On June 1, Massachusetts’ ban on sale of flavored tobacco products, including menthol cigarettes, took effect. Flavored vapor products were already banned. When signing the ban into law, Gov. Charlie Baker (R) argued that the ban, which is the broadest in the country, was enacted to limit youth uptake of nicotine products. While youth uptake is a very real concern which deserves the public’s attention, outright bans could impede historically high smoking cessation rates. Lawmakers must thread the needle between protecting adult smokers’ ability to switch and barring minors’ access to nicotine products.

Aside from public health concerns, a ban on flavored tobacco, especially when including cigarettes, has significant taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. implications and could result in unintended consequences such as increased smuggling. In Massachusetts, more than 20 percent of cigarettes smoked are purchased out of state.

Tobacco excise taxes are already an unstable source of tax revenue. Further narrowing the tobacco tax base by banning a portion of tobacco sales altogether could worsen the instability of this revenue source while driving up the costs of administration and law enforcement associated with the ban, especially if the lost revenue is made up by raising the tax rate on the remaining tobacco tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. .

Other states that are considering implementing a similar ban may want to consider the lessons from Massachusetts. For instance, in California, a flavor ban proposal, SB793, passed the state Senate this year, and is now before the Assembly, where it has been rereferred to committee for further consideration. The California Department of Tax and Fee Administration (CDTFA) estimated a revenue loss of $218 million in the first full fiscal year (FY). While that is significant in any year, it is even more significant in the midst of a severe budget shortfall (California has a $54 billion deficit). Moreover, the CDTFA estimate may be low as flavored cigarettes raised $528 million in fiscal year 2018.

