500 full-time equivalent employees for calendar year 2019 or firms with under $41.5 million in gross receipts for calendar year 2019.

- A Social Security payroll tax credit for hospitals equal to 90 percent of COVID-19 related charity care conducted during the quarter.

- A Social Security payroll tax credit for up to 90 percent of hospital facility expenditures paid or incurred by a hospital. This credit can only offset payroll tax up to wages and it is not refundable.

Both the House and Senate bills, still being negotiated to reach a deal, provide rebates for individual taxpayers and economic relief for businesses, though the House bill expands tax credits such as the EITC and CTC in addition to individual rebates. The individual rebate is more generous than the Senate Republicans’ CARES Act and targets more low-income individuals who may not have filed recent tax returns.

The business provisions of the House bill would improve business liquidity, including the loosening of NOL rules and tax credit for employees retained on payroll. However, this bill leaves out the CARES Act proposal to loosen the net interest limitation, which would be another way to provide liquidity to businesses. Additionally, accelerating NOL and depreciation deductions on firms’ books would boost firm liquidity and would not have a large long-run revenue cost.

When finalizing a deal, policymakers should remain focused on individual and business economic relief to weather the public health and economic crisis, leaving permanent and ideologically-motivated provisions out of the deal. This will ensure a broad consensus for the provisions that are passed, and that they are well-suited for the crisis in front of us.

Share this article