Texas Governor and presidential candidate Rick Perry has unveiled his plan to replace the current U.S. income taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. system with a flat taxAn income tax is referred to as a “flat tax” when all taxable income is subject to the same tax rate, regardless of income level or assets. for both individuals and corporations. While not all of the details of the plan have been outlined, it is possible to perform a basic assessment of how it will impact taxpayers and the economy.

Here are the major components of the plan and a brief assessment:

- Optional 20 percent flat income tax for individuals: The plan would allow individuals to opt out of the current tax system and file their taxes under a simplified system with a single rate of 20 percent. The plan consolidates the current standard deductionThe standard deduction reduces a taxpayer’s taxable income by a set amount determined by the government. It was nearly doubled for all classes of filers by the 2017 Tax Cuts and Jobs Act (TCJA) as an incentive for taxpayers not to itemize deductions when filing their federal income taxes. and personal exemption into a $12,500 exemption for each person in the family. This means that a family of four earning up to $50,000 would have no income tax liability. For taxpayers earning up to $500,000, the plan also keeps the deductions for mortgage interest, charitable giving, and state and local taxes. These deductions would be phased out for upper-income taxpayers.

Assessment: This plan is similar to the well-known flat tax promoted by Steve Forbes in that it taxes everyone at the same flat rate above a generous family allowance, but differs from Forbes’ flat tax by keeping some deductions. It appears that these deductions were retained in order to mirror the progressivity of the current tax code.

In principle, no one’s taxes will go up because the flat tax is optional. Most taxpayers would see a tax cut under this plan – except for the 42 percent of filers who currently pay no income taxes.

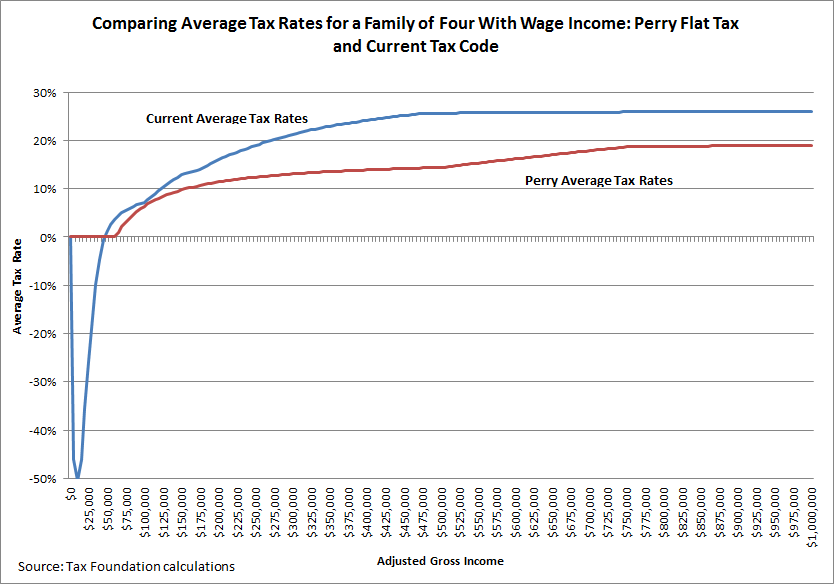

(Below we show how these provisions would affect a family of four with wage income.)

The negatives of the plan are that: (1) it retains to much of the complexity and distortive nature of the current system by maintaining the deductions for mortgage interest, charitable contributions, and state and local taxes; (2) it adds another parallel tax system to our current code; and (3) it also leaves too many taxpayers off the tax rolls, a large percentage of who currently have a negative tax rate.

- Eliminate the taxes on qualified dividends, long-term capital gains, and estate taxAn estate tax is imposed on the net value of an individual’s taxable estate, after any exclusions or credits, at the time of death. The tax is paid by the estate itself before assets are distributed to heirs. : The plan eliminates the double, or sometimes triple, taxation of capital income by eliminating the current taxes on qualified dividends, long-term capital gains, and the estate tax.

