Last month, Democratic presidential candidate and former Texas congressman Beto O’Rourke reintroduced his “war tax” proposal as part of a broader initiative to address veterans’ issues. It mirrors the Veterans Health Care Trust Fund Act, which stalled in the House of Representatives when he introduced it in 2016 and 2017. Though there have been other war taxes, O’Rourke’s plan differs from these previous plans in important ways.

Under this plan, each war would trigger creation of a new taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. and a new trust fund. The fund would support the hospital care, medical services, and disability compensation for veterans of that war. It would be financed by an income tax levied on households without active duty members or veterans of the armed forces. The rate would be anywhere from $25 for individuals with income of less than $30,000 to $1,000 for individuals with income of $200,000 or more. The policy has no stated exemptions for low-income taxpayers.

|

Source: H.R. 1790, “Veterans Health Care Trust Fund Act,” 115th Congress (2017-2018) |

|

| If the adjusted gross income of the taxpayer is: | The tax is: |

|---|---|

| Less than $30,000 | $25 |

| At least $30,000 but less than $40,000 | $57 |

| At least $40,000 but less than $50,000 | $98 |

| At least $50,000 but less than $75,000 | $164 |

| At least $75,000 but less than $100,000 | $270 |

| At least $100,000 but less than $200,000 | $485 |

| At least $200,000 | $1,000 |

O’Rourke’s proposal is unusual but not unprecedented. The Revenue and Expenditure Control Act of 1968, which was signed into law in 1968, imposed a temporary 10 percent income tax surcharge on individuals and corporations to pay for the Vietnam War. Former Representative Dave Obey’s (D-WI) 2009 proposal to help fund the war in Afghanistan, Share the Sacrifice Act of 2010, would have imposed a progressive surtaxA surtax is an additional tax levied on top of an already existing business or individual tax and can have a flat or progressive rate structure. Surtaxes are typically enacted to fund a specific program or initiative, whereas revenue from broader-based taxes, like the individual income tax, typically cover a multitude of programs and services. on individual and corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. liability. The rate, to be determined by the president each year, would have raised revenues enough to equal federal expenditures on the war during that fiscal year.

The structure of these taxes differs, as shown in the table below.

|

Revenue and Expenditure Control Act of 1968 (enacted) |

Share the Sacrifice Act of 2010 (not enacted) |

Veterans Health Care Trust Fund Act (not enacted) |

|

|---|---|---|---|

| Purpose | Offset some of the overall cost of war | Offset the overall cost of war for the prior year | Finance specific veterans programs for future use |

| Exemptions | Individuals whose income taxes were below specified limits. | Individuals serving in the armed forces, immediate family of service members who die on active duty, and individuals with income less than $30,000 | Individuals who have served on active duty in the armed forces |

| Tax Base | Net income tax liability | Net income tax liability | Adjusted gross income |

| Duration | Part of the Vietnam War | Part of the war in Afghanistan | Entire duration all future wars |

The key difference, however, is that O’Rourke’s proposal would impose a flat rate within each bracket instead of a percentage throughout. This results in small cliffs, or large increases in tax liability, for individuals moving in between brackets. For example, an individual currently earning $29,999 would face an increase in their tax bill of $22 with another dollar of income.

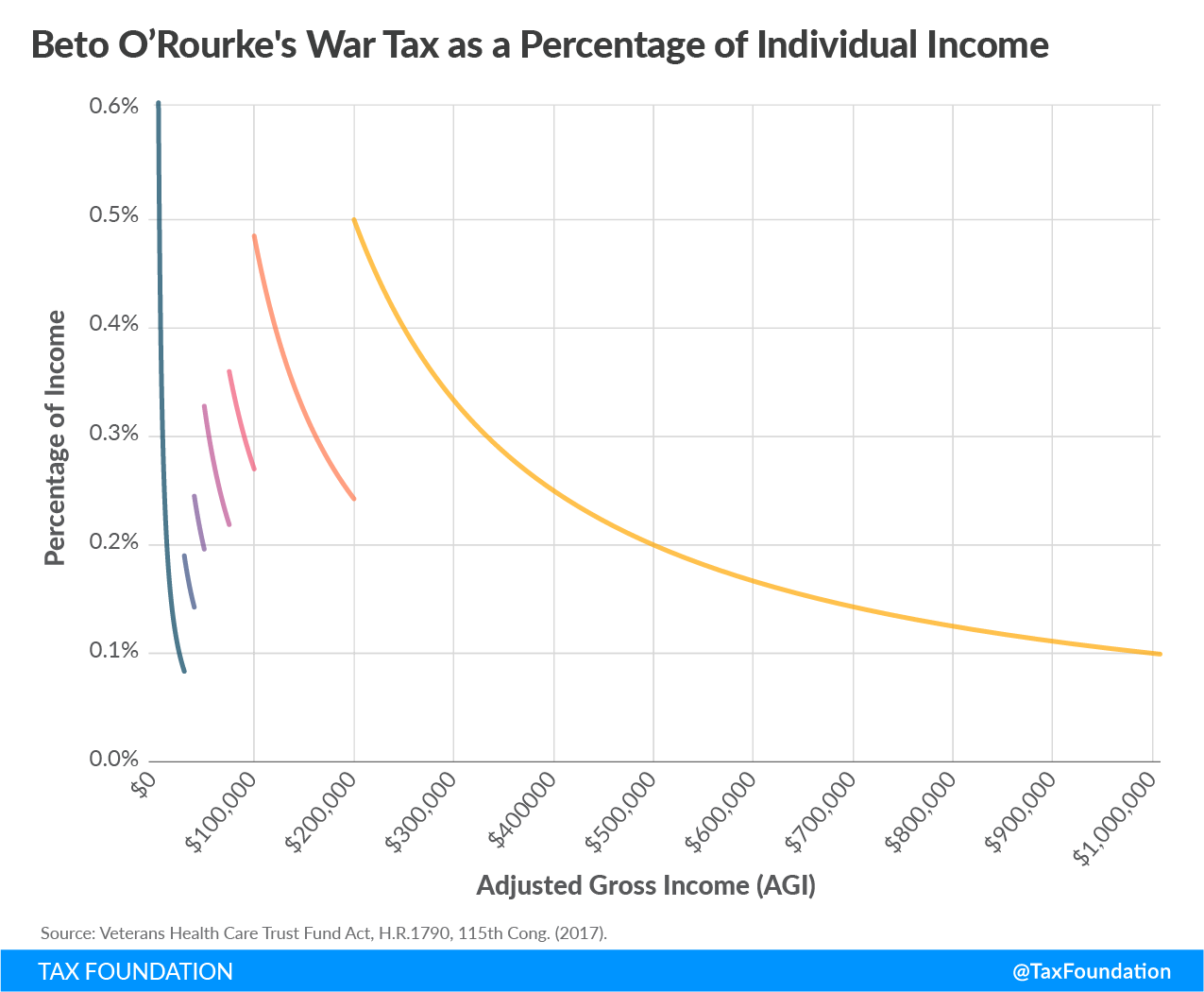

O’Rourke’s proposal also makes the tax less progressive than it otherwise could be. For taxpayers earning between $1 and $200,000, the effective tax rate, on average, increases as income increases, from about 0.1 percent of income to around 0.3 percent of income.

However, as individuals earn significantly more than $400,000, the effective tax rate drops significantly. An individual earning $1 million would face an effective rate of 0.1 percent, about half the rate faced by those earning around $30,000.

A “war tax” would be nothing new. However, O’Rourke’s proposal would be a departure from previous war tax proposals.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe