The Internet Tax Freedom Act (ITFA), enacted in 1998, was intended to protect the developing internet technology. ITFA, which prohibited states and localities from applying taxes on internet access or imposing discriminatory digital-only taxes, became permanent in 2016 but included a grandfather clause that allowed states with taxes existing before 1998 to keep that taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. in place until June 30, 2020.

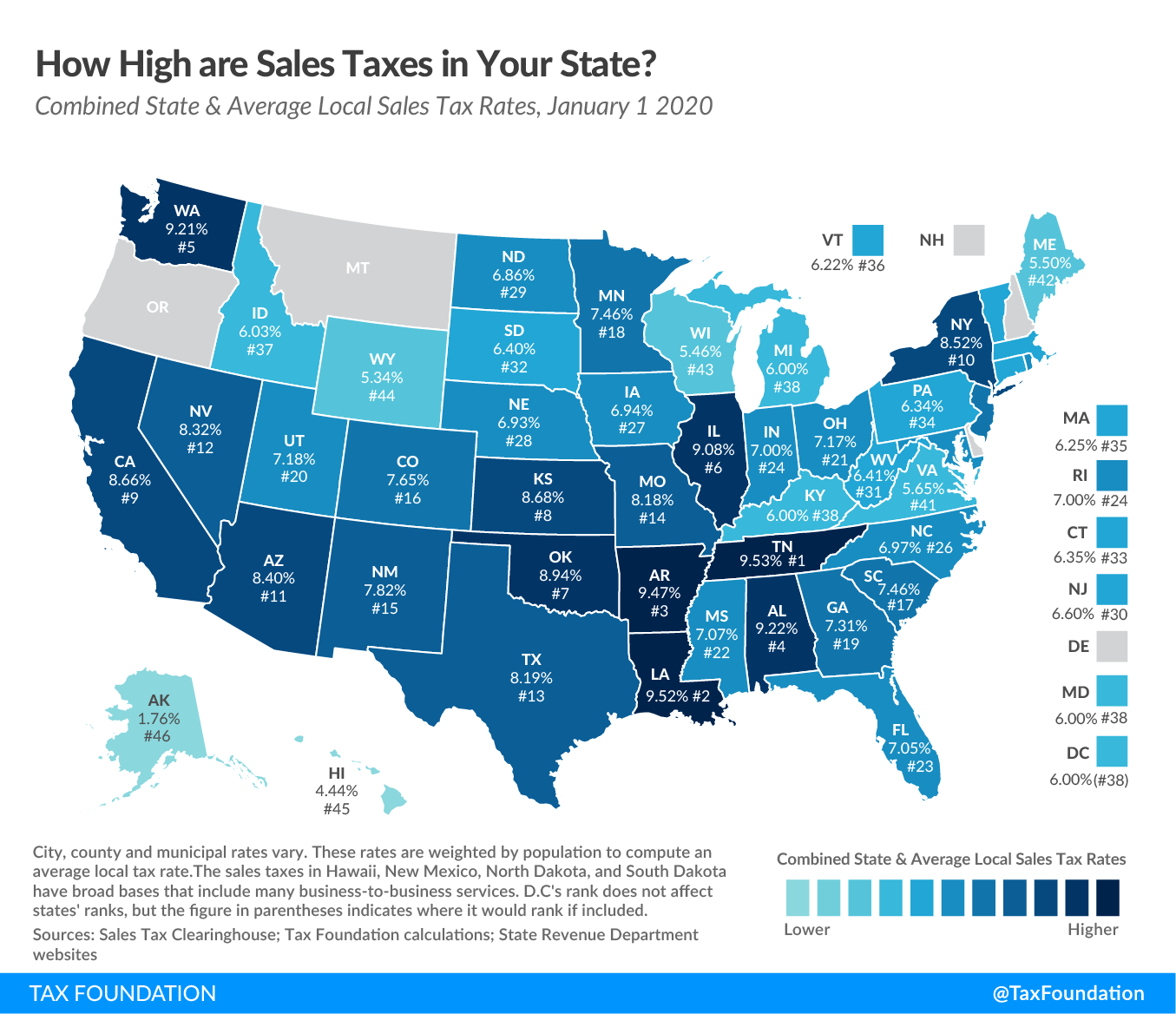

On July 1, sales taxes levied on internet access in six states—Hawaii, New Mexico, Ohio, South Dakota, Texas, and Wisconsin—will become illegal under the provisions of the Permanent Internet Tax Freedom Act (PITFA). The states would have collected nearly $1 billion in fiscal year 2021.

Today, the internet hardly requires extraordinary protection from state and local sales taxes. In fact, 80 percent of U.S. households have a subscription to the internet, and 90 percent of U.S. adults use the internet. Indeed, the application of sales taxes on access to the internet does not seem to impact this number, as the percent of households with internet access in states currently levying a sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. is comparable to national averages (2014-2018 data): 83 percent in Hawaii, 72 percent in New Mexico, 80 percent in Ohio, 78 percent in South Dakota, 79 percent in Texas, and 80 percent in Wisconsin.

With this in mind, states should have the authority to levy a general sales tax on internet access. This would, according to the Congressional Research Service, enable states and localities to raise at least $6.5 billion a year—a figure likely to grow in the future. As states struggle with declining sales tax revenue and an explosion of expenses due to the coronavirus crisis, a sensible base-broadening measure like taxing internet access could help states raise meaningful revenue—and importantly, they could do so quickly.

Other provisions of the Permanent Internet Tax Freedom Act which prohibit discriminatory taxation on digital commerce, where similar offline activity is untaxed, have considerably more merit. Certainly, moreover, states should not impose excise taxes on internet access or online activity; such taxes would lack justification. But in addition to providing some much-needed revenue for states, allowing sales taxes on internet access is simply sound tax policy. A well-designed sales tax is levied on all final consumer goods and services while exempting all purchases made by businesses that will be used as inputs in the production process.

Most states that apply sales taxes have taxes designed for a goods-based economy, but the economy has changed. Today, goods only represent around a third of personal consumption, with services representing the other two-thirds. Consumer services do not deserve this preferential tax treatment; it is merely a result of outdated tax codes designed for a different economy. As it is, prohibition against taxing internet services distorts the market. For instance, states and localities can tax the part of the phone plan that allows consumers to make phone calls, but they are barred from taxing the part of the plan that allows consumers to make data calls.

Narrower bases limit the ability to collect necessary revenues. A broader sales tax base provides the opportunity for additional revenue, because there is a larger basket of goods and services to tax. In contrast, exempting items from the sales tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. (whether through policy carveout or federal prohibition) means that the tax rate on taxable items must be higher than it would otherwise be. Broadening the sales tax base to include more services will allow states to raise revenue with lower rates in a more neutral and effective manner.

One argument in favor of the prohibition against taxes on internet access is that it may increase accessibility for low-income Americans. This is a common criticism of the sales tax, because lower-income individuals have lower savings rates and consume a greater share of their income. However, broadening the base to include additional consumer services, more often purchased by wealthier Americans, represents a progressive change.

While there are good arguments for empowering states and localities to levy the general sales tax on internet access, specific discriminatory taxes on internet access or internet services should be avoided. Not only is internet access crucial to most Americans’ work or education, investments in better technology and access should be encouraged. Keeping a ban against applying additional taxes besides the sales tax on internet access could serve as a guarantee that states and localities are limited to applying the sales tax.

Share this article