Understanding the House GOP Tax Plan

What does the tax reform package do well? What does it do poorly? How would it affect me?

4 min readStay informed with quick and accessible analysis of today's top tax policy topics. Read Tax Foundation's Tax Policy Blog for insight from our experts on tax policies across the U.S. and abroad.

To find our most recent research papers and data, click the links below.

What does the tax reform package do well? What does it do poorly? How would it affect me?

4 min read

The JCT analysis raises some useful questions for the U.S. domestic debate over Pillar Two. The Treasury Department should examine its support for an agreement that will reduce its own revenue intake. But it is also worth noting that the principal mechanism for the revenue reduction—the foreign tax credit—is a policy already baked into U.S. law, including the Republican-enacted global minimum tax from 2017. The OECD deal merely takes advantage of this longstanding feature.

6 min read

House Republicans are proposing to expand the Opportunity Zone program and alter its reporting requirements as part of a new suite of tax bills packaged as the American Families and Jobs Act.

4 min read

As fiscal year 2023 draws to a close, North Carolina’s House and Senate have each passed their own versions of the biennial budget for fiscal years 2024-25. While legislative leaders have generally agreed to overall spending levels, negotiations remain ongoing to resolve different approaches to tax policy.

7 min read

Texas’s robust surpluses create an opportunity to use state funds to lower local property taxes. However, it remains important for legislators to pursue a principled approach to rate compression, rather than enacting a plan that will simply shift the tax burden in nonneutral ways.

3 min read

Sens. Kevin Cramer (R-ND) and Christopher Coons (D-DE) have recently introduced a bill laying the groundwork for a possible solution to the problem: a tax on the carbon content of imports. But it falls short of the optimal approach in several ways.

4 min read

By extending bonus depreciation and introducing neutral cost recovery, the RSC budget would significantly improve the treatment of investment leading to increased growth, expanded employment, and higher wages.

3 min read

The price tag of the Inflation Reduction Act’s green energy tax credits is much higher than originally thought. Among other things, the updated analysis indicates the Inflation Reduction Act does not reduce deficits after all.

6 min read

In the closing days of the 2023 legislative session, Oklahoma lawmakers repealed the state’s corporate franchise tax and eliminated the marriage penalty in its individual income tax. Both tax changes represent a positive step forward for the state.

4 min read

The National Foreign Trade Council’s survey shows that the private sector recognizes the economic value of treaties as an instrument to increase tax certainty and decrease distortions.

4 min read

Lawmakers should avoid delivering social and economic benefits through the tax code whenever possible and work to simplify or repeal the tax expenditures already in the tax code.

7 min read

The current tax treatment of R&D expenses is irrational, complicated, and counterproductive. Fortunately, fixing this problem is a bipartisan issue.

4 min read

As the UTPR is a new concept, it is worth explaining what it is and why Rep. Smith cares about it. In a sentence, the Undertaxed Profits Rule (UTPR) is a looming extraterritorial enforcement mechanism for a tax base the U.S. has not adopted.

6 min read

To address the more challenging parts of the budget, especially the unsustainable growth in mandatory spending, lawmakers should follow up on this debt ceiling agreement with a focus on long-term fiscal sustainability.

6 min read

Making expensing permanent is especially important now, when the economy is threatened with a recession and inflation remains high.

7 min read

The legislation follows from the bipartisan concern regarding tax policies adopted by other countries specifically targeting U.S. businesses or the U.S. tax base.

6 min read

Legislation currently advancing in Louisiana—related to the franchise tax, inventory tax, and corporate rebate and exemption programs—would make the state’s tax code simpler and more competitive.

4 min read

The Pennsylvania Senate Finance Committee recently advanced two bills, SB 345 and SB 346, that would build on last year’s historic corporate net income tax (CNIT) reform.

7 min read

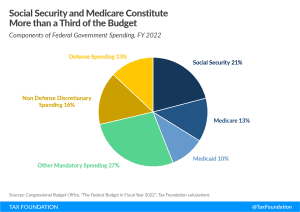

Any serious proposal to tackle the emerging debt and deficit crisis must also address our largest mandatory spending programs: Social Security and Medicare. Together, these two programs will be responsible for nearly 80 percent of the deficit’s rise between 2023 and 2032, according to Congressional Budget Office (CBO) projections.

8 min read

Rather than continue down the path of growing debt, lawmakers should craft a comprehensive solution. International experience cautions against tax-based fiscal consolidations, but modest tax increases may be part of a successful debt reduction package.

6 min read