Modeling the Impact of President Trump’s Proposed Tariffs

The Trump administration’s proposed tariffs would lead to job losses and a reduction in economic growth, as the Tax Foundation’s updated Tax and Growth model shows.

4 min readStay informed with quick and accessible analysis of today's top tax policy topics. Read Tax Foundation's Tax Policy Blog for insight from our experts on tax policies across the U.S. and abroad.

To find our most recent research papers and data, click the links below.

The Trump administration’s proposed tariffs would lead to job losses and a reduction in economic growth, as the Tax Foundation’s updated Tax and Growth model shows.

4 min read

The Tax Cuts and Jobs Act improved the US tax code, but key provisions are only temporary. Now Congress may vote to ensure those tax breaks are permanent.

3 min read

States considering legalizing and taxing marijuana should pay attention to natural experiments occurring in states across the country.

4 min read

The proposal includes some good reforms, including conforming to the federal full expensing provision, but also rolls back some recent positive changes.

2 min read

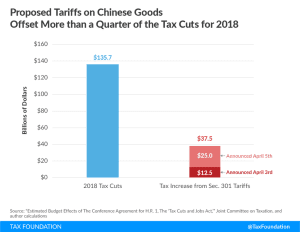

The Trump administration’s plan to levy $60 billion in tariffs on Chinese products could negate 20 percent of the benefits of the recently adopted tax cuts.

3 min read

The Tax Cuts and Jobs Act was meant to boost growth and deter corporate inversions. What does it mean that an Ohio company is still moving its HQ to the UK?

5 min read