Alabama’s 2025 Legislative Session Advances Pro-Growth Tax Reforms

Alabama’s 2025 legislative session mostly demonstrates a commitment to pro-growth tax policies that enhance competitiveness and reduce compliance burdens.

4 min readAbir Mandal is a Senior Policy Analyst at the Tax Foundation, focused on state tax policy.

Dr. Mandal holds a PhD in economics from Clemson University, where he focused on economic growth and development, trade, and econometrics.

Prior to the Tax Foundation, he was an assistant professor of economics at the University of Mount Olive, in North Carolina, which followed faculty and research positions at the University of Kansas. His work has been published in various journals as well as non-academic outlets.

Born and brought up in New Delhi, India, Dr. Mandal now lives outside Raleigh, NC, with his two cats that have moved all around the country with him. When he is free, he prefers to spend time at the gym, the gun range, and exploring quaint coffee shops and bourbon bars around the Research Triangle Park with friends.

Alabama’s 2025 legislative session mostly demonstrates a commitment to pro-growth tax policies that enhance competitiveness and reduce compliance burdens.

4 min read

By implementing a more sophisticated and nuanced trigger system for its tax reduction goals, North Carolina can sustain its trajectory toward lower tax rates, reinforce its reputation as a business-friendly state, and ensure long-term fiscal stability in an ever-changing economic landscape.

4 min read

The trend of tax exemptions on tips, overtime, and bonuses may sound like a win for workers, but it is a shortsighted fix with long-term drawbacks.

11 min read

A North Carolina House bill titled “No Tax on Tips, Overtime, Bonus Pay,” is gaining bipartisan traction in the General Assembly, mirroring similar proposals nationwide, including those championed by President Trump.

4 min read

With such an important change to Iowa’s property tax system, it’s important that lawmakers get the details right.

33 min read

A recent proposal in Minnesota exempting certain nonresident workers from having to file and pay income taxes would reduce compliance costs for business travelers and their employers at limited cost to the state.

4 min read

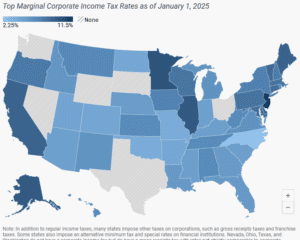

Forty-four states levy a corporate income tax, with top rates ranging from a 2.25 percent flat rate in North Carolina to a 11.5 percent top marginal rate in New Jersey.

7 min read

Nebraska has an opportunity to revise the property tax package enacted in 2024 to ensure that Nebraskans enjoy meaningful property tax relief.

32 min read

Thirty-nine states will begin 2025 with notable tax changes, including nine states cutting individual income taxes. Recent years have seen a wave of significant tax reforms, and the changes scheduled for 2025 show that these efforts have not let up.

25 min read

Tax reform in Alabama is desirable and very possible. However, the overtime exemption, which complicates the tax code, reduces neutrality, and adds to compliance and reporting costs, is not a good example.

4 min read

Especially for a state that relies so heavily on the sales tax as a source of revenue—and where most people want to keep it that way—a broad base and a low rate is crucial.

5 min read

With a changing economy—the law is about companies selling tangible products, but our economy is increasingly service-oriented—and state-level tests to the ongoing validity of the law, perhaps the time has come for Congress to update and expand upon these protections, which are designed to limit states from imposing substantial tax remittance and compliance burdens on businesses with only the most minimal of contacts with the state.

5 min read

Taxes are on the ballot this November—not just in the sense that candidates at all levels are offering their visions for tax policy, but also in the literal sense that voters in some states will get to decide important questions about how their states raise revenue.

9 min read

The recently released FY 2025 budget for New York State signals a degree of optimism, with caveats. New York cannot tax itself toward a balanced budget.

6 min read

Next year, West Virginians will see an income tax cut thanks to revenue triggers in a 2023 law. The Mountain State joins 14 other states that have cut income taxes this year.

4 min read

The Fifth Circuit has affirmed states’ authority over their respective tax policies and has asserted that the offset clause—often called the “Tax Mandate”—of the American Rescue Plan Act (ARPA) has enough fiscal impact on a state’s budget so as to be coercive, as opposed to incentivizing.

5 min read

Retail delivery fees are an inefficient and ineffective way to close budget gaps, and lawmakers should consider other, more sound, policy options.

5 min read