Corporate taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rate cuts are good for economic growth, and they aren’t bad for government revenues, either.

In fact, eliminating the corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. would actually increase annual federal revenue in the long run. This is due to two main factors: economic growth and the distribution of corporate income to other taxpayers.

The elimination of the corporate tax would lead to increased investment, higher wages, more jobs, and a significant boost to GDP. Additionally, though corporate income would no longer face the corporate tax, the income would still face capital gains and dividends taxes. (This is due to the double taxation of corporate income in the current tax code.)

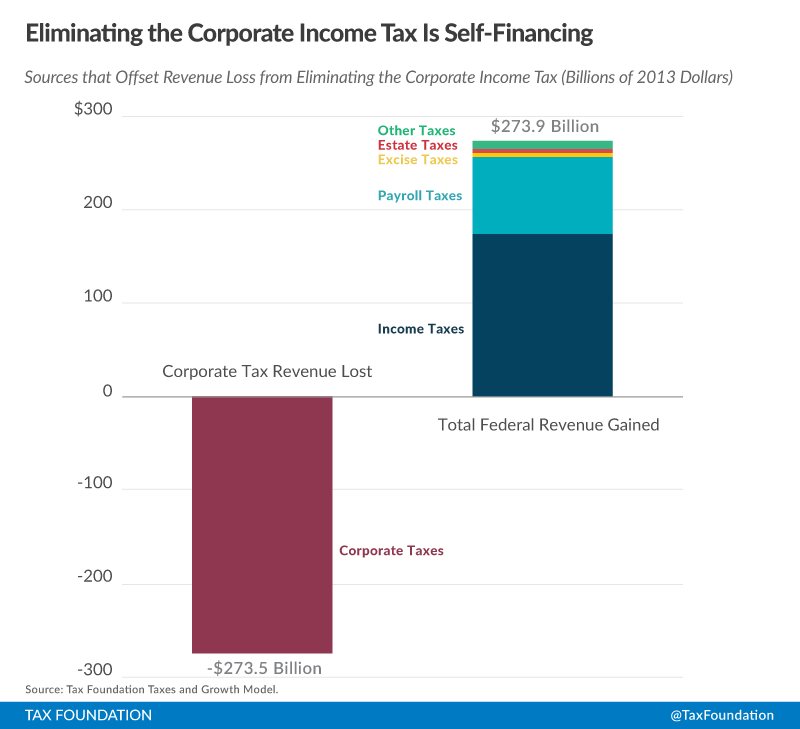

In total, the loss of corporate taxes as a revenue stream would lead to a revenue loss of about $273.5 billion per year. However, this lost corporate revenue would be replaced entirely by an increase in total federal revenue of $273.9 billion due to additional economic activity—a net gain of $400 million per year.

More jobs and higher wages would result in over $80 billion in new payroll taxA payroll tax is a tax paid on the wages and salaries of employees to finance social insurance programs like Social Security, Medicare, and unemployment insurance. Payroll taxes are social insurance taxes that comprise 24.8 percent of combined federal, state, and local government revenue, the second largest source of that combined tax revenue. revenue and $175.2 billion in new income tax revenue. Part of that income tax revenue would be the taxes on corporate income at the capital gains and dividend level. Customs, excise taxes, and the estate taxAn estate tax is imposed on the net value of an individual’s taxable estate, after any exclusions or credits, at the time of death. The tax is paid by the estate itself before assets are distributed to heirs. would combine with a few other taxes for the remaining $17.9 billion.

It’s important to note that this increase in revenue would be in the long run, after the economy has fully adjusted (probably about 10 years in the future). In the early years, federal revenue would fall before investment and growth pick up fully as the economy adjusts to a better tax system.

However, tax policy—all public policy, in fact—should be made with a focus on the long-term. In the long-term, significant cuts to the corporate tax rate would come with great benefits to the economy and even a small benefit to the U.S. Treasury.

To see how various corporate tax cuts would affect revenue and economic growth, see here.

Share this article