Alec Fornwalt was a Policy Analyst with the Center for Federal Tax Policy at the Tax Foundation. He previously interned at the Heritage Foundation.

Alec was born in southern Pennsylvania, but grew up in Cecil County, Maryland. He has a B.S. in Politics and Policy from Liberty University.

In his free time, Alec enjoys playing guitar, watching Philadelphia sports teams, and reading.

Latest Work

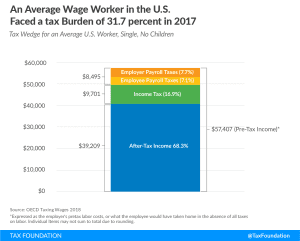

A Comparison of the Tax Burden on Labor in the OECD, 2018

Before accounting for state and local sales taxes, the tax burden that a single average wage earner faces in the U.S. is 31.7 percent of pretax earnings, amounting to $18,198 in taxes in 2017.

18 min read