In the Shadow of T-TIP: Why Congress Should Care About EU Tax and Trade Issues in 2023

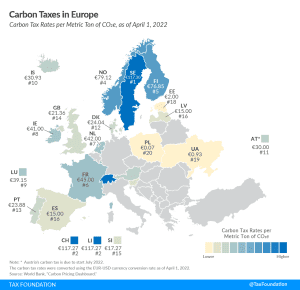

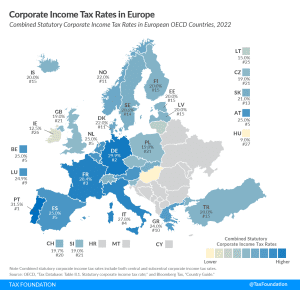

The EU’s unilateral approach with carbon taxes, faster track on the global minimum tax, and threat of renewed efforts on DSTs means that U.S. policymakers face some hard choices. Policymakers on both sides of the Atlantic should keep in mind pro-growth tax and trade principles that promote a rules-based international order and increase opportunity.

7 min read