Reforming the Pass-Through Deduction

Here’s how the new pass-through deduction works and how it can be reformed to be less complex, less prone to abuse, more neutral, and more economically efficient.

49 min readScott Greenberg was a Senior Analyst with the Center for Federal Tax Policy at the Tax Foundation. His research has been cited by the New York Times, Washington Post, USA Today, Politico, and several other publications, and he has appeared on CNBC, Fox Business News, NPR, and BBC.

Scott grew up in central New Jersey and attended Yale University, where he earned a B.A. in Economics. He enjoys board games, classical music, and happy hours.

Here’s how the new pass-through deduction works and how it can be reformed to be less complex, less prone to abuse, more neutral, and more economically efficient.

49 min read

How have federal tax expenditures changed since passage of the Tax Cuts and Jobs Act? We compare 2017 and 2018 Joint Committee on Taxation estimates.

8 min read

Expiring provisions, scheduled tax increases on investment, unresolved issues in the code—The Tax Cuts and Jobs Act was passed, but tax reform isn’t done yet.

37 min read

The Tax Cuts and Jobs Act tax preference for farm co-ops would distort agricultural activity and create tax planning opportunities for wealthy taxpayers.

9 min read

The broad conclusion here is that, in drafting the Republican Framework, lawmakers have left themselves with at least one significant lever for delivering middle class tax relief: the child tax credit.

7 min read

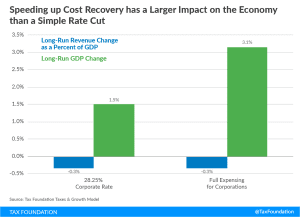

If lawmakers are looking to maximize the positive economic effects from a tax bill, then improving tax depreciation for structures should probably be part of the conversation. Here are a few options.

10 min read

Based on the details we have, the Big Six tax plan would lower taxes on the bottom 80% of taxpayers, and raise the tax burden on the top 20% of taxpayers.

7 min read

Republican leadership in the House, Senate, and White House released a framework for a tax proposal that would lower taxes on businesses and individuals and simplify a number of aspects of the federal tax code. Here are the details we know right now.

3 min read

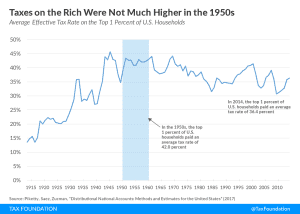

The top 1 percent of Americans today do not face an unusually low tax burden, by historical standards. In the 1950s, when the top marginal income tax rate reached 92 percent, the top 1 percent of taxpayers paid an effective rate of only 16.9 percent.

4 min read