Important Differences Between the House and Senate Tax Reform Bills Heading into Conference

The House and Senate have both passed legislation that would overhaul the federal tax code. Learn about the key differences between the two bills.

7 min readStay informed with quick and accessible analysis of today's top tax policy topics. Read Tax Foundation's Tax Policy Blog for insight from our experts on tax policies across the U.S. and abroad.

To find our most recent research papers and data, click the links below.

The House and Senate have both passed legislation that would overhaul the federal tax code. Learn about the key differences between the two bills.

7 min read

A brief summary of the most notable provisions of the Senate Tax Cuts and Jobs Act in the form in which it enters the “vote-a-rama.”

3 min read

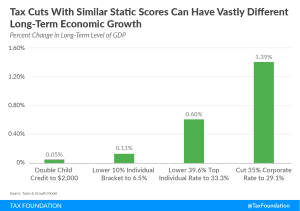

The Joint Committee on Taxation (JCT) dynamic scoring estimate of the Senate’s Tax Cuts and Jobs Act confirms that tax changes impact economic growth. While JCT’s estimates are positive, there is reason to believe that the tax plan would produce even greater dynamic effects than its analysis shows.

3 min read

The Senate’s version of the Tax Cuts and Jobs Act (TCJA) includes several important changes to the taxation of multinational corporations.

5 min read

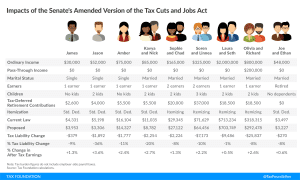

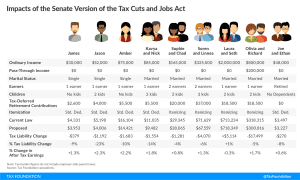

Here’s how the individual income tax provisions of the amended Senate’s Tax Cuts and Jobs Act would impact individuals and families across the income spectrum.

5 min read

The National Conference of State Legislatures may revisit a decision to reject tax reform that repeals the state and local tax deduction.

2 min read

New Jersey has the worst state business tax climate of the 50 states and the third highest state and local tax burden. If federal tax reform prompts New Jersey to overhaul its tax code, it’s long overdue.

3 min read

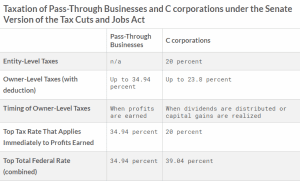

A more careful look shows that the Senate Tax Cuts and Jobs Act doesn’t put pass-through businesses at a disadvantage compared to C corporations.

4 min read

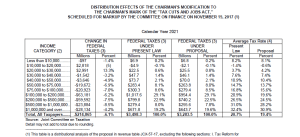

Much attention is being paid to distributional tables released by JCT on the Senate’s Tax Cuts and Jobs Act, but their results don’t quite seem to show what some are suggesting. While the results appears to show a tax increase for some lower-income filers, this is due to the unique nature of the individual mandate and the premium tax credits available under the Affordable Care Act.

2 min read

The House of Representatives passed the Tax Cuts and Jobs Act by a vote of 227-205. Here is a summary of the major provisions in the final package.

2 min read

The Senate Tax Cuts and Jobs Act is right to make the most pro-growth policies permanent and sunset the ones that will do less economic harm.

6 min read

The Chairman’s Mark of the Senate’s Tax Cuts and Jobs Act includes a number of important changes. Here’s a quick overview of those that matter most.

3 min read

Here’s how the individual income tax provisions of the Senate’s Tax Cuts and Jobs Act would impact individuals and families across the income spectrum.

5 min read

The Senate Tax Cuts and Jobs Act includes hundreds of structural reforms to the tax code. Here is a guide to the eight most important changes.

5 min read

This list, though not exhaustive, catalogues the major differences between the House and Senate version of the Tax Cuts and Jobs Act.

4 min read