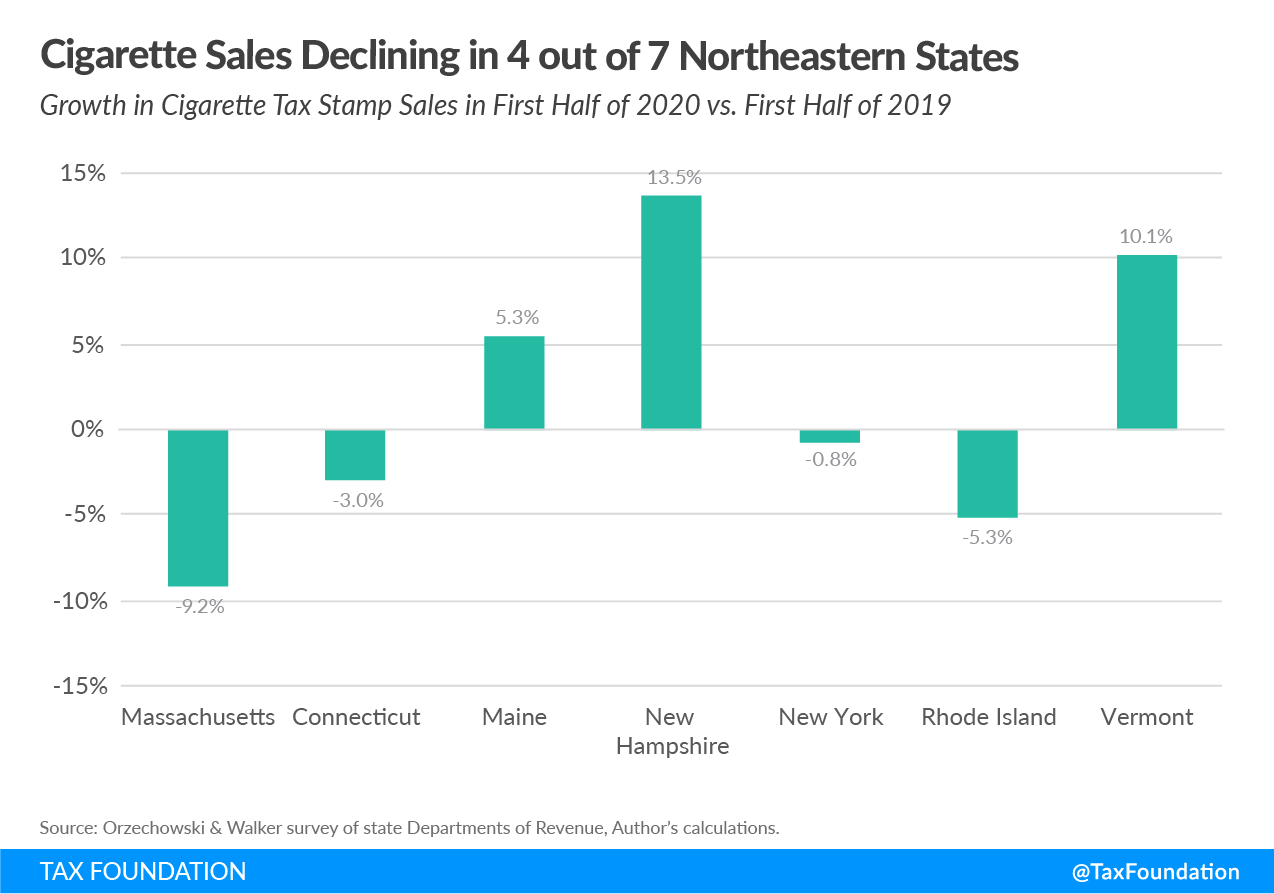

A month into Massachusetts’ flavor ban, early data is available for the real-world effects. If we only look at Massachusetts, the figures may look like a public health success story at first: sales of cigarette tax stamps in the Bay State have declined 9.2 percent in the first half of 2020 compared to the same months last year. Even more telling, in May, the last month before the ban, sales declined 34.7 percent compared to May 2019. In June 2020, sales dropped 17.2 percent versus June 2019.

