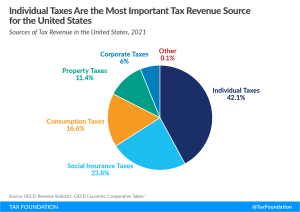

Sources of U.S. Tax Revenue by Tax Type, 2023

Different taxes have different economic effects, so policymakers should always consider how tax revenue is raised and not just how much is raised.

4 min readCecilia Perez Weigel is Public Affairs Manager of Tax Foundation Europe, where she focuses on international and European tax issues.

Prior to joining the Tax Foundation, Cecilia interned at the American Chamber of Commerce in France, the Delegation of the European Union to the United States, and the Public Finances Chamber of the Paris Court of Appeal.

Cecilia holds a joint master’s degree in transatlantic affairs from the College of Europe in Bruges and the Fletcher School in Boston, a master’s degree in European regulation from Sciences Po Paris, and a bachelor’s degree in political science and international affairs from Sciences Po Paris.

Cecilia is French and Guatemalan. She is fluent in Spanish, French, and English, and has a good command of Russian and German. She enjoys learning new languages, playing chess, and gastronomy.

Different taxes have different economic effects, so policymakers should always consider how tax revenue is raised and not just how much is raised.

4 min read

When it comes to providing economic relief to those in need, wartime energy security, and principled tax policy, the EU can do all three. But a windfall profits tax is not the policy to achieve these goals.

8 min read

Designing tax policy in a way that sustainably finances government activities while minimizing distortions is important for supporting a productive economy.

5 min read