Soda taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. es are highly regressive and volatile sources of revenue, but policymakers should also be wary of how complex these proposals are to implement, as Seattle is finding out firsthand.

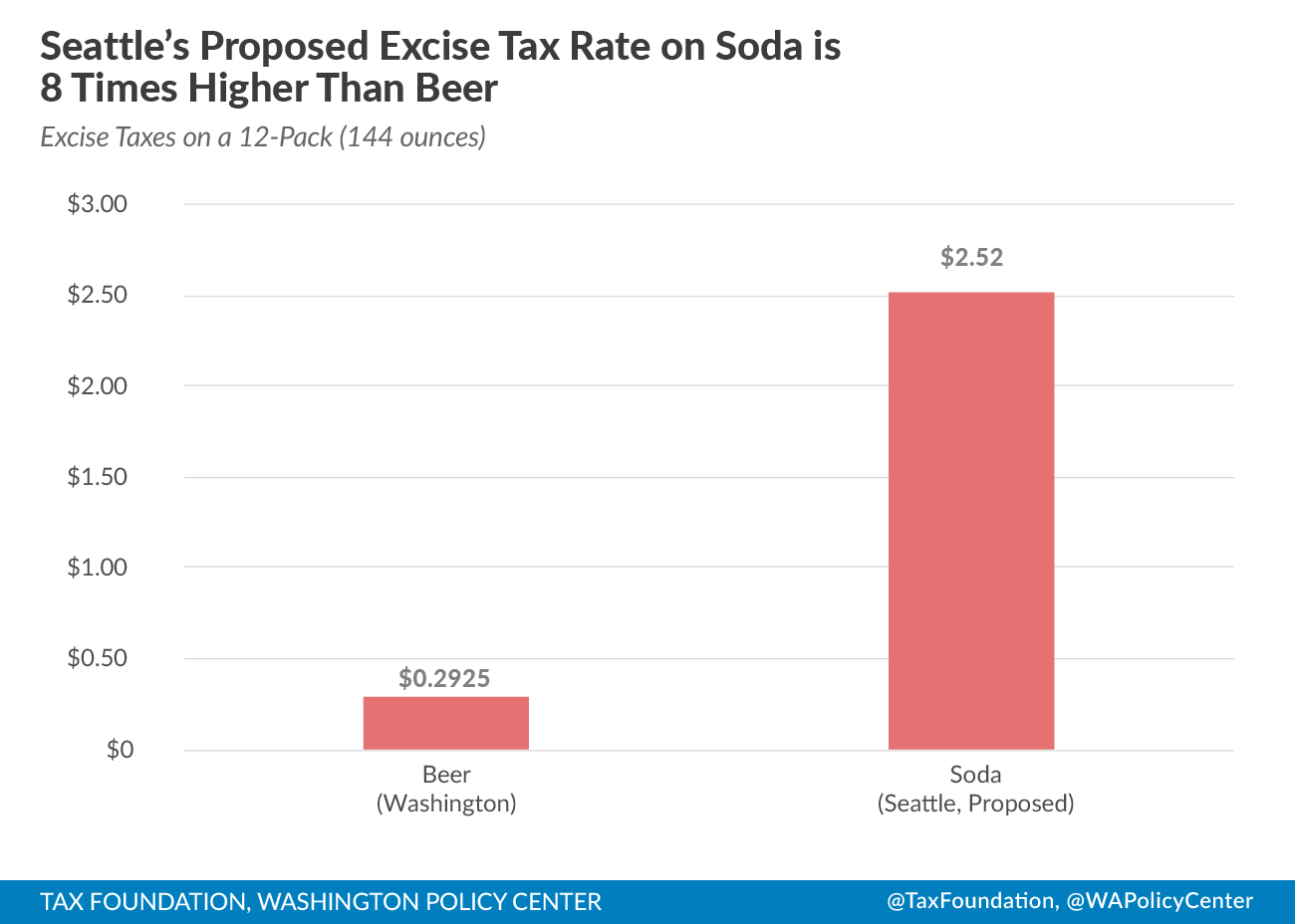

With the Seattle City Council poised to vote on a tax of 1.75 cents per ounce on sugary beverages and syrups (eight times higher than the rate on beer), questions have arisen about what beverages the city plans to exempt. As this Seattle Times piece points out, the mayor initially planned to exempt “in-store prepared coffee beverages.” Now it appears that the tax would apply to syrups added to prepared coffee drinks, but the actual details will remain unknown until the post-adoption rulemaking process. Suffice to say, residents of Seattle—the birthplace of Starbucks—may have a different take on this tax depending on its treatment of sweetened coffee drinks.

To add to the confusion, the Seattle Times story notes that policymakers intend to exempt homemade syrups. How much time, effort, and ingredients would have to be combined for a syrup to be considered homemade and exempt? If the Seattle City Council approves this tax, we probably won’t know until after the fact. As any state that’s sought special tax treatment of candy versus other foods can attest, the regulatory disputes over how the tax is applied won’t stop even after a final rule is passed.

A Tax Foundation report from 2011 highlights the complexities involved with imposing excise taxes on soda, candy, and other products seen as unhealthy. In 2008, Maine voters ended up rolling back a soda taxA soda tax is an excise tax on sugary drinks. Most soda taxes apply a flat rate per ounce of a sugar-sweetened beverage. after people realized that a popular, famous Maine beverage—Moxie—was subject to the tax. If Seattle is looking to curb consumption of sugary drinks, it’d be difficult to justify an exemption for Starbucks’ Unicorn Frappuccino. On the other hand, to avoid this problem, the city may decide to exempt coffee to appease the coffee constituency. After all, as my colleague Scott Drenkard noted on Twitter, taxing coffee drinks in Seattle would be like Italy imposing an excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. on pasta.

Share