Blog Articles

Latvia Joins the Cash-Flow Tax Club

3 min read

Kentucky Legislature Overrides Governor’s Veto to Pass Tax Reform Package

By broadening bases while lowering rates, policymakers in Kentucky took a responsible approach to comprehensive tax reform.

2 min read

Modeling the Impact of President Trump’s Proposed Tariffs

The Trump administration’s proposed tariffs would lead to job losses and a reduction in economic growth, as the Tax Foundation’s updated Tax and Growth model shows.

4 min read

Lawmakers May Vote on Making Key Provisions of the TCJA Permanent

The Tax Cuts and Jobs Act improved the US tax code, but key provisions are only temporary. Now Congress may vote to ensure those tax breaks are permanent.

3 min read

Gross Receipts Taxes in the Marijuana Industry Found to Cause Distortionary Effects

States considering legalizing and taxing marijuana should pay attention to natural experiments occurring in states across the country.

4 min read

Governor Dayton’s Budget Proposal: Some Pro-Growth Provisions, but Misses the Mark on Others

The proposal includes some good reforms, including conforming to the federal full expensing provision, but also rolls back some recent positive changes.

2 min read

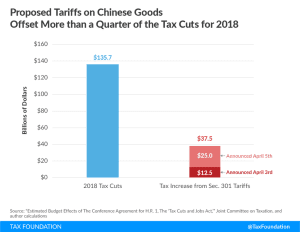

Proposed Chinese Tariffs Will Raise Taxes Following a Large Tax Cut

The Trump administration’s plan to levy $60 billion in tariffs on Chinese products could negate 20 percent of the benefits of the recently adopted tax cuts.

3 min read