Gavin Ekins

W. Gavin Ekins is a research economist at the Tax Foundation. He holds a Ph.D. in economics from George Mason University. He has worked for the Center for Neuropolicy at Emory University and the Center for the Study of Neuroeconomics at George Mason University. He has also worked as a researcher and visiting professor at Emory University. His research involved behavioral studies of tax and subsidy policies as well as neuroeconomic. He has conducted behavioral studies on direct and indirect subsidies, Domar-Musgrave’s model of income tax on risky investment, and the percentage-law subsidies. He has also published neuroeconomic studies on bonus and penalty framing in contracts and coordination in games.

Gavin’s research interests include tax policy, public choice, public finance, and game theory. He is also interested in analyzing how the human brain evaluates taxes and subsidies under different frames. He has taught experimental economics, computational economics, and various levels of microeconomics at both Emory University and George Mason University. He also holds a bachelor’s degree in industrial engineering and a master’s degree in systems engineering from the University of Arizona.

Latest Work

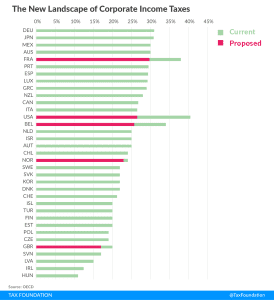

Tax Cuts and Jobs Act Puts the U.S. with its International Peers

If enacted, the Tax Cuts and Jobs Act would put the U.S. corporate tax rate more in line with its international peers at 13th highest of 35 OECD countries.

2 min read

The Health Impact of Alcohol Taxes

A proposal in the Senate tax reform bill to reduce alcohol taxes wouldn’t create the negative health consequences that some claim.

2 min read

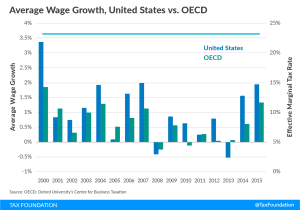

JCT’s Dynamic Score is Positive But Underestimates Economic Benefits

The Joint Committee on Taxation (JCT) dynamic scoring estimate of the Senate’s Tax Cuts and Jobs Act confirms that tax changes impact economic growth. While JCT’s estimates are positive, there is reason to believe that the tax plan would produce even greater dynamic effects than its analysis shows.

3 min read

International Provisions in the Senate Tax Cuts and Jobs Act

The Senate’s version of the Tax Cuts and Jobs Act (TCJA) includes several important changes to the taxation of multinational corporations.

5 min read

How The Tax Cut and Jobs Act Would Change International Business Taxation

One goal of the House Tax Cuts and Jobs Act is to move international business taxation to a territorial rather than a worldwide system. Here’s how it would work.

7 min read

Time to Shoulder Aside “Crowding Out” As an Excuse Not to Do Tax Reform

This paper evaluates the arguments for and against “crowding out” and compares these arguments to empirical studies. It discusses the impact of tax changes on the allocation of national income between consumption and saving, and the allocation of saving between private investment and government deficits. It finds that the crowding out argument is largely based on a mistaken assumption about the flexibility and availability of saving and credit for the financing of government deficits and private investment.

31 min read

March 2017 Model Update Overview

5 min read

Tax Revenues Reach New High Across OECD

3 min read