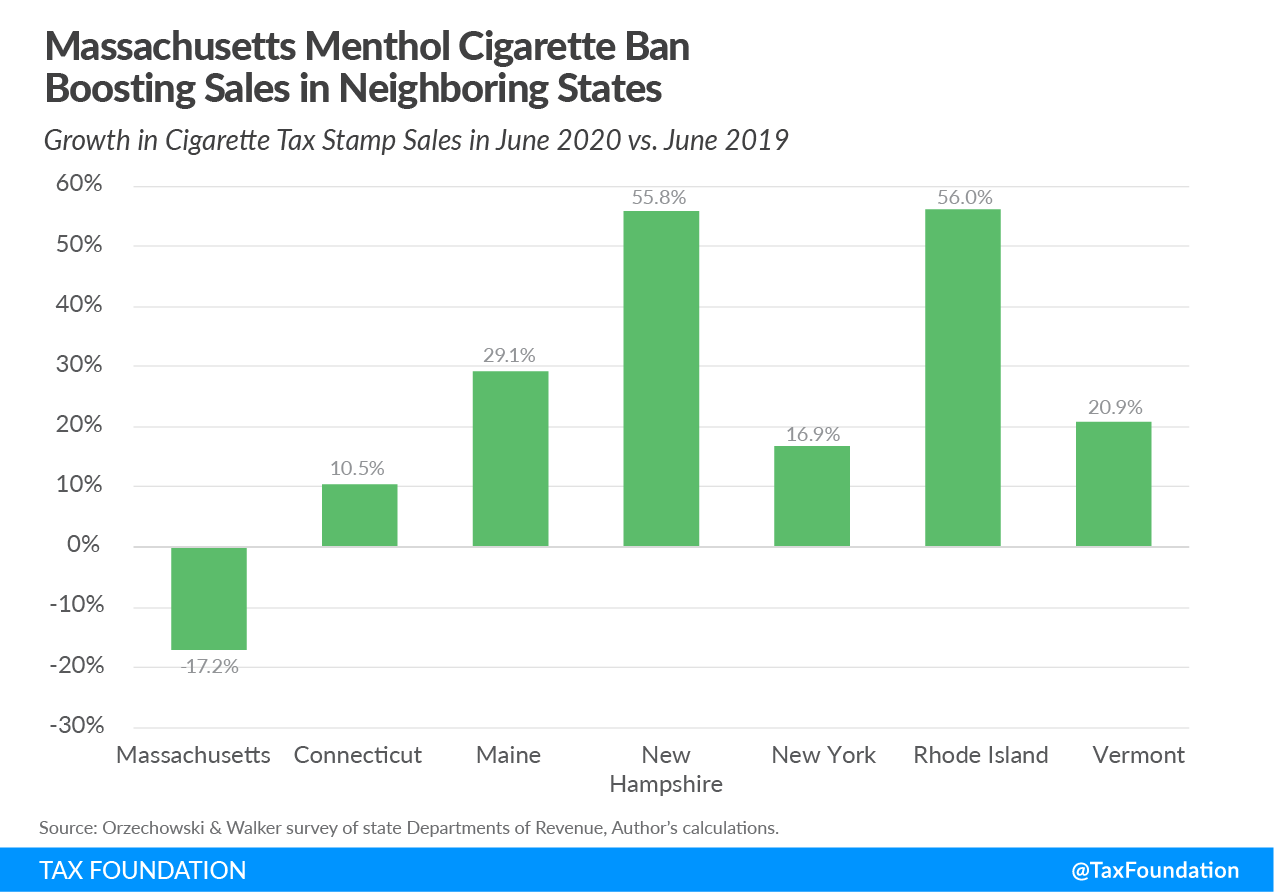

These numbers would seem to prove the best argument for implementing a ban—limiting use of tobacco and nicotine. Unfortunately, if we dig a little deeper, it becomes evident that Massachusetts’ flavor ban has not limited use, just changed where Bay Staters purchase cigarettes. In fact, sales of cigarette tax stamps in the Northeast (Connecticut, Maine, Massachusetts, New Hampshire, New York, Rhode Island, and Vermont) have stayed remarkably stable in the first half of 2020 compared to the first half of 2019. From January 1, 2020 to June 30, 2020, 311,848,000 stamps were sold. For the same period in 2019, that number was 311,974,000. For June alone, sales actually increased from 53,877,000 in 2019 to 63,449,000 in 2020. Massachusetts sales plummeted, but only because those sales went elsewhere.

