Neutral Cost Recovery Is Not a New Idea

As stated by Rep. Jack Kemp in 1985, “Neutral cost recovery is designed to provide the present value of investment expensing without some of its practical problems.”

5 min readErica York is Vice President of Federal Tax Policy with Tax Foundation’s Center for Federal Tax Policy. She previously worked as an auditor at a large community bank in Kansas and interned at Tax Foundation’s Center for State Tax Policy.

Her analysis has been featured in The Wall Street Journal, The Washington Post, Politico, and other national and international media outlets. She holds a master’s degree in Economics from Wichita State University and an undergraduate degree in Business Administration and Economics from Sterling (KS) College, where she is currently an adjunct professor. Erica lives in Kansas with her husband and their two children.

As stated by Rep. Jack Kemp in 1985, “Neutral cost recovery is designed to provide the present value of investment expensing without some of its practical problems.”

5 min read

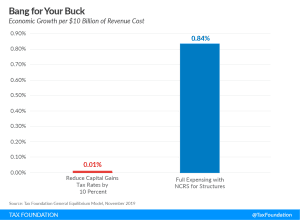

Improving the tax treatment of structures is one of the most cost-effective tax policy changes available to lawmakers as they consider how to remove investment barriers in the tax code to hasten the economic recovery. Policymakers must weigh the trade-offs among long-run economic output goals, revenue constraints, and the existing stock of structures.

13 min read

When considering long-term policies for increasing long-run levels of investment and economic growth, full expensing and neutral cost recovery are better targeted than policies like a capital gains cut.

6 min read

Permanent full expensing for all types of investment is an effective policy change lawmakers can use to encourage additional investment and economic growth.

9 min read

One of the most cost-effective policy changes would be to make full expensing of machinery and equipment permanent and extend this important tax treatment to structures as well as for firms in a net operating loss position.

7 min read

Congress recently passed the largest economic relief bill in American history (CARES Act). We’ve created a FAQ portal to better inform policymakers, journalists, and taxpayers across the country on the new law.

13 min read

As lawmakers debate how to respond to the coronavirus crisis, they should focus the legislative response to the emergency at hand, using principled policy solutions to provide relief to those affected. Attempts to use the crisis to make other, unrelated policy changes should be avoided.

3 min read

The timing from enactment to distribution has varied from about one and a half months to more than two months, indicating that it has historically taken a significant amount of time for individual taxpayers to receive their rebates after the policies have been put in place.

4 min read

The U.S. Treasury Department has pushed the April 15 tax payment deadline to July 15. However, taxpayers still have to file their tax returns by the usual April 15 deadline.

3 min read

The House bill would provide two weeks of paid sick leave to workers who must quarantine, take care of a family member who is sick with coronavirus, or care for their children whose school or daycare has closed due to the public health emergency.

2 min read

Taxes present one policy tool available to ease the impending liquidity crunch brought on by the coronavirus crisis, which policymakers are already pursuing by postponing the tax payment deadline and waiving interest and penalties.

3 min read

The bill, the Families First Coronavirus Response Act, would expand federal medical leave, create an emergency paid sick leave requirement, and provide tax credits against employer-side payroll taxes to help offset the cost of these two programs, among other provisions.

3 min read

Joe Biden and Bernie Sanders have each proposed changes to the individual income tax, one of the largest sources of federal revenue. Our new analysis compares the economic, revenue, and distributional effects of the various proposals.

13 min read

As policymakers evaluate changes to the tax code, such as proposals coming from presidential candidates and the White House, it will be important for them to evaluate the relative effects of various provisions. According to our analysis, making full expensing permanent would be one of the most efficient ways to increase after-tax incomes for the middle class.

3 min read

The latest IRS data shows that the U.S. individual income tax continues to be very progressive, borne primarily by the highest income earners. The top 1 percent of taxpayers pay a 26.8 percent average individual income tax rate, which is more than six times higher than taxpayers in the bottom 50 percent (4.0 percent).

6 min read

2020 Democratic presidential candidates have proposed various changes to the corporate income tax, which includes increasing the rate, ranging from 25 percent to 35 percent, imposing a corporate surtax or a minimum tax, and lengthening depreciation schedules.

17 min read

Making 100 percent bonus depreciation permanent avoids the uncertainty associated with the phaseout of a powerful pro-growth policy and would provide a cost-effective boost to long-run economic output, wages, and employment in the United States.

2 min read

The “Real Deal” would increase the tax burden on saving, investing, and working in the United States, and reduce the global competitiveness of the U.S. economy.

3 min read