Tonight, the Utah legislature enacted a rebalancing of the state’s taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. code in a one-day special session at the culmination of a months’-long process that saw lawmakers crisscross the state and entertain more than 62 hours of public comment across 17 meetings. The legislation enacted tonight was in some respects a product of that process, incorporating refinements, compromises, and sweeteners along the way. But it is also a reflection of priorities that have driven the process from day one, and with tonight’s vote, Utah is a signature away from putting the capstone on reforms that began 12 years ago and make the state’s tax code among the most competitive in the nation.

The legislation passed the Senate 19-7 and passed the House 43-27. It now goes to Gov. Gary Herbert (R), who called the special session and is expected to sign the legislation into law.

As a modernization of Utah’s sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. code, SB 2001 fell short of what could have been, though the expansion to select services still puts Utah ahead of most of its peers in this regard. As legislative leaders and representatives of the governor’s office said in the final hearing of the Tax Restructuring and Equalization Task Force on Tuesday, the service expansion gives the state another 5-7 years of breathing room; it does not, unfortunately, fundamentally revisit the taxation of services to provide flexibility in adapting to an evolving economy.

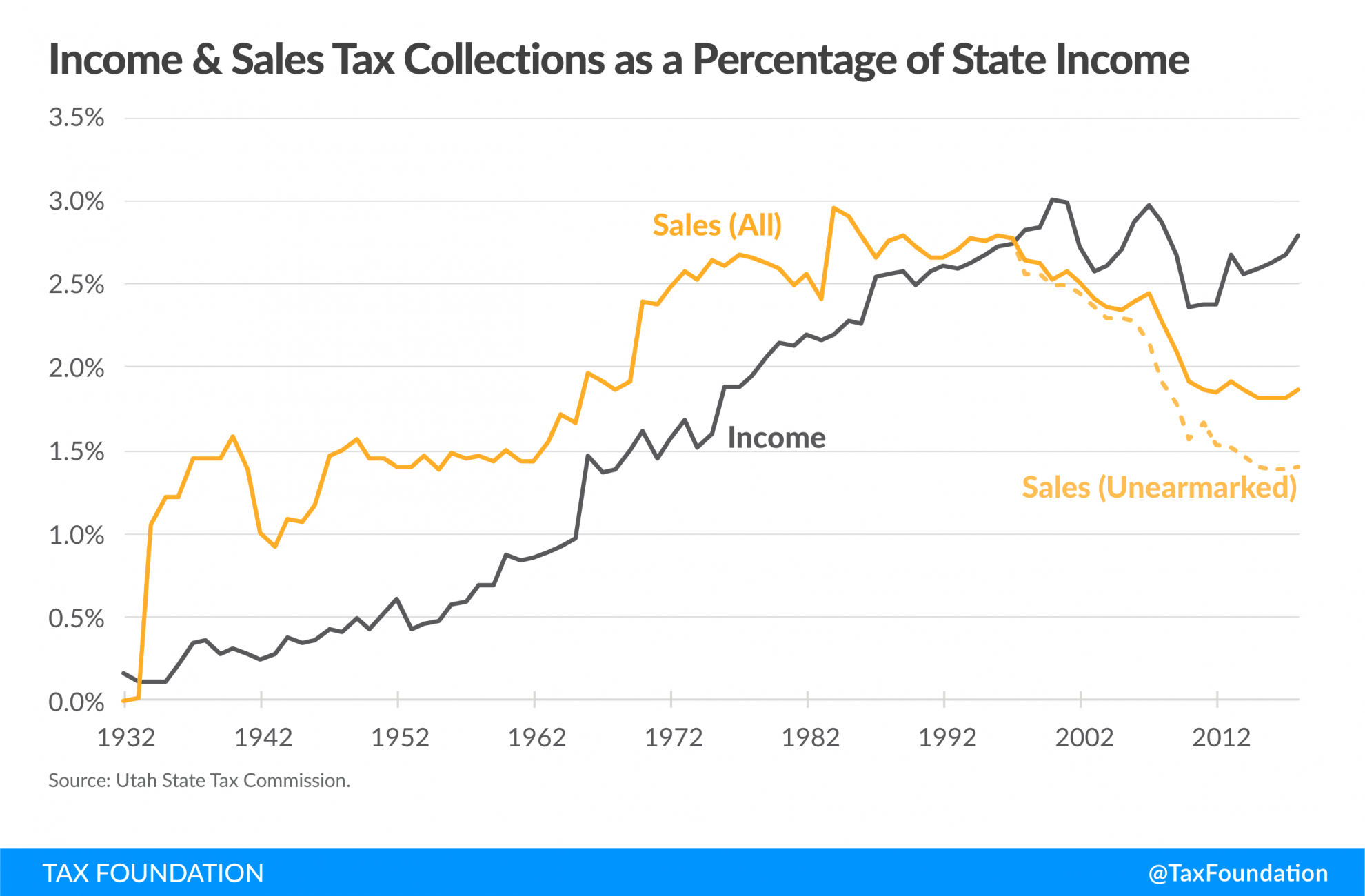

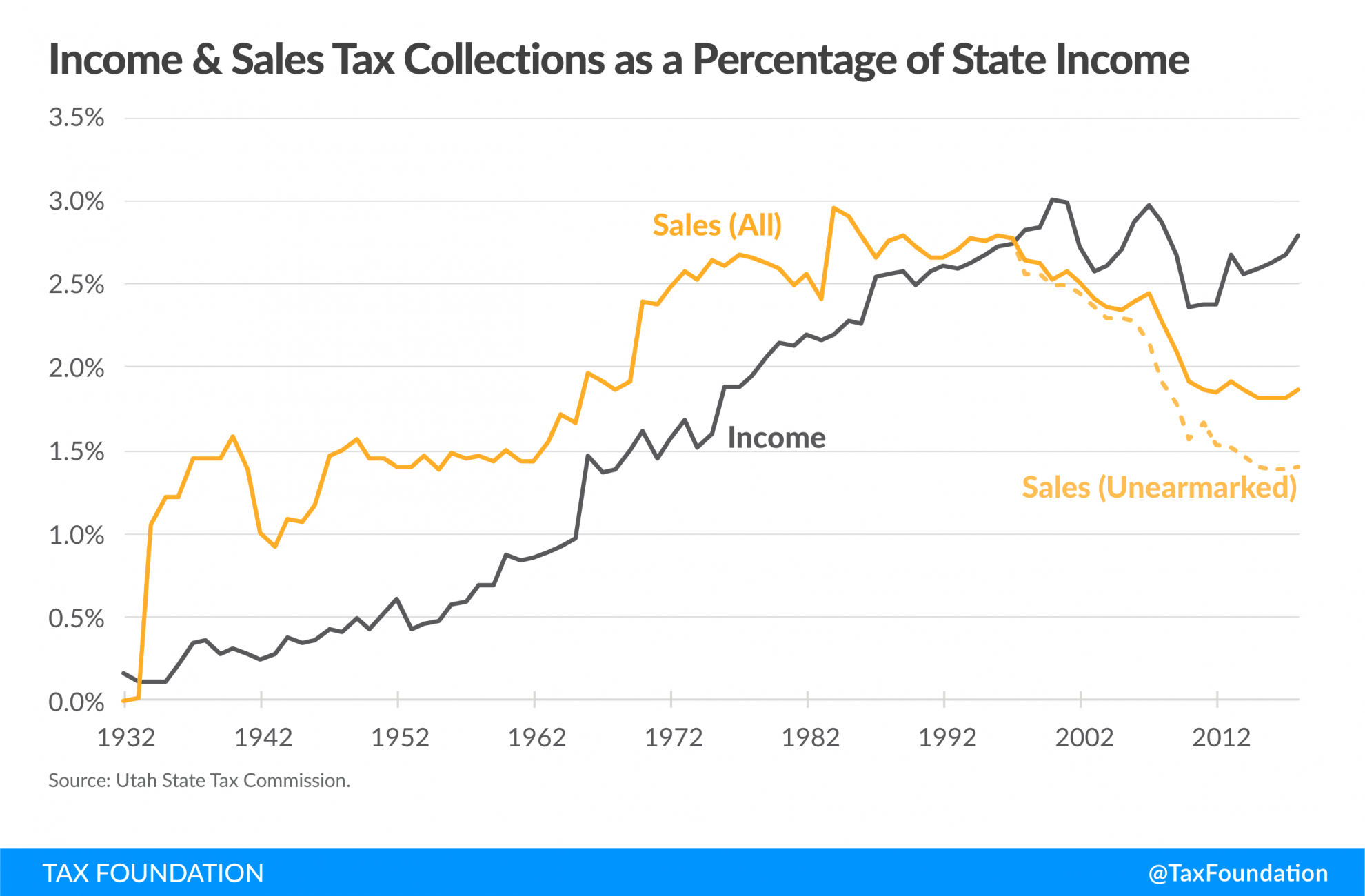

Where the bill succeeds, though, is in a rebalancing of the state’s code after decades of erosion of the state’s reliance on consumption taxes rather than income taxes. Three decades ago, Utah’s sales tax collections—none of them earmarked for specific expenditures—equaled 2.8 percent of state income, while income tax collections stood at 2.6 percent By 2016, sales tax collections had plummeted as a share of state income, to 1.9 percent, with the unearmarked share at 1.4 percent. Meanwhile, income taxes, pegged at 2.6 percent three decades earlier, increased to 2.8 percent.