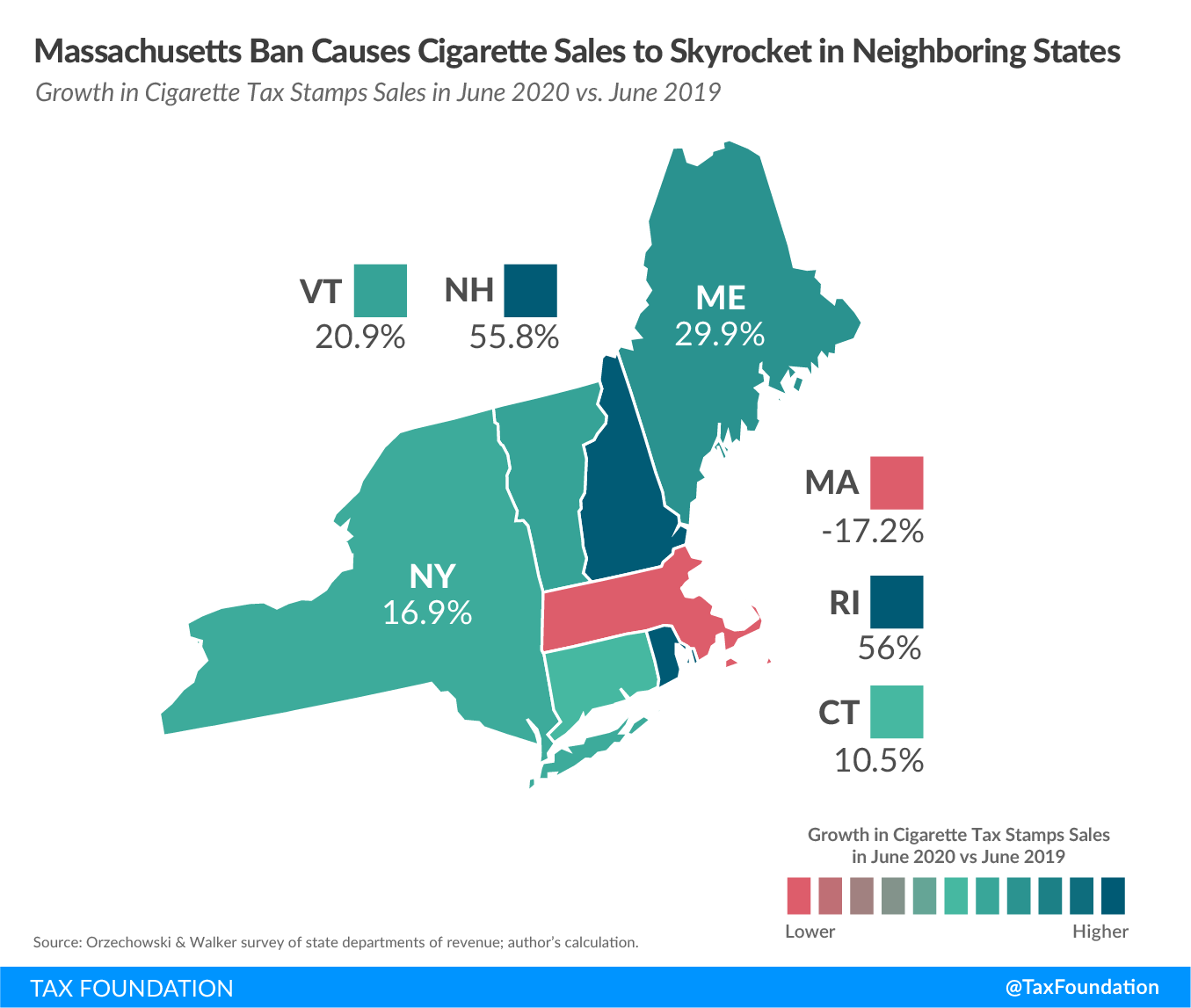

The increase in sales in the Northeast region is most notable in Rhode Island and New Hampshire but all have seen increased sales following the ban.

These declines and increases impact the excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. revenue in these states. Massachusetts collected $553 million in cigarette excise taxes in FY 2019. For FY 2020, the decrease of 9.7 percent in the first of 2020 sales translates to a decline in revenue of $53.6 million. While this is still in the early days, assuming the decline continues through 2021, the cost of the flavor ban could end up being more than $100 million for FY 2021, with most sales simply shifted to other states, not actually eliminated. In December last year, the Department of Revenue estimated the ban would decrease collections by $93 million in FY 2021. That revenue is now being collected by Massachusetts neighbors.

Out of the seven states in the Northeast, only three had growing sales in 2020 compared to 2019, but if we only look at the time past the flavor ban, the only state that is losing sales (and revenue) is Massachusetts.

The lost revenue will have to be made up through other taxes (or spending cuts) as Massachusetts allocates the vast majority ($506 million for FY 2020) of the tobacco excise tax revenue to the general fund and only $4.6 million to smoking cessation programs. The state also allocates an amount to health-care-related spending.

For Gov. Baker’s FY 2021 budget, only $317 million is projected in general fund revenue. This sudden drop in excise tax revenue, largely attributed to the ban, illustrates why excise tax revenues collected from smokers should be allocated to offset the negative effects of smoking. A narrow tax base makes cigarette excise taxes volatile, meaning they are a poor tool for general fund revenue.

State tax coffers are not the only thing impacted by this ban, however. Bans impact the large number of small business owners operating vape shops, convenience stores, and gas stations. Policymakers should not lose sight of the law of unintended consequences as they set tax rates and regulatory regimes for nicotine products.

All in all, early signs indicate that the ban will not decrease tobacco consumption in the state. It is not in the interest of Massachusetts to pursue a public health measure that merely sends tax revenue to their neighboring states without improving public health. In addition, the ban on flavored tobacco highlights the complications of contradictory tax and regulatory policy, the instability of excise taxes that go beyond pricing in the cost of externalities, and the public risks of driving consumers into the black market through excessive taxation or regulation.

Share this article