Erica York is Senior Economist and Research Director with Tax Foundation’s Center for Federal Tax Policy. She previously worked as an auditor at a large community bank in Kansas and interned at Tax Foundation’s Center for State Tax Policy.

Her analysis has been featured in The Wall Street Journal, The Washington Post, Politico, and other national and international media outlets. She holds a master’s degree in Economics from Wichita State University and an undergraduate degree in Business Administration and Economics from Sterling (KS) College, where she is currently an adjunct professor. Erica lives in Kansas with her husband and their two children.

Latest Work

New Letter Says the “Retail Glitch” is Discouraging Business Investment

Retail groups sent a letter to Congress explaining that the “retail glitch” in the Tax Cuts and Jobs Act would discourage business investment.

3 min read

The Fixtures Fix: Correcting the Drafting Error Involving the Expensing of Qualified Improvement Property

Due to a legislative oversight, the Tax Cuts and Jobs Act excluded the category of qualified improvement property investment from 100 percent bonus depreciation.

12 min read

The Complicated Taxation of America’s Retirement Accounts

Changes to the way we tax long-term savings could remove the excess tax burden on saving and investment, helping individuals to better provide for their financial future.

15 min read

Business Investment Increases by 39 Percent in Q1 2018

Several S&P 500 companies reported an increase in capital expenditures, a possible sign that the Tax Cuts and Jobs Act will help encourage new investment.

2 min read

Recommendations to Congress on the 2018 Tax Extenders

Congress should allow these tax extenders to expire and instead focus on making permanent features of the tax code that move it toward a more ideal system, such as full expensing.

12 min read

Modeling the Impact of President Trump’s Proposed Tariffs

The Trump administration’s proposed tariffs would lead to job losses and a reduction in economic growth, as the Tax Foundation’s updated Tax and Growth model shows.

4 min read

Tax Freedom Day 2018 is April 19th

Tax Freedom Day is the day when the nation as a whole has earned enough money to pay its total tax bill for the year. In 2018, Tax Freedom Day falls on April 19th, 109 days into the year.

5 min read

Lawmakers May Vote on Making Key Provisions of the TCJA Permanent

The Tax Cuts and Jobs Act improved the US tax code, but key provisions are only temporary. Now Congress may vote to ensure those tax breaks are permanent.

3 min read

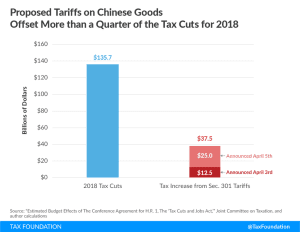

Proposed Chinese Tariffs Will Raise Taxes Following a Large Tax Cut

The Trump administration’s plan to levy $60 billion in tariffs on Chinese products could negate 20 percent of the benefits of the recently adopted tax cuts.

3 min read