As Congress considers President Biden’s proposal to raise the corporate taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rate from 21 percent to 28 percent, it is important to remember that the Tax Cuts and Jobs Act (TCJA) of 2017 expanded the corporate tax base. A broader corporate tax base means that increasing the tax rate will have a larger impact on the economy and federal revenue than it would have prior to the TCJA’s passage.

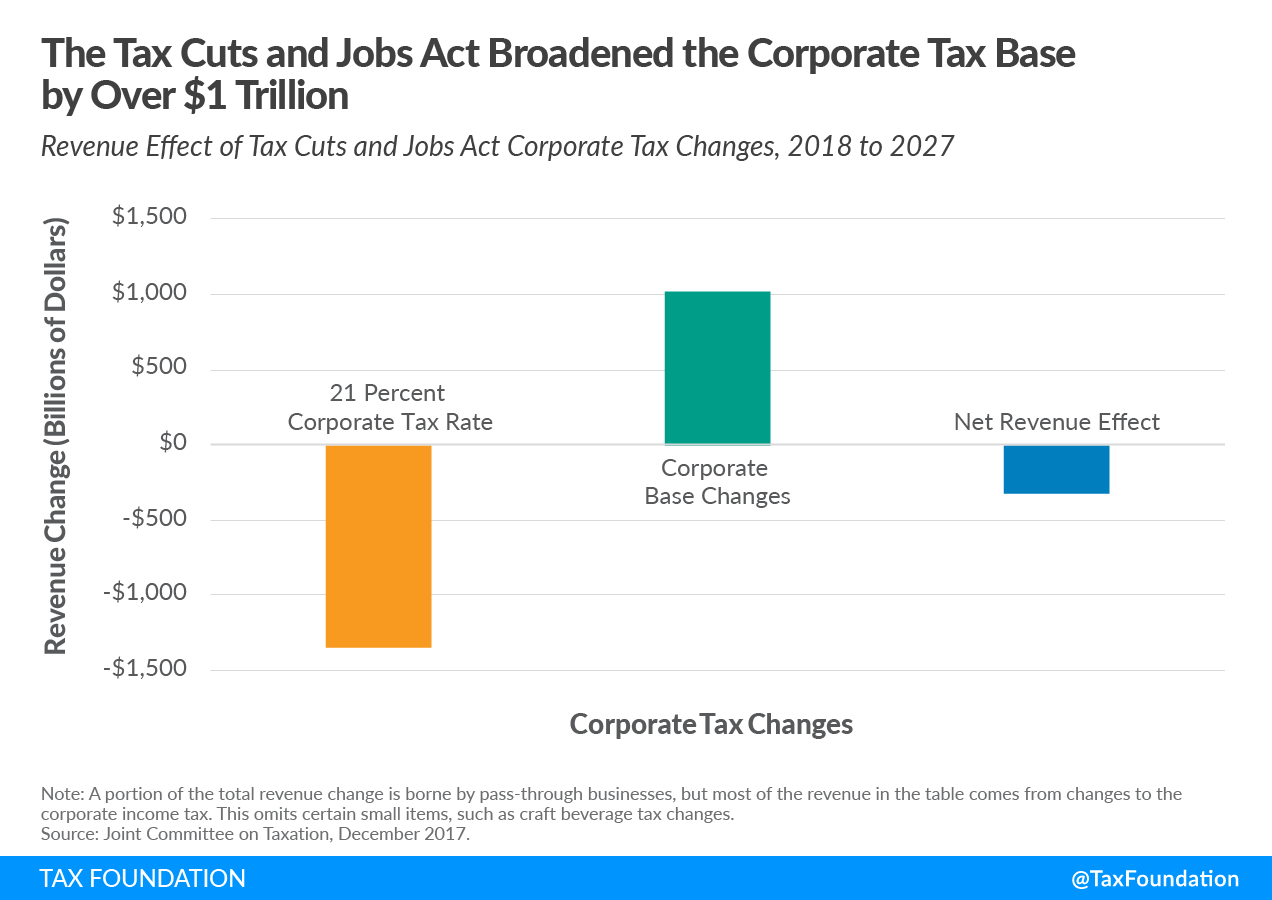

The TCJA reduced the corporate tax rate from 35 percent to 21 percent beginning in 2018, which reduced federal revenue by about $1.3 trillion over 10 years according to the Joint Committee on Taxation (JCT). The revenue reduction was partially offset by changes to the corporate tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. , such as eliminating provisions like the Section 199 deduction for domestic production, imposing new limits on interest deductions, and reforming the international tax system.

The major tax base changes raised about $1 trillion when including one-time tax revenue collected on profits repatriated from abroad (see Table 1). Together with the lower tax rate, the changes meant that revenue collected from corporations was projected to drop by about $324 billion from 2018 to 2027—the $1.3 trillion loss of federal revenue from the corporate rate reduction was largely offset by about a $1 trillion tax increase from expansion of the corporate tax base.

