Where do federal government taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. dollars come from? In 2013, the largest share of revenue came from individual income taxes and payroll taxes, accounting for $2.26 trillion in total. The smallest share came from estate and gift taxes at $19 billion.

This has changed significantly over time. In 1940, excise taxes were the largest source of federal revenue. Today, excise taxes account for about 3 percent of federal revenue and individual income taxes are the largest single source of revenue.

What the federal government buys with your tax dollars has also changed over time. In 1962, the largest federal expenditure was defense spending at 49 percent of the budget. Today, spending on health (27 percent) and Social Security (23 percent) make up the largest segments of government spending.

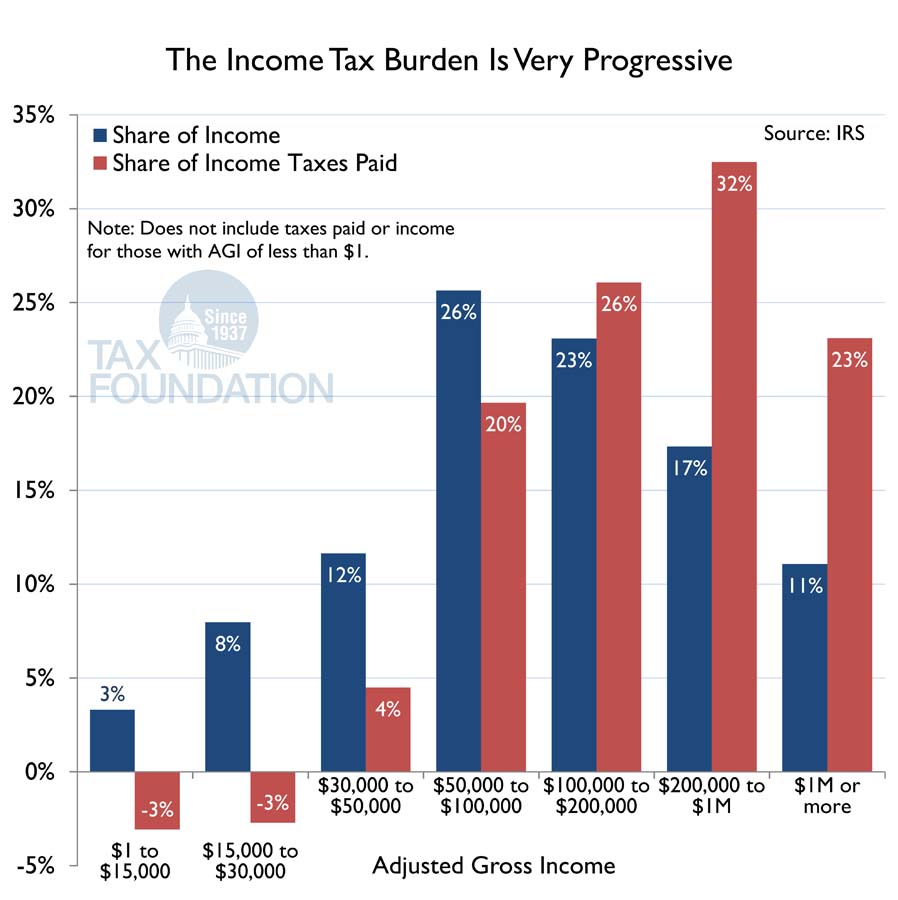

The progressivity of our tax code has also changed over time. Since the mid-1980s, the share of income taxes paid by the top 10 percent of taxpayers by income has gone from 54.7 percent to 70.6 percent while the share of taxes paid by the bottom 90 percent of taxpayers has gone from 45.3 percent to 29.4 percent.

The progressivity of the tax code is still prevalent when you consider income, with high-earners pay a large share of federal income taxes. For example, taxpayers who make over $200,000 a year earn about 28 percent of the all income, but they pay about 55 percent of all income taxes.

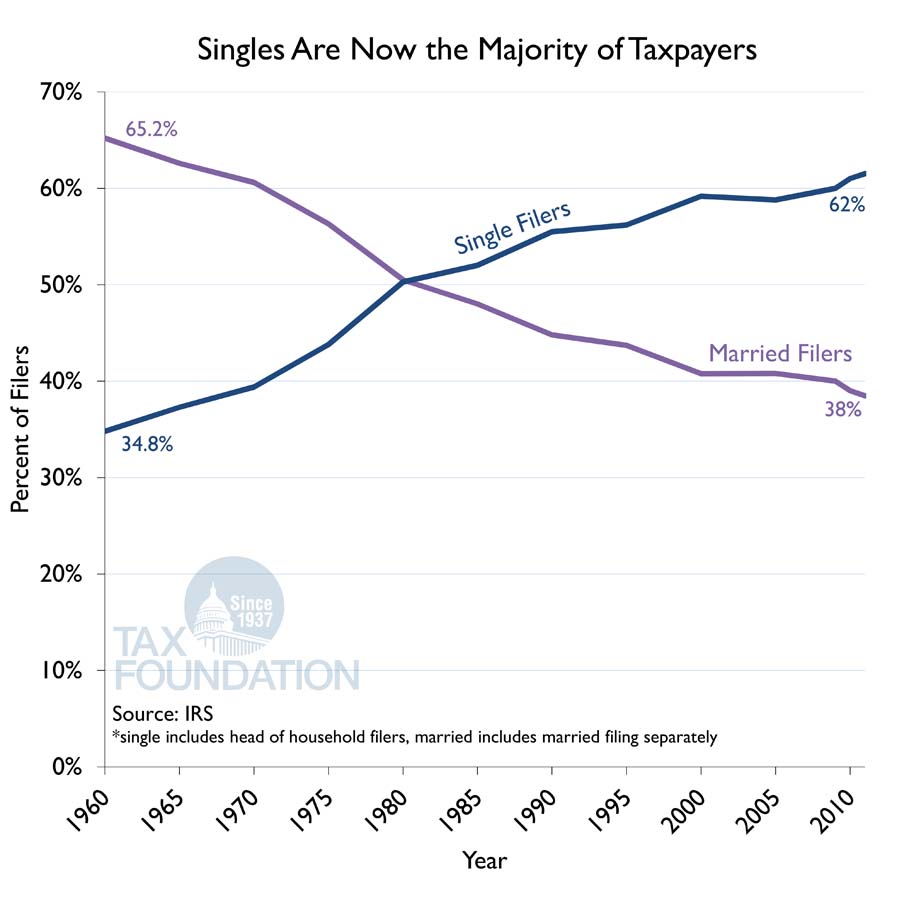

The composition of taxpayers has also changed overtime. In 1960, a large majority of tax returns came from married filers. Today, 62 percent of tax returns come from single filers with the remaining 38 percent coming from married filers.

Share