R&D Amortization Hurts Economic Growth, Growth Industries, and Small Businesses

The current tax treatment of R&D expenses is irrational, complicated, and counterproductive. Fortunately, fixing this problem is a bipartisan issue.

4 min readStay informed with quick and accessible analysis of today's top tax policy topics. Read Tax Foundation's Tax Policy Blog for insight from our experts on tax policies across the U.S. and abroad.

To find our most recent research papers and data, click the links below.

The current tax treatment of R&D expenses is irrational, complicated, and counterproductive. Fortunately, fixing this problem is a bipartisan issue.

4 min read

As the UTPR is a new concept, it is worth explaining what it is and why Rep. Smith cares about it. In a sentence, the Undertaxed Profits Rule (UTPR) is a looming extraterritorial enforcement mechanism for a tax base the U.S. has not adopted.

6 min read

To address the more challenging parts of the budget, especially the unsustainable growth in mandatory spending, lawmakers should follow up on this debt ceiling agreement with a focus on long-term fiscal sustainability.

6 min read

Making expensing permanent is especially important now, when the economy is threatened with a recession and inflation remains high.

7 min read

The legislation follows from the bipartisan concern regarding tax policies adopted by other countries specifically targeting U.S. businesses or the U.S. tax base.

6 min read

Legislation currently advancing in Louisiana—related to the franchise tax, inventory tax, and corporate rebate and exemption programs—would make the state’s tax code simpler and more competitive.

4 min read

The Pennsylvania Senate Finance Committee recently advanced two bills, SB 345 and SB 346, that would build on last year’s historic corporate net income tax (CNIT) reform.

7 min read

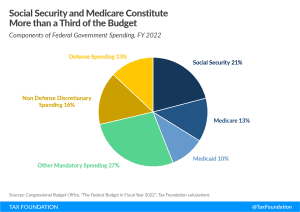

Any serious proposal to tackle the emerging debt and deficit crisis must also address our largest mandatory spending programs: Social Security and Medicare. Together, these two programs will be responsible for nearly 80 percent of the deficit’s rise between 2023 and 2032, according to Congressional Budget Office (CBO) projections.

8 min read

Rather than continue down the path of growing debt, lawmakers should craft a comprehensive solution. International experience cautions against tax-based fiscal consolidations, but modest tax increases may be part of a successful debt reduction package.

6 min read

According to the International Monetary Fund (IMF), the U.S. federal government is among the most indebted governments in the world.

6 min read

While research on optimal taxation often focuses on the pure economic implications, it rarely considers cultural and societal differences that can lead to very different outcomes when trying to implement an optimal tax system.

4 min read

As Minnesota lawmakers consider making theirs the first state to mandate worldwide combined reporting, they are relying on a revenue estimate that is—this may not be the technical term—completely bogus.

7 min read

By letting the corporate surtax expire, eliminating taxes on GILTI, and embracing full expensing, New Jersey would take important steps toward creating a more welcoming and competitive tax environment.

6 min read

As policymakers look to tackle America’s debt and deficit crisis, they should consider international experiences on successful fiscal consolidations.

6 min read

One of the arguments in favor of the FairTax is that it would do a better job of taxing the underground economy than the income tax it is intended to replace.

6 min read

When a country has a broad base with a simple and transparent tax code, small rate changes have little influence. Therefore, policymakers shouldn’t only focus on rate changes when it comes to increasing tax competitiveness.

4 min read

As policymakers in St. Paul finalize this year’s tax bill, they should avoid policies that incentivize the diversion or relocation of capital. Importantly, states do not institute tax policy in a vacuum. The evidence from states’ experiences and the academic literature supports the conclusion that tax competitiveness matters not just to businesses but to human flourishing.

15 min read

When it comes to EU-level tax policy ideas, competitiveness seems to be less of a priority than raising revenue or pursuing social objectives.

4 min read

The Carbon Border Adjustment Mechanism (CBAM) is a key aspect of the EU’s broader Fit for 55 package which aims to cut 55 percent of net greenhouse gas (GHG) emissions in the EU by 2030. The growing number of competing climate policies between the EU and U.S., such as tax provisions in the Inflation Reduction Act, could present policymakers on both sides of the Atlantic an opportunity to work together.

5 min read