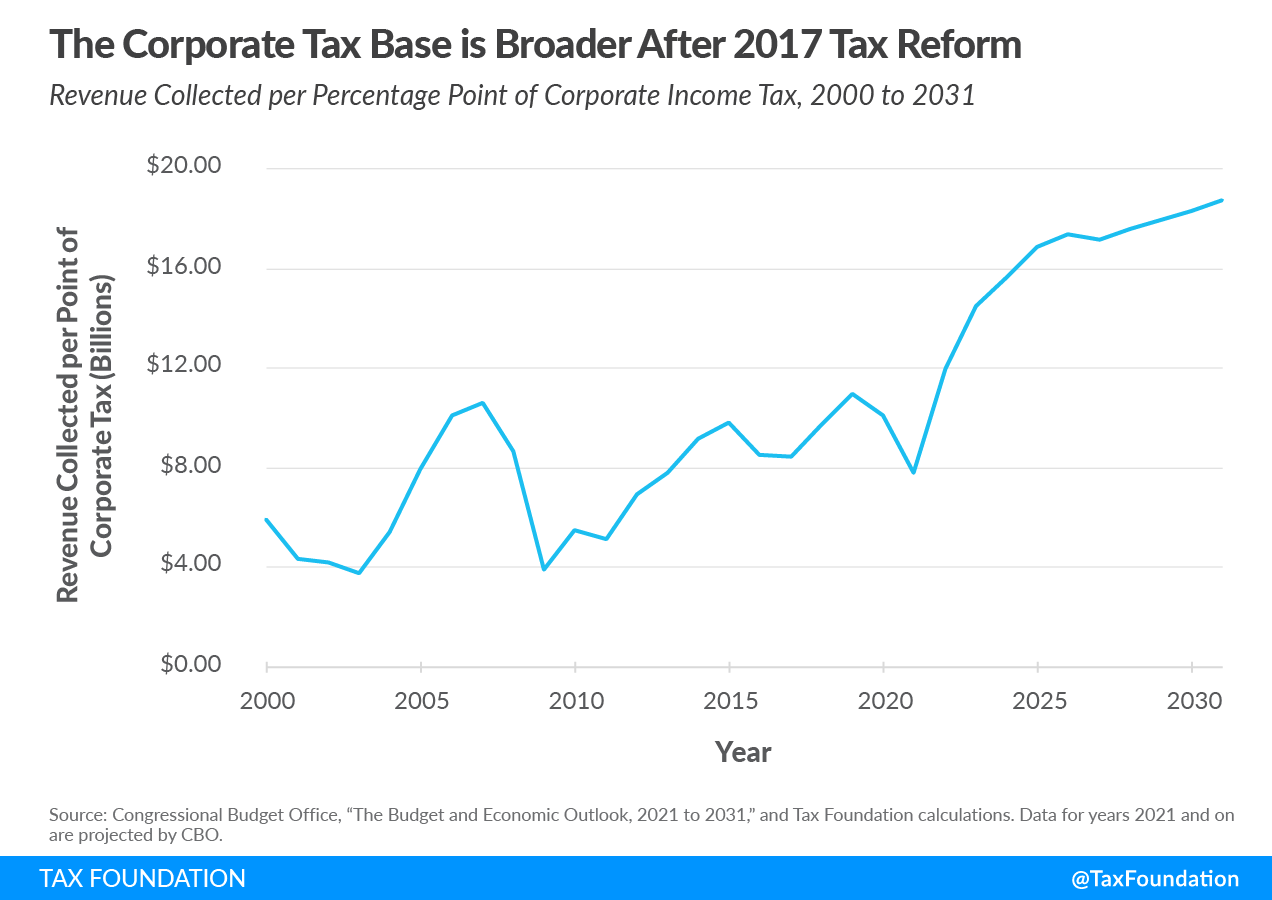

Another way to examine how the corporate tax base has become broader since the TCJA is looking at how much corporate revenue is collected for each percentage point of the corporate tax. A higher figure suggests a broader corporate tax base because it controls for the change in the tax rate, though it is also influenced by corporate profitability. However, this is a useful way to see how the corporate tax changes evolve over time.

As Table 2 shows, one percentage point of the corporate tax raised about $8.5 billion in 2017 prior to the TCJA and then $11 billion in 2019, before dropping to $7.8 billion due to the coronavirus pandemic’s impact on profits. This is projected by the Congressional Budget Office (CBO) to rise to $16.9 billion by 2025 and then to $18.3 billion by 2030, as base broadeners like the stricter limits to interest deductions and a higher tax rate on global intangible low-taxed income (GILTI) begin to take effect. Bonus depreciation for corporations also fully phases out by 2030, which broadens the tax base even further while reducing the incentive for corporations to invest.

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Corporate Revenue | $299.6 | $297.0 | $204.7 | $230.2 | $211.8 | $164.0 | $252.0 | $304.0 | $328.0 | $355.0 | $365.0 | $361.0 | $369.0 | $377.0 | $385.0 |

| Corporate Tax Rate | 35% | 35% | 21% | 21% | 21% | 21% | 21% | 21% | 21% | 21% | 21% | 21% | 21% | 21% | 21% |

| Revenue per point of Corporate Tax | $8.6 | $8.5 | $9.7 | $11.0 | $10.1 | $7.8 | $12.0 | $14.5 | $15.6 | $16.9 | $17.4 | $17.2 | $17.6 | $18.0 | $18.3 |

| Source: Congressional Budget Office, “The Budget and Economic Outlook, 2021 to 2031” and Tax Foundation calculations. Revenue for years 2021 and on are projected by CBO. | |||||||||||||||

Since 2000, a percentage point of corporate tax raised a low of $3.8 billion after the early 2000s’ recession up to about $10.6 billion in 2007, and only surpassed this mark in 2019 after the tax base was broadened. This is partly because the broader base collected more per point of corporate tax than before the TCJA.

A broader corporate tax base post-TCJA matters when considering Biden’s proposed corporate tax increase. A 28 percent tax rate would be applied to a broader base, which means it would have a larger revenue and economic impact than a 28 percent rate under the narrower pre-TCJA corporate tax base.

My colleagues estimate that Biden’s American Jobs Plan (AJP) would raise about $1.7 trillion in revenue from corporations over 10 years, roughly five times the size of the corporate tax cut that occurred as part of the TCJA. The broader corporate tax base’s impact on revenue and the economy are important to consider when evaluating Biden’s proposed corporate tax rate increase.

Share this article