In 1977, sales taxes were responsible for 42.7 percent of state tax collections, but they accounted for only 29.4 percent by 2016. Nationally, sales tax collections have risen slightly as a percentage of state income over those years, but in Utah, they’ve plummeted 31.1 percent. Even the income tax rate cuts of 2007 did not arrest those trends; if anything, the state’s booming economy since emerging from the Great RecessionA recession is a significant and sustained decline in the economy. Typically, a recession lasts longer than six months, but recovery from a recession can take a few years. has broadened the gap. This has meant far greater reliance on individual income taxes, which tend to be less economically competitive than sales taxes, and considerably more volatile. Because the income tax is fully earmarked, moreover, the entire general fund budget is drawn from the shrinking sales tax. A rebalancing was in order, and SB 2001 accomplishes that.

The bill broadens the sales tax base* to include unprepared foods (groceries), previously taxed at a partial rate, gasoline, and select new services, increases the car rental tax from 2.5 to 4 percent, and creates a new diesel excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. . The $478.5 million generated by this consumption taxA consumption tax is typically levied on the purchase of goods or services and is paid directly or indirectly by the consumer in the form of retail sales taxes, excise taxes, tariffs, value-added taxes (VAT), or an income tax where all savings is tax-deductible. expansion, combined with a net tax cut of $160.5 million out of recent revenue growth, funds:

- An income tax rate reduction, lowering individual and corporate rates from 4.95 to 4.66 percent;

- An increase in the Utah dependent exemption from $565 to $2,500, along with a one-time rebate for 2018 filers (who lost exemptions under the state’s conformity with federal tax reform in 2018);

- A new grocery tax creditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income, rather than the taxpayer’s tax bill directly. of $125 for the first four household members for lower- and middle-income households, with another $50 for each additional household member;

- A new Social Security Income tax credit; and

- A new state earned income tax credit worth 10 percent of the federal credit for those experiencing intergenerational poverty.

These restructuring revisions are not perfect, but they represent an important step in the right direction. Instead of relying on a reduced rate on groceries, which studies suggest does little to improve the progressivity of the sales tax, the legislation passed tonight extends sales tax to cover more transactions, including high-end purchases, while using revenues for more targeted relief.

Policymakers often exempt or lower rates on certain classes of consumption as an attempt at progressive reform, but it doesn’t always work out that way. Prepared foods are taxed at the standard rate and most of the progressivity of taxing unprepared foods is addressed by the exemption for SNAP (food stamps) and WIC purchases, while the exemption is enjoyed by high-income earners as well—who often spend considerably more on groceries.

This represents a superior targeting of progressive provisions. There was, however, a timing concern—that even though the credit is more generous, the reduced sales tax rate on groceries benefits consumers throughout the year, whereas the credit is only available later. Utah lawmakers addressed that with a one-time expenditure to provide both a partial grocery tax credit payment and a partial Utah dependent exemption debate up front, at a cost of $72 million.

By raising gasoline and diesel taxes, moreover, the legislation shifts a greater share of the cost of road construction and maintenance—heavily subsidized by the general fund—to road users, including interstate truckers (under the new diesel excise tax). The bill also seeks to lay the groundwork for a shift away from motor fuel taxes toward a vehicle miles traveled tax in the future.

Additional goods and services added to the sales tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. under tonight’s legislation include:

- Unprepared foods (previously taxed at a preferential rate);

- Gasoline;

- Installation of tangible personal property when part of a taxable sale;

- Pet boarding and pet daycare services;

- Most non-governmental transportation services, including ridesharing (but not car sharing, which is already subject to sales tax);

- Parking and towing;

- Certain primarily digital services, like streaming media, identity theft protection, dating services, and database services;

- Electronic security monitoring of real property;

- Shipping and handling when part of a taxable sale;

- Certain entertainment activities, like admissions to college athletic events or playing arcade games;

- Certain entertainment-adjacent purchases (electricity for ski resort lifts, vehicles used at temporary sporting events);

- Certain cleaning services (car washes and “unassisted” cleaning services); and

- Newspapers and textbooks.

Many proponents of the legislation adopted tonight have acknowledged that the expansion to services is inadequate, and that further reforms will be necessary in a few years. Nevertheless, this year’s rebalancing toward a greater reliance on consumption, building on the significant reforms of 2017, burnishes Utah’s reputation for having one of the most competitive tax systems in the country.

* Note: As of the time of publication, a summary is only available for the second substitute. The lists below reflect further changes made on the floor. A new link will be provided when available.

Share