The Future of Arkansas Tax Reform: Next Steps on the Road Map to Competitiveness

Responsible pro-growth reforms to Arkansas’s tax code can help ensure that the Natural State is indeed a Land of Opportunity.

9 min read

Responsible pro-growth reforms to Arkansas’s tax code can help ensure that the Natural State is indeed a Land of Opportunity.

9 min read

A bill introduced in the Massachusetts House, (H. 74) would expand funding for community media programming by imposing a new tax on the gross revenues of digital streaming service providers. The sentiment is understandable, but the proposed solution leaves much to be desired.

6 min read

The Pennsylvania Senate Finance Committee recently advanced two bills, SB 345 and SB 346, that would build on last year’s historic corporate net income tax (CNIT) reform.

7 min read

As policymakers in St. Paul finalize this year’s tax bill, they should avoid policies that incentivize the diversion or relocation of capital. Importantly, states do not institute tax policy in a vacuum. The evidence from states’ experiences and the academic literature supports the conclusion that tax competitiveness matters not just to businesses but to human flourishing.

15 min read

The overall U.S. tax and transfer system is overwhelmingly progressive, and understanding the extent—and source—of that progressivity is essential for lawmakers considering the trade-offs associated with each tax policy decision.

23 min read

A recently enacted bill in Mississippi made the Magnolia State only the second state in the country to make full expensing permanent. The bill joins reductions to the individual income tax and capital stock tax rates, already in progress, as model, pro-growth reforms for the region.

5 min read

Adopting the sound tax reforms still pending in Santa Fe is an opportunity for New Mexico to keep up with the pack or risk falling further behind.

7 min read

The proposed reforms would be welcome changes to the Commonwealth’s tax code, but the economic principles behind the reforms also have important implications for the Bay State’s income tax system writ large.

6 min read

Crafting a hybrid bill for a low, flat rate on a broad base—with well-designed revenue triggers to responsibly reduce rates in the future—could be an ideal way forward for the North Dakota Senate.

7 min read

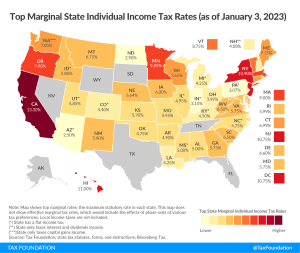

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections:

9 min read

Most of the 2023 state tax changes represent net tax reductions, the result of an unprecedented wave of rate reductions and other tax cuts in the past two years as states respond to burgeoning revenues, greater tax competition in an era of enhanced mobility, and the impact of high inflation on residents.

20 min read

On Election Day, a narrow majority of Massachusetts voters approved Question 1, also known as the Fair Share Amendment, which will transition the Commonwealth from a flat rate individual income tax to a graduated rate system.

7 min read

From income tax changes to cannabis legalization and taxation, here’s what voters decided on Election Day.

6 min read

Massachusetts’ competitive tax advantage in New England is driven primarily by its competitive individual income tax rate and its sales and use tax structure. If the Commonwealth changes its tax code in ways that narrow the base or increase the rate, it cedes greater tax competitiveness to other states, regionally and nationally.

34 min read

Every change to a state’s tax system makes its business tax climate more or less competitive compared to other states and makes the state more or less attractive to business.

7 min read

Arkansas recently became the 13th state to authorize an individual income tax rate reduction this year. This round of tax cuts accelerated reforms enacted eight months ago.

7 min read

Policymakers from both parties in Harrisburg have proposed reducing Pennsylvania’s 9.99 percent corporate net income tax (CNIT) rate but could not agree on an approach—until now. With the enactment of HB 1342 lawmakers finally succeeded in cutting what had been the second highest state corporate tax rate in the nation.

7 min read

Among the 46 states that held legislative sessions this year, structural state tax reform and temporary tax relief measures were recurring themes.

13 min read

Research almost invariably shows a negative relationship between income tax rates and gross domestic product (GDP). Cuts to marginal tax rates are highly correlated with decreases in the unemployment rate.

26 min read