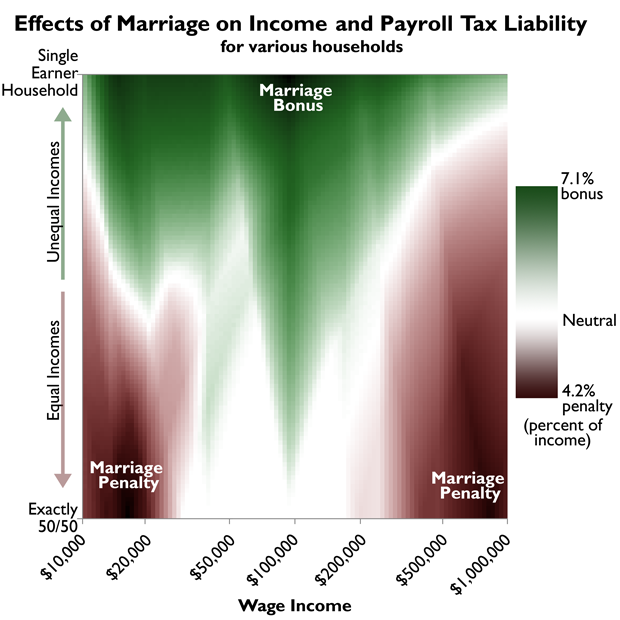

One important principle of sound tax policy is neutrality – the idea that the tax code should treat everyone equally and influence decision making as little as possible. Nevertheless, taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. considerations often intrude into what ought to be a private and personal decision – the decision to get married. Marriage can change a couple’s income tax bill substantially because of joint filing; generally, there’s a tax bonus when the two spouses have disparate incomes and a tax penalty when their incomes are similar.

(Note: This chart, when first published, was accidentally reversed horizontally while processing the image. We’ve corrected the error.)

Wealthy dual-earner couples get hit the hardest, so the tax code tends to discourage second earners and encourage single-earner households (particularly in the professional class). The bonus component raises additional concerns in that it is unavailable to married same-sex couples due to the federal Defense of Marriage Act, which prevents the government from recognizing such relationships. All of this is problematic for those of us opposed to using the tax code for social engineering, and believe that it should treat everyone the same.

Because it’s Valentine’s Day, we’ve created a simple calculator that shows you if your marriage is increase or decreasing your taxes. For simplicity and ease of use we allow only wage income and no deductions; if you’d like to do a more complicated calculation the Tax Policy Center has an excellent calculator as well.

Share this article