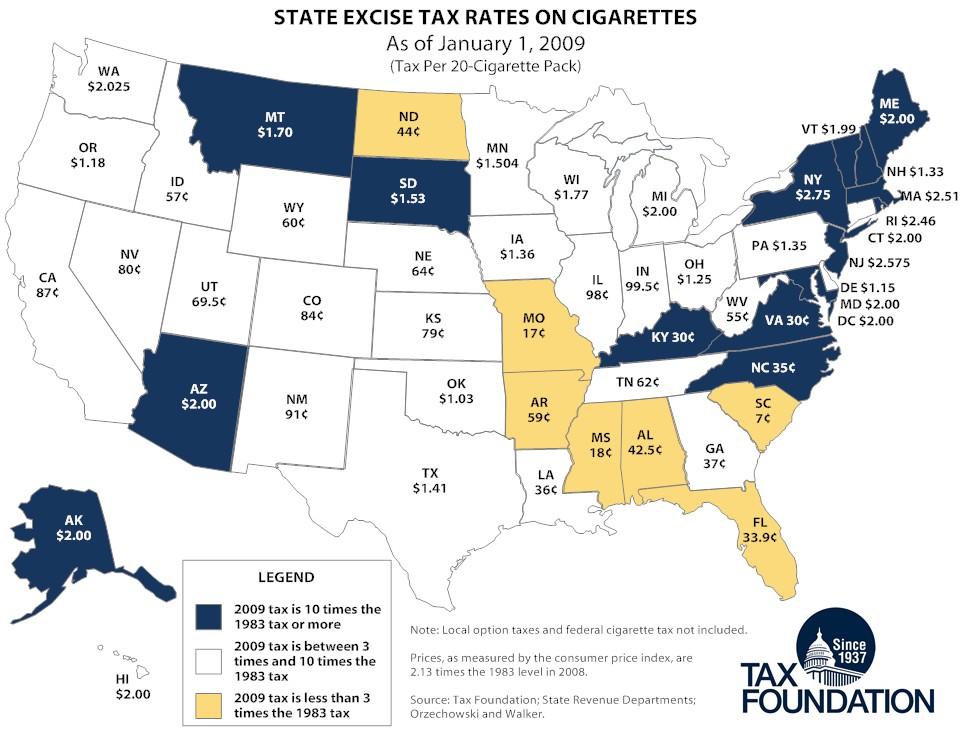

New York will jump from the 4th-highest state cigarette excise tax in the U.S. to the highest under a proposal to be voted on today, going from $2.75 per pack to $4.35 per pack, a 58% increase. New York City adds an additional $1.50 taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. . The New York Times reports today:

The proposal, which officials said [Governor] Paterson would include in an emergency budget bill due for a vote on Monday, would also raise wholesale taxes on other tobacco products like chewing tobacco, bringing the tax on those products closer in line with those of cigarettes.

In New York City, which levies steep taxes of its own on tobacco products, a pack of cigarettes would come with a tax of $5.85, making it the nation’s first city to break $5, antismoking advocates said. That would bring the overall cost of a pack of premium cigarettes above $10 in many stores in the city.

The legislation will also include a plan to begin collecting taxes on cigarettes sold off the reservation by Indian tribes in New York, an issue that has provoked confrontations between State Police officers and protesting tribe members in years past.

The proposal would generate $440 million in revenue this year, helping close a state budget gap estimated at over $9 billion. But it is unclear whether there are enough votes to approve the plan in the State Senate, where Republicans have threatened to vote against any emergency budget bill that includes tax increases and some Democrats oppose efforts to collect taxes on cigarettes sold by the tribes.

New York would jump past Hawaii ($2.80) and Rhode Island ($3.46).

As my colleague Patrick Fleenor wrote recently:

if history is any guide, most cigarettes sold will actually be trucked up from Virginia, or shipped in from China, by “butt-leggers” who can make over $1 million on each tractor-trailer load of smuggled smokes. The blunt fact, which politicians of both political parties are determined to ignore, is that high cigarette taxes in New York have led to a bloody, decades-long smuggling epidemic.[…]

While the problem first surfaced during the Great Depression, tax hikes in the early 1960s created a major profit opportunity for smugglers and kicked the epidemic into high gear. By 1967, a quarter of the cigarettes consumed in the Empire State were bootlegged. New York City’s finance administrator labeled cigarette smuggling the “principal stoking facility of the engine of organized crime.”[…]

[A] series of homicides, including witness murder, discouraged lawmakers from further tax hikes in the late 1970s and early ’80s. High inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. in those years drove cigarette prices up, but the fixed excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. —the smuggler’s profit margin—declined by more than 40%, greatly reducing bootlegging and related crime.

Lawmaker memories are short, however, and the state again began raising the cigarette tax in the 1980s. As a state tax enforcement official noted, it soon became “literally more profitable to hijack a cigarette-delivery truck than an armored truck.” More tax hikes followed in the 1990s. City and state records of tax-paid cigarettes show sales plummeting, despite stable smoking rates. This signals the resurgence of smuggling and large-scale tax evasion.

Click on the map for a larger image.

Share this article