Historic Oil Price Burns Hole in State Budgets

Alaska and North Dakota collect revenue primarily from oil-related taxes. These states must start thinking about how to plan for an era of reduced oil revenue.

5 min readUlrik was Director of Excise Tax Policy with the Center for State Tax Policy at the Tax Foundation. His focus was on excise taxation and supporting the team developing principled positions on various excise taxes ranging from gasoline to tobacco.

Prior to joining the Tax Foundation, Ulrik worked in tobacco, finance, and public relations. He has a master’s degree in business administration from Copenhagen Business School and has always been interested in public policy—he has been involved in local politics since high school.

Ulrik was born and raised in Copenhagen, but now resides in Washington, D.C. with his wife and infant daughter. In his spare time he enjoys playing and watching soccer, as well as traveling.

Alaska and North Dakota collect revenue primarily from oil-related taxes. These states must start thinking about how to plan for an era of reduced oil revenue.

5 min read

On July 1, sales taxes levied on internet access in six states—Hawaii, New Mexico, Ohio, South Dakota, Texas, and Wisconsin—will become illegal under the provisions of the Permanent Internet Tax Freedom Act (PITFA)

4 min read

We examine whether excise taxes are a solution to budget deficits, and while the short answer to that question is no, there are of course nuances. Excise taxes can play a role in state revenues even as policymakers appreciate that excise taxes are not viable long-term revenue tools for general spending priorities.

21 min read

Many states are racing to pass budgets, emergency COVID-19 supplemental appropriations, and other must-pass legislation as quickly as possible. We’re tracking the latest state legislative responses to the coronavirus crisis.

66 min read

Fewer people driving means fewer people buying gasoline, which may have positive effects on air pollution but could be detrimental to motor fuel excise tax revenue for federal and state governments.

4 min read

Denmark, a high-tax country with 5.5 million citizens, has implemented policies designed to avoid layoffs and bankruptcies and basically unplug the economy during the pandemic.

4 min read

States will have to consider the effects of the COVID-19 pandemic on their excise tax revenues, including from gas taxes, tobacco taxes, and alcohol taxes.

7 min read

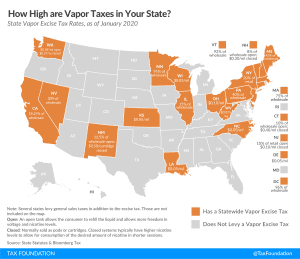

While lawmakers are working through the design of vapor tax proposals, they must thread the needle between protecting adult smokers’ ability to switch and barring minors’ access to nicotine products. A good first step is creating appropriate definitions for the new nicotine products to avoid unintended disproportionate taxation based on design differences or bundling.

7 min read

One notable consequence of high state tobacco excise tax rates is increased smuggling as people procure discounted products from low-tax states and sell them in high-tax states. Smugglers wouldn’t have to look far to find cheaper smokes. All of Maryland’s neighboring states have rates lower than $4 per pack, including Virginia ($1.20) and West Virginia ($0.30). Such an increase would impact the many small business owners operating vape shops around the state and convenience stores relying heavily on vapers as well as tobacco sales.

7 min read

The prospect of a ban on flavored tobacco and nicotine products highlights the complications of contradictory tax and regulatory policy, the instability of excise taxes that go beyond pricing in the cost of externalities, and the public risks of driving consumers into the black market through excessive taxation or regulation.

6 min read