Blog Articles

Watch: Tax Foundation Excise Tax Event

1 min read

Tax Reform Moving Quickly in Georgia

In response to federal tax reform, Georgia is poised to reform its own tax code in a way that would make the state more competitive with its neighbors.

3 min read

Idaho Tax Reform Bill Advances

3 min read

Oregon’s Chance to Limit a Flaw in the Federal Tax Code

Senator Hass’s proposal to limit the special pass-through deduction in Oregon is the right choice, protecting the state’s budget, while advancing sound tax policy.

3 min read

Tax Compliance Burden Could Cost America as much as 1.2 Percent of its GDP

The time and effort associated with tax compliance is a drag on the economy, as researchers have shown. Will the Tax Cuts and Jobs Act reduce that burden?

3 min read

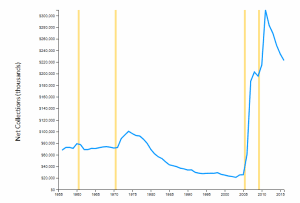

Electric Vehicles Will Have a Long-Term Impact on the Gas Tax

In the wake of the Trump administration’s infrastructure plan, it’s worth considering how the gas tax will remain viable with the rise of electric vehicles.

3 min read

The ‘Grain Glitch’ Needs to Be Fixed

The Tax Cuts and Jobs Act tax preference for farm co-ops would distort agricultural activity and create tax planning opportunities for wealthy taxpayers.

9 min read

Introducing the Tax Foundation’s Tax Reform Calculator

The Tax Foundation’s 2018 tax reform calculator shows you how the Tax Cuts and Jobs Act will impact take-home incomes, taxes owed, and more.

2 min read

The U.S.’s New Ranking on the International Tax Competitiveness Index

The TCJA is projected to improve the United States’ current ranking from 30th among the 35 Organisation for Economic Co-operation and Development (OECD) countries to 25th, an improvement of five places.

4 min read

Pennsylvania’s New Penalties on Investment Could Scare off Amazon, Others

While other states are working to promote growth, Pennsylvania is headed in the opposite direction with a policy that dramatically overtaxes investment.

4 min read