Assessment: Eliminating these taxes would have a positive impact on productivity and economic growth by reducing the cost of capital in the U.S. It would increase incentives to save and invest by increasing the after-tax rate of return.

- Cut the corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. rate to 20 percent while eliminating most tax provisions: The plan would lower the current 35 percent corporate income tax rate to 20 percent while eliminating most corporate tax deductions. The R&D tax creditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income rather than the taxpayer’s tax bill directly. would be retained and corporations would be able to fully expense their capital investments.

Assessment: This part of the plan would instantly make the U.S. one of the most attractive places for investment in the world. Cutting the federal corporate tax rate to 20 percent would bring the overall U.S. rate to roughly 25 percent when accounting for state taxes. This would bring the U.S. rate in line with the OECD average of 25 percent and the Chinese rate of 25 percent. Cutting the corporate tax rate will have a significant and lasting impact on long-term economic growth. (For more on the benefits of cutting the corporate tax rate see this Tax Foundation Special Report).

- Transition to a territorial tax systemTerritorial taxation is a system that excludes foreign earnings from a country’s domestic tax base. This is common throughout the world and is the opposite of worldwide taxation, where foreign earnings are included in the domestic tax base. : The plan would replace our current “worldwide” system of corporate taxation with a territorial system that taxes only domestically earned profits. During the transition to this new system, companies would be able to repatriate accumulated foreign earnings at a reduced 5.25 percent tax rate.

Assessment: This provision of the plan would make U.S. companies much more competitive in the global economy. It would also make the U.S. system look like the systems of our major trading partners – such as Great Britain, Canada, and Japan – all of which have territorial tax systems. Reducing the toll charge for accumulated foreign earnings is an important step in the transition to a new system and increases the likelihood that $1 trillion or more in accumulated profits will be reinvested in the U.S. (For more information on the benefits of moving to a territorial tax system, see this Tax Foundation Special Report).

How does it impact the “typical” family? The big question for many is what will be the effect of the plan on typical taxpayers. To illustrate how the Perry plan would affect a “typical” family of four with only wage income, Tax Foundation economists calculated the income tax payments and the average tax rates for such a family for incomes between $0 and $1 million. We assume that each family gets a family allowance of $50,000 and that the value of their itemized deductions would equal 18 percent of their AGI. Since the Perry plan does not specify how the deductions phase out after $500,000, we assume that they phase out in a straight line fashion from $500,000 to $750,000.

The first chart shows that every family with a current income tax liability would see a reduction in their average tax rateThe average tax rate is the total tax paid divided by taxable income. While marginal tax rates show the amount of tax paid on the next dollar earned, average tax rates show the overall share of income paid in taxes. . Those taxpayers who currently benefit from the refundable Earned Income Tax Credit (EITC), for example, would not likely opt into the new system, so they would be unaffected.

Based upon the simplified assumptions we made here, it appears that the largest reductions in average tax rates would be for taxpayers earning under $500,000. However, it is important to note that even with a single 20 percent tax rate, the Perry plan maintains the general progressivity of the current system because of the plan’s generous family allowance and the phase out of the itemized deductions.

The second chart shows the difference in tax liabilities for this prototypical family of four. Again, taxpayers at every income level would see a reduction in their tax payments, but it is also clear that the relative progressivity of the tax system is maintained. Wealthier taxpayers still pay more in actual dollar terms than lower-income taxpayers.

Overall, the Perry flat tax plan would be a boon to long-term economic growth and increasing the competitiveness of the U.S. in the global economy. While it could be criticized for not immediately replacing the current system with a simpler tax code, it does offer taxpayers the opportunity for “self-help tax reform.” In this way, it allows taxpayers the choice between the current complicated tax code and a simpler, single-rate tax code.

From a political perspective, the optional nature of the plan frees politicians from taking on the special interests directly. These special interest provisions will decrease in importance as people gravitate to the new simplified tax system.

The plan will undoubtedly be criticized for not being revenue neutral in the short run. But it is clear that the authors put economic growth and competitiveness ahead of revenue neutrality. Considering the state of the economy today, that is probably a good decision.

Share this article